Kavita.bhangdia

Active Member

Hi David,

Please can you help me with this problem.

I am struggling with how do I take the confidence interval into consideration while calculating the CVAR.

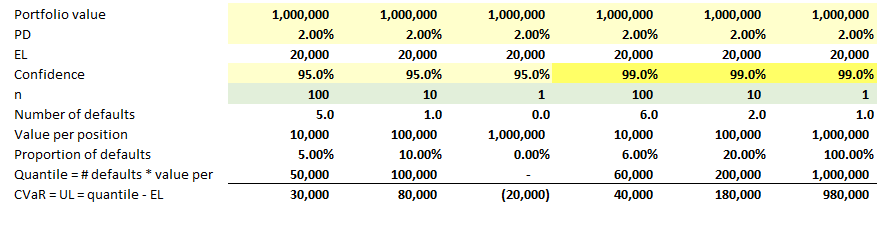

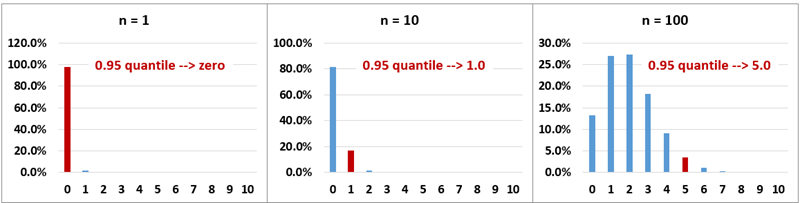

A portfolio has n credit, total portfolio value is 1,0000,000.

The probability of default is 2% for each credit. Assume zero recovery and default correlation is 1.

Find the CVAR at 95% confidence interval.

Solution

My expected loss =.02*1000000= 20000

My credit loss at 95% is zero. So my Cvar is -20000

Is it correct??

What will be my Cvar at 99% confidence.

Please can you help me with this problem.

I am struggling with how do I take the confidence interval into consideration while calculating the CVAR.

A portfolio has n credit, total portfolio value is 1,0000,000.

The probability of default is 2% for each credit. Assume zero recovery and default correlation is 1.

Find the CVAR at 95% confidence interval.

Solution

My expected loss =.02*1000000= 20000

My credit loss at 95% is zero. So my Cvar is -20000

Is it correct??

What will be my Cvar at 99% confidence.