Hi Friends - looking to confirm my understanding of the bootstrapping approach described in this chapter.

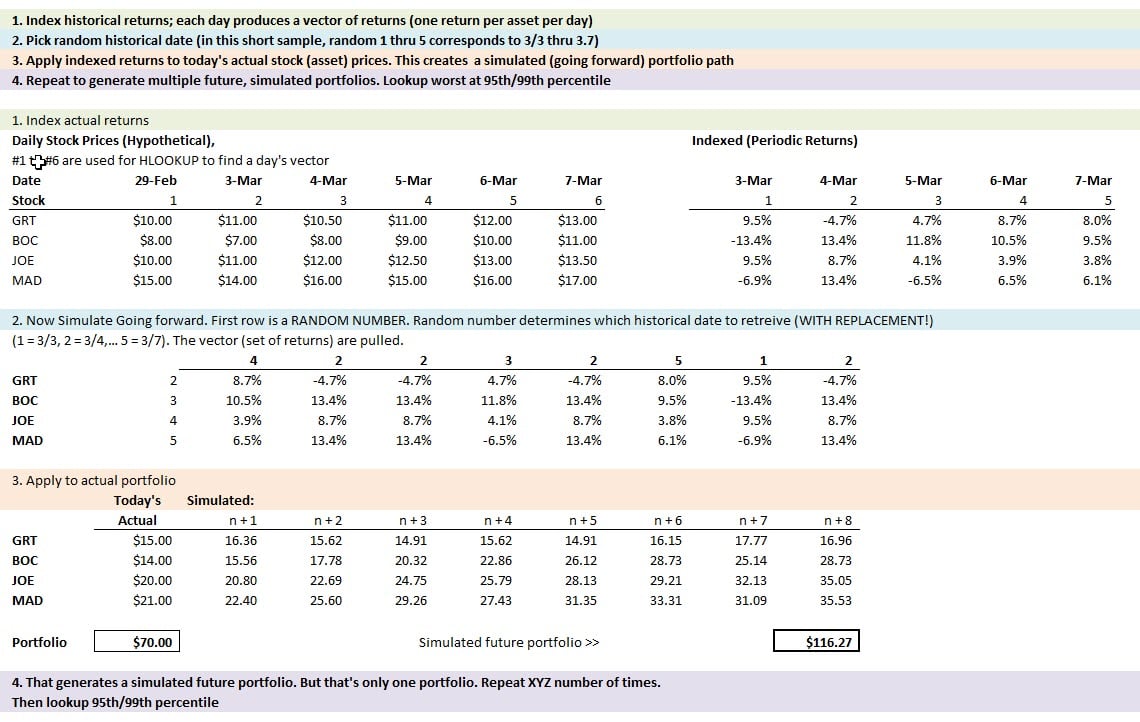

@David Harper CFA FRM - in your video, it looks like the example is assuming a portfolio of stocks. For instance, if there are 10 stocks and 100 days of histroical returns, we would have a 10x100 matrix of returns or 100 10x1 vectors. Then we would choose a vector at random (with replacement) to generate a larger sample.

I assume this also applies to a single asset or to the averages of the assets in David's example.

For instance, assume we take the weighted average return or portfolio return for each day in David's example. This is equivalent to having one stock rather than a portfolio of stocks. Then we would have a 1x100 matrix or 100 returns.

Can we apply the bootstrap by simply picking one of the returns (with replacement) to generate larger samples?

Thanks!

@David Harper CFA FRM - in your video, it looks like the example is assuming a portfolio of stocks. For instance, if there are 10 stocks and 100 days of histroical returns, we would have a 10x100 matrix of returns or 100 10x1 vectors. Then we would choose a vector at random (with replacement) to generate a larger sample.

I assume this also applies to a single asset or to the averages of the assets in David's example.

For instance, assume we take the weighted average return or portfolio return for each day in David's example. This is equivalent to having one stock rather than a portfolio of stocks. Then we would have a 1x100 matrix or 100 returns.

Can we apply the bootstrap by simply picking one of the returns (with replacement) to generate larger samples?

Thanks!