afterworkguinness

Active Member

Hi,

Can you quickly clarify for me how to determine a comparative advantage ? I simply don't get it.

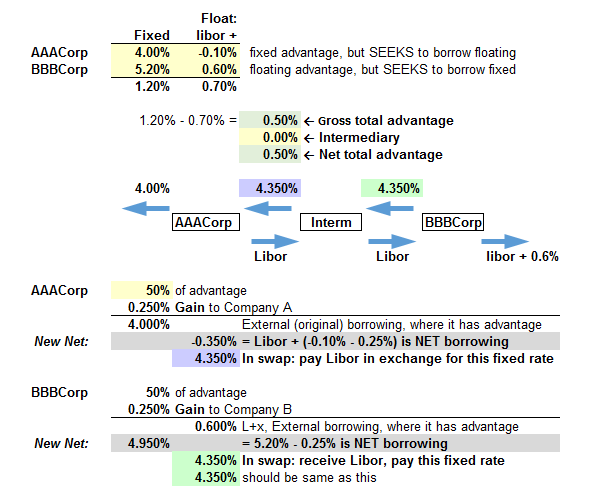

As per Hull 7.4:

Company | Fixed | Floating

AAACorp | 4.0% | LIBOR -0.1%

BBBCorp | 5.2% | LIBOR + 0.6%

I only see the absolute advantage.

Can you quickly clarify for me how to determine a comparative advantage ? I simply don't get it.

As per Hull 7.4:

Company | Fixed | Floating

AAACorp | 4.0% | LIBOR -0.1%

BBBCorp | 5.2% | LIBOR + 0.6%

I only see the absolute advantage.