hi, please explain related to

Paying fixed in a variance swap on an index and receiving fixed on individual

what does the following statement mean:

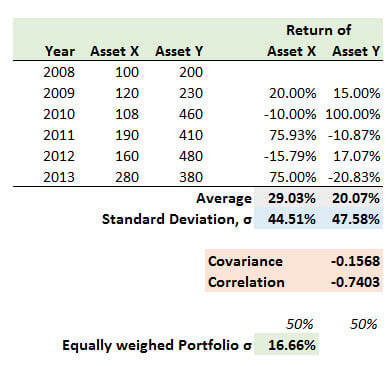

If correlation increases, so will the variance. As a consequence, the present value for the variance swap buyer, the

fixed variance swap payer, will increase. This increase is expected to outperform

the potential losses from the short variance swap positions on the individual

components.

Paying fixed in a variance swap on an index and receiving fixed on individual

what does the following statement mean:

If correlation increases, so will the variance. As a consequence, the present value for the variance swap buyer, the

fixed variance swap payer, will increase. This increase is expected to outperform

the potential losses from the short variance swap positions on the individual

components.