Maximus_FRM2012

New Member

Hi David,

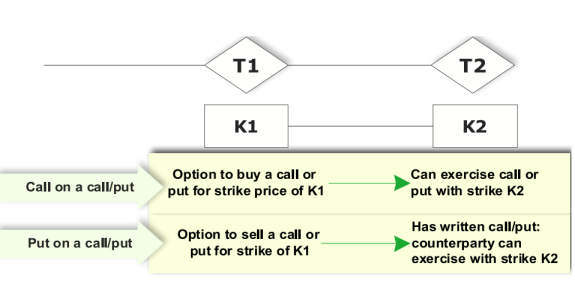

I'm going through your notes and I searched the forum but I can't find any where that details how compound options work. Can you please let me know if I have the logic correct:

For example, a call on a call option:

on the first maturity, the holder of the option has the following choices:

1. Choose to purchase another option for another strike or maturity

2. Excercise Option

On the second maturity:

1. Excercise the option if its in the money

2. Expires worthless

For put on a put:

The holder of the option on the first maturity can choose the following:

1. Can choose to sell another put option to the counter party for another strike and maturity

2. Excercise the option

on the second maturity:

1. the counter party can excercise the option

2. counter party has the option expire worthless

Please let me know if this is correct and if not, can you please give an example like above for a call on a call and put on a put to help solidify it.

Thank you.

Maximus

I'm going through your notes and I searched the forum but I can't find any where that details how compound options work. Can you please let me know if I have the logic correct:

For example, a call on a call option:

on the first maturity, the holder of the option has the following choices:

1. Choose to purchase another option for another strike or maturity

2. Excercise Option

On the second maturity:

1. Excercise the option if its in the money

2. Expires worthless

For put on a put:

The holder of the option on the first maturity can choose the following:

1. Can choose to sell another put option to the counter party for another strike and maturity

2. Excercise the option

on the second maturity:

1. the counter party can excercise the option

2. counter party has the option expire worthless

Please let me know if this is correct and if not, can you please give an example like above for a call on a call and put on a put to help solidify it.

Thank you.

Maximus