You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Confidence intervals....one tail or two tailed?

- Thread starter shivanin

- Start date

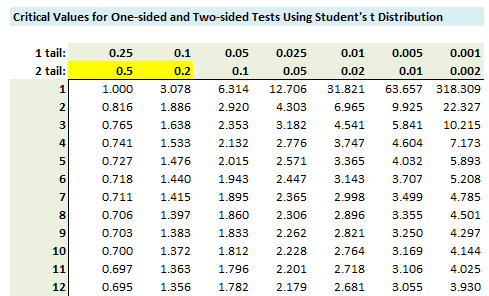

Hi @shivanin Setting aside the usual caveat about VaR (ie, VaR confidence is always one-tailed, being only concerned with the loss tail; e.g., 1.645 @ 95% and 2.33 @ 99% under a normal distribution), if it doesn't say or your aren't sure, I'd suggest assuming two-tail because it's the more common significance test. A well-written question should not leave it in doubt. Keep in mind the null must contain the equals sign ("="). So your typical situation is an alternative hypothesis that is "in either direction of the null;" i.e., less than or greater than. Below is an example of a one-sided test (from https://forum.bionicturtle.com/threads/p1-t2-317-continuous-distributions-topic-review.7227/ ). My question is explicit, I went out of my way to identify one tailed  . But it would be fair game to have written something like the following: "... His hypothesis is that the true hedge fund return is greater than zero .... " and that would be enough to signal that the alternative hypothesis is one-tailed rather than two-tailed (the alternative hypo is usually what you are trying to prove...). I hope that helps!

. But it would be fair game to have written something like the following: "... His hypothesis is that the true hedge fund return is greater than zero .... " and that would be enough to signal that the alternative hypothesis is one-tailed rather than two-tailed (the alternative hypo is usually what you are trying to prove...). I hope that helps!

. But it would be fair game to have written something like the following: "... His hypothesis is that the true hedge fund return is greater than zero .... " and that would be enough to signal that the alternative hypothesis is one-tailed rather than two-tailed (the alternative hypo is usually what you are trying to prove...). I hope that helps!

. But it would be fair game to have written something like the following: "... His hypothesis is that the true hedge fund return is greater than zero .... " and that would be enough to signal that the alternative hypothesis is one-tailed rather than two-tailed (the alternative hypo is usually what you are trying to prove...). I hope that helps!317.1. For a sample of ten (n = 10) market-neutral hedge funds, analyst Peter finds their sample average monthly excess return to be +0.890% with a sample standard deviation of 1.00%. He wants to conduct a one-tailed test of significance, specifically: his null hypothesis is that the true excess return is equal to, or less than, zero. Here is a snippet of the student's t lookup table:

Which is nearest to his p-value? (bonus: use the p-value in a sentence)

a. 0.01%

b. 0.50%

c. 1.00%

d. 2.00%

@shivanin Right, i think you are referring to question 2 ("2. Using the prior 12 monthly returns, an analyst estimates the mean monthly return of stock XYZ to be -0.75% with a standard error of 2.70%."). The confidence interval is generally (almost always?) two-sided, although it can be one-sided. It's so common that they don't need to explicitly say two-sided. Thanks!

Similar threads

- Replies

- 2

- Views

- 392

- Replies

- 1

- Views

- 299

- Replies

- 0

- Views

- 464

- Replies

- 1

- Views

- 275