Eustice_Langham

Active Member

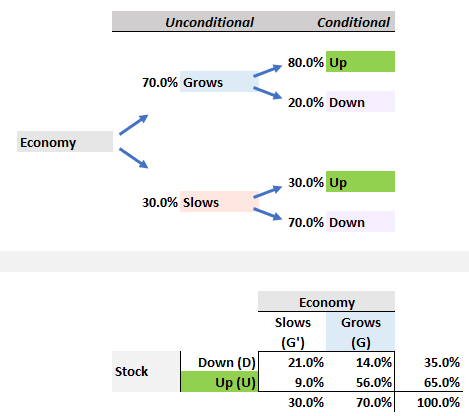

Hi David, I have a question concerning an old video on YT concerning the Bayes Theory.

The YT link is here,

, my question concerns how you have arrived at the values in the formula, specifically the values in the denominator of P(U).

In the formula, you have:

P(G/U) = P(U/G) * P(G) / P(U)

= (.8)*(.7) / ((.8)*(.7)) + ((.3)*(.3))

My question is why is P(U), in the denominator = .3 * .3 and not equal to .3?

The only up .3 that I can see is when the economy slows ie .3 the stock only has a .3 chance of going up.

Thanks

The YT link is here,

In the formula, you have:

P(G/U) = P(U/G) * P(G) / P(U)

= (.8)*(.7) / ((.8)*(.7)) + ((.3)*(.3))

My question is why is P(U), in the denominator = .3 * .3 and not equal to .3?

The only up .3 that I can see is when the economy slows ie .3 the stock only has a .3 chance of going up.

Thanks