Hello,

Reviewing the available material on both MA and AR, which is in my view on of the more abstract concepts in the quant topic, I found a difference in the definition between GARP's book and the BT notes. In addition to simply having different notations (GARP use a notation for regressions that was not familiar to me but still made sense), I don't understand how it relates to the same concept.

AR(1)

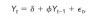

=> GARP (p163 FRM Part I Quantitative Analysis, GARP) writes that AR(1) can be written as :

Then, the unconditional mean is stated as being dependent on the intercept.

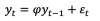

=> In the BT notes we have :

Here, I get that the same unconditional mean is 0, pointing to an intercept that in basically 0.

Question : Does GARP add an intercept so the equation looks more like a regression, but in reality it's always zero ? I don't really get the rational behind the difference in notations.

Same question for MA(1)

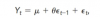

=> GARP (p169 FRM Part I Quantitative Analysis, GARP) writes that MA(1) can be written as :

=> In the BT notes we have :

Again, GARP have an additional intercept variable that is not stated as being zero.

Question : Does GARP add an intercept so the equation looks more like a regression, but in reality it's always zero ? I don't really get the rational behind the difference in notations.

Thanks in advance for any clarification that you guys could provide me.

Greg

Reviewing the available material on both MA and AR, which is in my view on of the more abstract concepts in the quant topic, I found a difference in the definition between GARP's book and the BT notes. In addition to simply having different notations (GARP use a notation for regressions that was not familiar to me but still made sense), I don't understand how it relates to the same concept.

AR(1)

=> GARP (p163 FRM Part I Quantitative Analysis, GARP) writes that AR(1) can be written as :

Then, the unconditional mean is stated as being dependent on the intercept.

=> In the BT notes we have :

Here, I get that the same unconditional mean is 0, pointing to an intercept that in basically 0.

Question : Does GARP add an intercept so the equation looks more like a regression, but in reality it's always zero ? I don't really get the rational behind the difference in notations.

Same question for MA(1)

=> GARP (p169 FRM Part I Quantitative Analysis, GARP) writes that MA(1) can be written as :

=> In the BT notes we have :

Again, GARP have an additional intercept variable that is not stated as being zero.

Question : Does GARP add an intercept so the equation looks more like a regression, but in reality it's always zero ? I don't really get the rational behind the difference in notations.

Thanks in advance for any clarification that you guys could provide me.

Greg