Hi, in book 2, chapter 4 (or the BT study notes), the following definitions are presented:

I do not understand how to read the second definition. [t, t+k) is a continuous set. Therefore, I do not see how the numerator is supposed to be defined here. Even if I assume that we simply iterate over all discrete subsets, say all days, how is

\[ Def_t^{t+k} \]

not the same as the numerator in the first formula?

\[ \sum_{i=t}^{t+k} DEF_i \]

I must misunderstand something, because to me both formulas show the frequency of names that default within the interval [t, t+k) (or maybe [t, t+k] because the upper boundary is clearly contained in the summation, but I have a feeling this is not the distinction de Laurentis is trying to make).

Then the confusion continues when the marginal default rate is defined as the same thing:

Since \[ PD_t^{\text{cumulated}} = \frac{\sum_{i=t}^{t+0} DEF_i}{Names_t} = 0 \]

according to the above definition. (I have substituted the upper boundary for t = t + 0, because I have a feeling that de Laurentis does not want the upper boundary to be t + t = 2t which would be consistent with his notation in the prior formula)

I know that there must be some inaccuracies with regard to the indexes but even trying to be lenient on the notation, I cannot make sense of these definitions, or distinguish any from the others.

I do not understand how to read the second definition. [t, t+k) is a continuous set. Therefore, I do not see how the numerator is supposed to be defined here. Even if I assume that we simply iterate over all discrete subsets, say all days, how is

\[ Def_t^{t+k} \]

not the same as the numerator in the first formula?

\[ \sum_{i=t}^{t+k} DEF_i \]

I must misunderstand something, because to me both formulas show the frequency of names that default within the interval [t, t+k) (or maybe [t, t+k] because the upper boundary is clearly contained in the summation, but I have a feeling this is not the distinction de Laurentis is trying to make).

Then the confusion continues when the marginal default rate is defined as the same thing:

Since \[ PD_t^{\text{cumulated}} = \frac{\sum_{i=t}^{t+0} DEF_i}{Names_t} = 0 \]

according to the above definition. (I have substituted the upper boundary for t = t + 0, because I have a feeling that de Laurentis does not want the upper boundary to be t + t = 2t which would be consistent with his notation in the prior formula)

I know that there must be some inaccuracies with regard to the indexes but even trying to be lenient on the notation, I cannot make sense of these definitions, or distinguish any from the others.

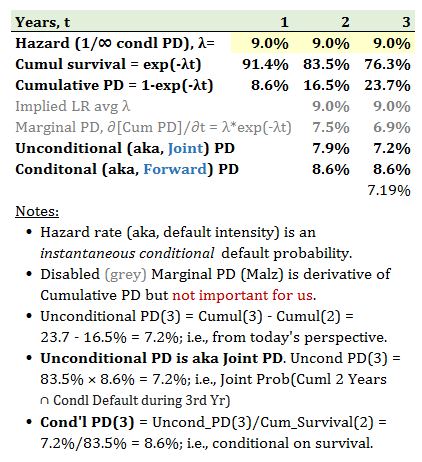

I created the XLS exhibit above to be as simple as possible yet to concretely define these terms, I don't think it needs to be oversold with analogies.

I created the XLS exhibit above to be as simple as possible yet to concretely define these terms, I don't think it needs to be oversold with analogies. if you include the derivative). I am retaining Forward (as synonym to Conditional) because I can see it has ample academic precedent ...

if you include the derivative). I am retaining Forward (as synonym to Conditional) because I can see it has ample academic precedent ...