Learning objectives: Describe the benefits of central counterparties (CCPs) and the potential risks which can arise when clearing through a CCP. Explain the interconnections between central counterparties and other financial institutions, including banks, clearing members, financial markets, and other CCPs. Explain how the failure of a CCP can spread systemic risk to other financial markets or institutions. Identify policy measures designed to reduce the probability or impact of potential CCP failures, and describe limitations to these measures. Explain measures which can be adopted to mitigate systemic risks related to interconnections and interdependence of CCPs.

Questions:

606.1. According to Wendt, does a central counterparty (CCP) reduce or magnify the interconnectedness of banks?

a. The CCP reduces the interconnectedness of banks due to its reliance on margin calls

b. The CCP magnifies the interconnectedness of banks due to the reaction implied by default of one of its clearing members

c. The CCP reduces the interconnectedness of banks due to its role as a firewall, but the CCP also creates new interconnections resulting from its actions to survive following the default of a clearing member or in the case of its own eventual default.

d. The CCP reduces the interconnectedness of banks due to its role as a firewall, and the CCP further reduces the interconnectedness of banks due to the procylicality of margin calls and via feedback loops between market stress and collateral haircuts

606.2. Which of the following is the LEAST LIKELY component of a central counterparty (CCP) risk waterfall?

a. Default fund contributions of surviving clearing members

b. Emergency contingent protocol liquidity assistance fund provisioned by central bank

c. CCP’s pre-defined contribution to the loss allocation waterfall capital; i.e., CCP's own capital, or ‘skin in the game'

d. Assessment calls of the CCP requesting replenishment of funds by surviving clearing members and/or other loss-sharing calls

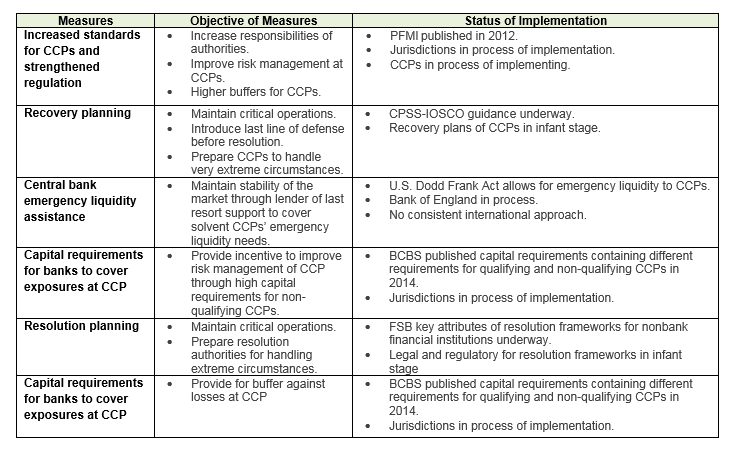

606.3. Wendt explains that "G20 leaders and regulatory authorities worldwide have recognized that the systemic importance of CCPs require measures to manage systemic risks. They have embarked on a multi-faceted approach to retain the benefits of CCPs, while limiting the risks that their activities may pose to national and/or global financial stability." The table below lists the various measures that have been proposed and in some cases adopted:

Consider the following statements about these current measures listed above:

I. These measures reduce the probability or impact of a CCP failure

II. These measures eliminate a source of contagion risk to surviving members arising from the risk waterfall and loss sharing arrangements

III. These measures address the dependency of the CCP on only a few commercial banks for liquidity, custody, and settlement

IV. These measures hedge the risk of increased market volatility arising from collateral sales by multiple CCPs

V. These measures reconcile the diverging interests of authorities in a globally cleared market

Which of the statements is (are) TRUE?

a. I. only is true

b. I., II. and III. only are true

c. III., IV. and IV. only are true

d. All are true

Answers here:

Questions:

606.1. According to Wendt, does a central counterparty (CCP) reduce or magnify the interconnectedness of banks?

a. The CCP reduces the interconnectedness of banks due to its reliance on margin calls

b. The CCP magnifies the interconnectedness of banks due to the reaction implied by default of one of its clearing members

c. The CCP reduces the interconnectedness of banks due to its role as a firewall, but the CCP also creates new interconnections resulting from its actions to survive following the default of a clearing member or in the case of its own eventual default.

d. The CCP reduces the interconnectedness of banks due to its role as a firewall, and the CCP further reduces the interconnectedness of banks due to the procylicality of margin calls and via feedback loops between market stress and collateral haircuts

606.2. Which of the following is the LEAST LIKELY component of a central counterparty (CCP) risk waterfall?

a. Default fund contributions of surviving clearing members

b. Emergency contingent protocol liquidity assistance fund provisioned by central bank

c. CCP’s pre-defined contribution to the loss allocation waterfall capital; i.e., CCP's own capital, or ‘skin in the game'

d. Assessment calls of the CCP requesting replenishment of funds by surviving clearing members and/or other loss-sharing calls

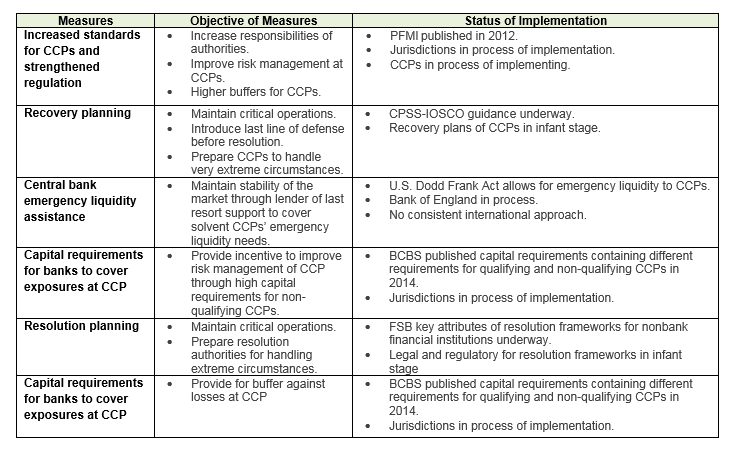

606.3. Wendt explains that "G20 leaders and regulatory authorities worldwide have recognized that the systemic importance of CCPs require measures to manage systemic risks. They have embarked on a multi-faceted approach to retain the benefits of CCPs, while limiting the risks that their activities may pose to national and/or global financial stability." The table below lists the various measures that have been proposed and in some cases adopted:

Consider the following statements about these current measures listed above:

I. These measures reduce the probability or impact of a CCP failure

II. These measures eliminate a source of contagion risk to surviving members arising from the risk waterfall and loss sharing arrangements

III. These measures address the dependency of the CCP on only a few commercial banks for liquidity, custody, and settlement

IV. These measures hedge the risk of increased market volatility arising from collateral sales by multiple CCPs

V. These measures reconcile the diverging interests of authorities in a globally cleared market

Which of the statements is (are) TRUE?

a. I. only is true

b. I., II. and III. only are true

c. III., IV. and IV. only are true

d. All are true

Answers here: