Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

709.1. Andrew Ang summarizes the dismal performance of risky assets during the global financial crisis (GFC): "During the financial crisis of 2008 and 2009, the price of most risky assets plunged ... U.S. large cap equities returned –37.0%; international and emerging markets equities had even larger losses [-43.0% and -53.2%, respectively]. The riskier fixed income securities, like corporate bonds, emerging market bonds [-9.7%], and high yield bonds [-26.3%], also fell, tumbling along with real estate [-16.9% for private real estate and -37.7% for equity REITs]. Alternative investments like hedge funds, which trumpeted their immunity to market disruptions, were no safe refuge: equity hedge funds and their fixed income counterparts fell approximately 20%. Commodities had losses exceeding 30%. The only assets to go up during 2008 were cash (U.S. Treasury bills) and safe-haven sovereign bonds, especially long-term U.S. Treasuries."

According to Ang's factor theory, we can accurately observe about the 2008-2009 Financial Crisis each of the following as accurate EXCEPT which is inaccurate?

a. The Financial Crisis demonstrated that diversification itself is dead

b. Asset class labels can be misleading: what matters are embedded factor risks

c. The Financial Crisis demonstrated that correlations are time-varying and increase in bad times

d. The crisis was consistent with an underlying factor model in which many asset classes were exposed to the same factors

709.2. While the universe of potential factors is very large, Ang emphasizes relatively few factors. According to Ang, each of the following statements is true EXCEPT which is false?

a. Investment-style factors can be static or dynamic

b. There are two types of factors: macro fundamental-based factors and investment-style factors; and the three most important macro factors are growth, inflation, and volatility

c. Although there do not (statistically) exist illiquidity risk premiums WITHIN most asset classes, there are significant liquidity risk premiums available ACROSS asset classes even after risk-adjusting

d. The low-risk anomaly has generally been demonstrated and says that (i) volatility is negatively related to future returns, (ii) realized beta is negatively related to future returns, and (iii) minimum variance portfolios do better than the market

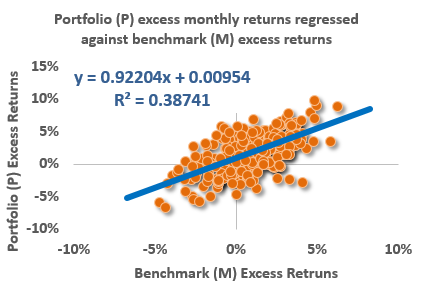

709.3. Consider the following regression of a portfolio's daily excess returns against its benchmark over the last year:

Please note that "excess return" refers to return in excess of the risk-free rate. Key output from the regression includes:

a. The correlation, ρ(P,B), is about 0.62

b. The information ratio (IR) is about 0.40

c. The portfolio's Sharpe ratio is about 0.59

d. The portfolio's Treynor ratio is about 0.63

Answers here:

Questions:

709.1. Andrew Ang summarizes the dismal performance of risky assets during the global financial crisis (GFC): "During the financial crisis of 2008 and 2009, the price of most risky assets plunged ... U.S. large cap equities returned –37.0%; international and emerging markets equities had even larger losses [-43.0% and -53.2%, respectively]. The riskier fixed income securities, like corporate bonds, emerging market bonds [-9.7%], and high yield bonds [-26.3%], also fell, tumbling along with real estate [-16.9% for private real estate and -37.7% for equity REITs]. Alternative investments like hedge funds, which trumpeted their immunity to market disruptions, were no safe refuge: equity hedge funds and their fixed income counterparts fell approximately 20%. Commodities had losses exceeding 30%. The only assets to go up during 2008 were cash (U.S. Treasury bills) and safe-haven sovereign bonds, especially long-term U.S. Treasuries."

According to Ang's factor theory, we can accurately observe about the 2008-2009 Financial Crisis each of the following as accurate EXCEPT which is inaccurate?

a. The Financial Crisis demonstrated that diversification itself is dead

b. Asset class labels can be misleading: what matters are embedded factor risks

c. The Financial Crisis demonstrated that correlations are time-varying and increase in bad times

d. The crisis was consistent with an underlying factor model in which many asset classes were exposed to the same factors

709.2. While the universe of potential factors is very large, Ang emphasizes relatively few factors. According to Ang, each of the following statements is true EXCEPT which is false?

a. Investment-style factors can be static or dynamic

b. There are two types of factors: macro fundamental-based factors and investment-style factors; and the three most important macro factors are growth, inflation, and volatility

c. Although there do not (statistically) exist illiquidity risk premiums WITHIN most asset classes, there are significant liquidity risk premiums available ACROSS asset classes even after risk-adjusting

d. The low-risk anomaly has generally been demonstrated and says that (i) volatility is negatively related to future returns, (ii) realized beta is negatively related to future returns, and (iii) minimum variance portfolios do better than the market

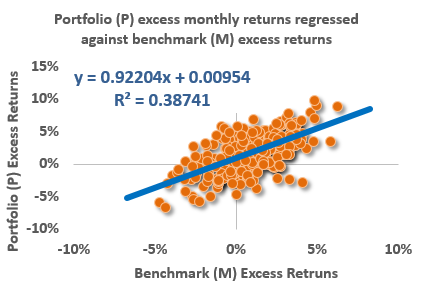

709.3. Consider the following regression of a portfolio's daily excess returns against its benchmark over the last year:

Please note that "excess return" refers to return in excess of the risk-free rate. Key output from the regression includes:

- Sample size: 250 trading days

- The portfolio's average excess return is 1.79% with volatility of 3.03%

- The benchmark's average excess return is 0.91% with volatility of 2.05%

- The average difference in return between the portfolio and the benchmark which is also called the "active return," avg(P-M), is 0.88%

- The regression intercept is 0.00954 and regression slope is 0.92204 (as displayed on plot)

- Tracking error (standard error of the regression) = 2.38%

a. The correlation, ρ(P,B), is about 0.62

b. The information ratio (IR) is about 0.40

c. The portfolio's Sharpe ratio is about 0.59

d. The portfolio's Treynor ratio is about 0.63

Answers here:

Last edited: