MagnusNordzell

New Member

Hi all,

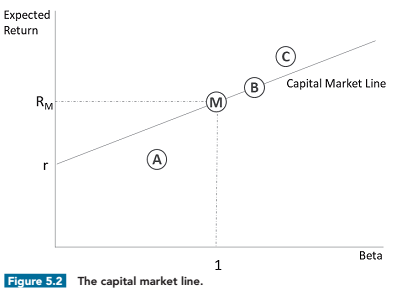

reading the FRM part I book 1 on CAPM (p. 75) I noticed that the text refers to the relationship between beta and expected return as the Capital Market Line. To me this is wrong as what they are describing is the Security Market Line. There is an important distinction between the two as the CML refers to total risk measured by the standard deviation, i.e. including specific (diversifiable) risk.

Anyone agrees with me?

Magnus

reading the FRM part I book 1 on CAPM (p. 75) I noticed that the text refers to the relationship between beta and expected return as the Capital Market Line. To me this is wrong as what they are describing is the Security Market Line. There is an important distinction between the two as the CML refers to total risk measured by the standard deviation, i.e. including specific (diversifiable) risk.

Anyone agrees with me?

Magnus