Sixcarbs

Active Member

Hello All,

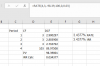

Reviewing one of David's video and there is a very basic example of a bond.

2 years, 6% coupon, Semi-Annual Payments, $100 Face Value.

Spot rates are:

5%, 5.8%, 6.4%, and 6.8% for .5, 1, 1.5, and 2 years.

Bond values at $98.39. Fine.

Calculate YTM using Goal Seek and come up with 6.76%, just like David in his video.

But when I run this on the calculator I keep getting a different figure. I get 2x3.44%=6.88%.

N=4

PMT=3

PV=-98.39

FV=100

What am I doing wrong? Going mad here.

Thank you,

Sixcarbs

Reviewing one of David's video and there is a very basic example of a bond.

2 years, 6% coupon, Semi-Annual Payments, $100 Face Value.

Spot rates are:

5%, 5.8%, 6.4%, and 6.8% for .5, 1, 1.5, and 2 years.

Bond values at $98.39. Fine.

Calculate YTM using Goal Seek and come up with 6.76%, just like David in his video.

But when I run this on the calculator I keep getting a different figure. I get 2x3.44%=6.88%.

N=4

PMT=3

PV=-98.39

FV=100

What am I doing wrong? Going mad here.

Thank you,

Sixcarbs