You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Amenc Chapter 4

- Thread starter skoh

- Start date

Hi skoh,

There is some conversation in the source thread: http://forum.bionicturtle.com/threads/l1-t1-27-correlation-impact.3451/

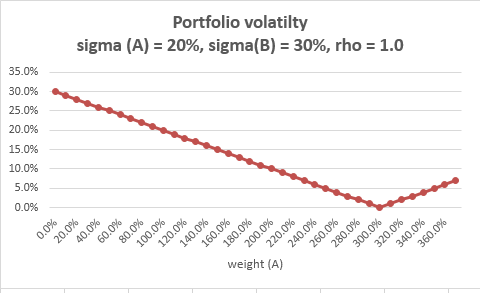

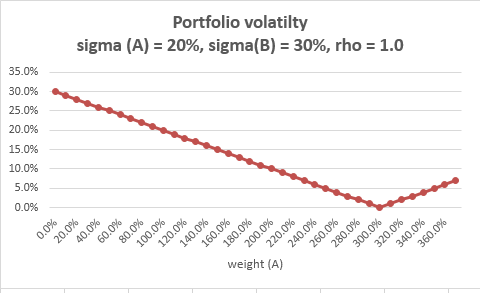

The application (derivation) of the minimum variance formula is above P1 exam difficulty, although the point is to illustrate 2-asset portfolio volatility. In this case, we are given the two assets volatilities and further given their correlation happens to be perfect. Then a plot of portfolio volatility (y axis) against weight of asset A shows that minimum variance occurs when the weight of asset A is 300% (which implies asset B must be -200% in order for portfolio weight to equal 100%). The perfect correlation manifests as a straight line (otherwise, with rho < 1.0, there is a curve). So the question is looking for the mix (weights) that happen to give the "minimum variance portfolio"

Then the next question demonstrates that, if we change the correlation, the MVP weight change too, i hope that explain, thanks,

There is some conversation in the source thread: http://forum.bionicturtle.com/threads/l1-t1-27-correlation-impact.3451/

The application (derivation) of the minimum variance formula is above P1 exam difficulty, although the point is to illustrate 2-asset portfolio volatility. In this case, we are given the two assets volatilities and further given their correlation happens to be perfect. Then a plot of portfolio volatility (y axis) against weight of asset A shows that minimum variance occurs when the weight of asset A is 300% (which implies asset B must be -200% in order for portfolio weight to equal 100%). The perfect correlation manifests as a straight line (otherwise, with rho < 1.0, there is a curve). So the question is looking for the mix (weights) that happen to give the "minimum variance portfolio"

Then the next question demonstrates that, if we change the correlation, the MVP weight change too, i hope that explain, thanks,

Similar threads

- Replies

- 0

- Views

- 206

- Replies

- 1

- Views

- 513

- Replies

- 0

- Views

- 173