You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

PQ-external CVA & credit limit question:

- Thread starter no_ming

- Start date

Dr. Jayanthi Sankaran

Well-Known Member

Hi @no_ming,

A Credit limit is assigned by an institution to each counterparty. The reason for doing this, is to ensure that the PFE to that counterparty does not breach this limit. As the PFE varies over the life of the transaction, credit limits will also be adjusted upwards or downwards.

In case a new trade will breach a credit limit at some time in the future, it will be rejected.

Although, a credit limit takes into account variables such as (1) default probability of counterparty (2) expected recovery rate of counterparty (3) downgrade probability of counterparty and (4) correlation between counterparties, it is done so in a qualitative fashion. As a result, decisions involving accepting or rejecting a new trade will be made on the basis of exposure alone, and not the actual profitability of the new trade.

In the case of the CVA, as long as an institution can make more profit than the CVA, the trade is a good one. This counterparty risk charge is calculated in a sophisticated way to account for all the aspects that define the CVA: (1) default probability of the counterparty (2) default probability of the institution (3) the transaction in question (4) netting of existing transactions with the same counterparty (5) collateralisation and (6) hedging aspects.

Hence, the answer is (b) because credit limits are typically enforced at the trade level.

Hope that helps!

A Credit limit is assigned by an institution to each counterparty. The reason for doing this, is to ensure that the PFE to that counterparty does not breach this limit. As the PFE varies over the life of the transaction, credit limits will also be adjusted upwards or downwards.

In case a new trade will breach a credit limit at some time in the future, it will be rejected.

Although, a credit limit takes into account variables such as (1) default probability of counterparty (2) expected recovery rate of counterparty (3) downgrade probability of counterparty and (4) correlation between counterparties, it is done so in a qualitative fashion. As a result, decisions involving accepting or rejecting a new trade will be made on the basis of exposure alone, and not the actual profitability of the new trade.

In the case of the CVA, as long as an institution can make more profit than the CVA, the trade is a good one. This counterparty risk charge is calculated in a sophisticated way to account for all the aspects that define the CVA: (1) default probability of the counterparty (2) default probability of the institution (3) the transaction in question (4) netting of existing transactions with the same counterparty (5) collateralisation and (6) hedging aspects.

Hence, the answer is (b) because credit limits are typically enforced at the trade level.

Hope that helps!

@no_ming and @Dr. Jayanthi Sankaran I think that is looking for correct (C), straight out of Gregory (emphasis mine):

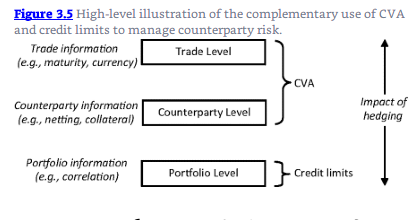

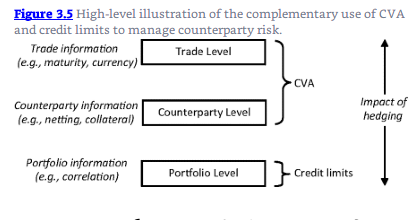

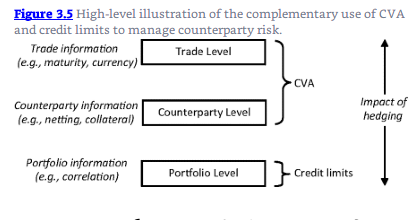

"3.3.3 CVA or Credit Limits? Both. CVA focuses on evaluating counterparty risk at the trade level (incorporating all specific features of the trade) and counterparty level (incorporating risk mitigants). In contrast, credit limits essentially act at the portfolio level by limiting exposures to avoid concentrations. When viewed like this, we see that CVA and credit limits act in a complementary fashion as illustrated in Figure 3.5. Indeed, CVA encourages minimising the number of counterparties an institution would trade with since this maximises the benefits of netting whilst credit limits encourage maximising this number. Hence, CVA and credit limits are typically used together as complementary ways to quantify and manage counterparty risk."-- Gregory, Jon. Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets (The Wiley Finance Series) (Kindle Locations 1352-1360). John Wiley and Sons. Kindle Edition.

"3.3.3 CVA or Credit Limits? Both. CVA focuses on evaluating counterparty risk at the trade level (incorporating all specific features of the trade) and counterparty level (incorporating risk mitigants). In contrast, credit limits essentially act at the portfolio level by limiting exposures to avoid concentrations. When viewed like this, we see that CVA and credit limits act in a complementary fashion as illustrated in Figure 3.5. Indeed, CVA encourages minimising the number of counterparties an institution would trade with since this maximises the benefits of netting whilst credit limits encourage maximising this number. Hence, CVA and credit limits are typically used together as complementary ways to quantify and manage counterparty risk."-- Gregory, Jon. Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets (The Wiley Finance Series) (Kindle Locations 1352-1360). John Wiley and Sons. Kindle Edition.

@no_ming and @Dr. Jayanthi Sankaran I think that is looking for correct (C), straight out of Gregory (emphasis mine):

"3.3.3 CVA or Credit Limits? Both. CVA focuses on evaluating counterparty risk at the trade level (incorporating all specific features of the trade) and counterparty level (incorporating risk mitigants). In contrast, credit limits essentially act at the portfolio level by limiting exposures to avoid concentrations. When viewed like this, we see that CVA and credit limits act in a complementary fashion as illustrated in Figure 3.5. Indeed, CVA encourages minimising the number of counterparties an institution would trade with since this maximises the benefits of netting whilst credit limits encourage maximising this number. Hence, CVA and credit limits are typically used together as complementary ways to quantify and manage counterparty risk."-- Gregory, Jon. Counterparty Credit Risk and Credit Value Adjustment: A Continuing Challenge for Global Financial Markets (The Wiley Finance Series) (Kindle Locations 1352-1360). John Wiley and Sons. Kindle Edition.

Mr. Harper, very clear explanation , thanks a lot.

Dr. Jayanthi Sankaran, also thanks for your help.

Similar threads

- Replies

- 0

- Views

- 331

- Replies

- 0

- Views

- 250

- Replies

- 0

- Views

- 220

- Replies

- 0

- Views

- 362

. For the following question, why C is not answer? and for B, credit limit is enforced at trade level, what's that mean? on the other hand, what level is CVA working at?

. For the following question, why C is not answer? and for B, credit limit is enforced at trade level, what's that mean? on the other hand, what level is CVA working at?