Fittyfive9

New Member

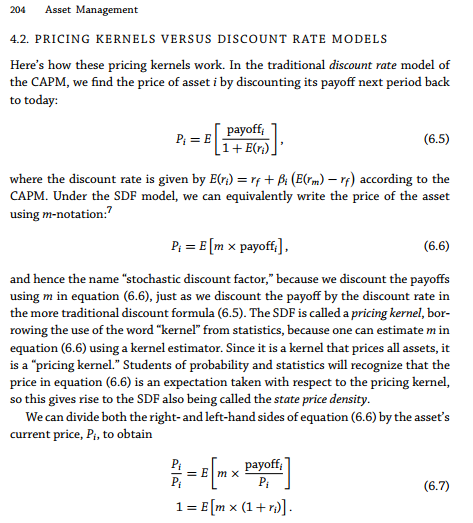

On page 9 of the notes for Ang's investment management - factoring investing, it says the stochastic discount factor is MULTIPLIED by the payoff to arrive at asset price, near the bottom of the page. Given that the STD, m, is = a + bf + bf...+bf and the CAPM discount is just = a + bf, why is the "CAPM discount" used to divide the payoff while the STD is used to multiply the payoff? Is this a typo?