Hi @David Harper CFA FRM.

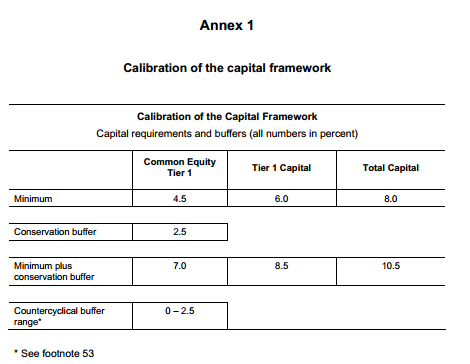

The Capital ratios are 4.5%, 6% and 8% , with CCB its 7%, 8.5% and 10.5%,

Now the RWA is 100 and the buffers are

5 for CE Tier 1, 2 for Additional Tier 1, 3.5 for Tier 2

Bank satisfies capital requirements ? We have 4 options.

a) Yes, because its Total Capital Ratio of 10.5% is sufficient

b) No, because it does not hold enough Common Equity Capital

c) No, because its Tier 1 Capital Ratio is insufficient

d) No, because the bank has no buffer-quality capital to contribute to its Capital Conservation Buffer

If we don't follow an order (i.e check Equity tier 1 then total tier 1 and then total capital) then we can mark option a is correct since 5+2+3.5=10.5 that satisfies total capital. But if we follow an the order to check option b is the correct answer. I believe we should check in an order and mark the first that seem incorrect.

Hence if option b was not there we will mark c as correct (follow the order).

Please verify.

The Capital ratios are 4.5%, 6% and 8% , with CCB its 7%, 8.5% and 10.5%,

Now the RWA is 100 and the buffers are

5 for CE Tier 1, 2 for Additional Tier 1, 3.5 for Tier 2

Bank satisfies capital requirements ? We have 4 options.

a) Yes, because its Total Capital Ratio of 10.5% is sufficient

b) No, because it does not hold enough Common Equity Capital

c) No, because its Tier 1 Capital Ratio is insufficient

d) No, because the bank has no buffer-quality capital to contribute to its Capital Conservation Buffer

If we don't follow an order (i.e check Equity tier 1 then total tier 1 and then total capital) then we can mark option a is correct since 5+2+3.5=10.5 that satisfies total capital. But if we follow an the order to check option b is the correct answer. I believe we should check in an order and mark the first that seem incorrect.

Hence if option b was not there we will mark c as correct (follow the order).

Please verify.

Last edited: