Learning objectives: Assess methods of mitigating volatility risk in a portfolio, and describe challenges that arise when managing volatility risk. Explain how dynamic risk factors can be used in a multifactor model of asset returns, using the Fama-French model as an example. Compare value and momentum investment strategies, including their risk and return profiles.

Questions:

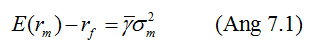

703.1. Andrew Ang explains that a large literature has tried to estimate the return-volatility trade-off as represented by Ang's formula 7.1 below, where gamma, γ, is the risk aversion of the average investor and σ(m)^2 is the variance of the market return:

About the relationship between between returns (or earned premiums) and volatility, which of the following statements is TRUE?

a. In theory, the risk aversion coefficient is negative; but in data, the risk aversion is always positive

b. Pure derivatives volatility trading takes a stance on expected returns; i.e., is necessarily directional

c. Rebalancing as a portfolio strategy is a short volatility strategy which earns a volatility risk premium

d. Selling volatility protection through derivatives markets is ultimately a low-risk strategy due to long-term mean reversion

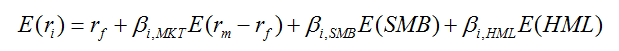

703.2. The Fama-French three-factor model is given by the following formula (Ang 7.2):

Which of the following statements about this Fama-French model is TRUE?

a. Unlike the size factor, the value premium is robust and outperforms over the long-run

b. Since 1965 to roughly the present, the size factor (size effect) in Fama-French has been significant and robust

c. Although the size effectc continues to be robust and significant, small stocks do NOT have higher returns, on average, than large stocks

d. The salient feature of value stocks is their tendency, both in theory and in the data, to outperform growth stocks especially during bad times for the economy

703.3. We can add a momentum factor to the Fama-French so that it becomes a four-factor model. This momentum factor is denoted by WML (i.e., past winners minus past losers) or UMD (i.e., stocks that have gone up minus stocks that have gone down). At least with respect to the historical window analyzed, which is the long period from January 1965 to December 2011, which of the following statements is TRUE about the momentum factor?

a. Momentum is a negative feedback strategy which is inherently stabilizing

b. The momentum factor is observed in equities but is NOT observed in bonds, commodities and real estate

c. Momentum investing by definition is an anti-value strategy; correlations between HML and WML are strongly negative

d. The cumulated profits on momentum strategies have been an order of magnitude larger than cumulated profits on either size or value

Answers here:

Questions:

703.1. Andrew Ang explains that a large literature has tried to estimate the return-volatility trade-off as represented by Ang's formula 7.1 below, where gamma, γ, is the risk aversion of the average investor and σ(m)^2 is the variance of the market return:

About the relationship between between returns (or earned premiums) and volatility, which of the following statements is TRUE?

a. In theory, the risk aversion coefficient is negative; but in data, the risk aversion is always positive

b. Pure derivatives volatility trading takes a stance on expected returns; i.e., is necessarily directional

c. Rebalancing as a portfolio strategy is a short volatility strategy which earns a volatility risk premium

d. Selling volatility protection through derivatives markets is ultimately a low-risk strategy due to long-term mean reversion

703.2. The Fama-French three-factor model is given by the following formula (Ang 7.2):

Which of the following statements about this Fama-French model is TRUE?

a. Unlike the size factor, the value premium is robust and outperforms over the long-run

b. Since 1965 to roughly the present, the size factor (size effect) in Fama-French has been significant and robust

c. Although the size effectc continues to be robust and significant, small stocks do NOT have higher returns, on average, than large stocks

d. The salient feature of value stocks is their tendency, both in theory and in the data, to outperform growth stocks especially during bad times for the economy

703.3. We can add a momentum factor to the Fama-French so that it becomes a four-factor model. This momentum factor is denoted by WML (i.e., past winners minus past losers) or UMD (i.e., stocks that have gone up minus stocks that have gone down). At least with respect to the historical window analyzed, which is the long period from January 1965 to December 2011, which of the following statements is TRUE about the momentum factor?

a. Momentum is a negative feedback strategy which is inherently stabilizing

b. The momentum factor is observed in equities but is NOT observed in bonds, commodities and real estate

c. Momentum investing by definition is an anti-value strategy; correlations between HML and WML are strongly negative

d. The cumulated profits on momentum strategies have been an order of magnitude larger than cumulated profits on either size or value

Answers here:

Last edited by a moderator: