Learning Objectives: Differentiate between sources of liquidity risk and describe specific challenges faced by different types of financial institutions in managing liquidity risk. Summarize the asset-liability management process at a fractional reserve bank, including the process of liquidity transformation. Compare transactions used in the collateral market and explain risks that can arise through collateral market transactions.

Questions:

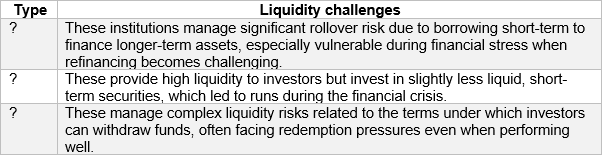

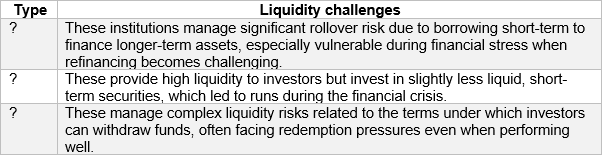

24.2.1. Henry Hoover, an officer at the Financial Conduct Authority (FCA), is tasked to categorize unique liquidity challenges faced by different financial institutions in the UK. He collected information but forgot to match the descriptions to the correct institution types in his report:

What should be the correct order of headings for his report?

a. Banks and Securities Firms, Money Market Mutual Funds, Hedge Funds.

b. Money Market Mutual Funds, Hedge Funds, Banks, and Securities Firms.

c. Money Market Mutual Funds, Banks and Securities Firms, Hedge Funds.

d. Hedge Funds, Money Market Mutual Funds, Banks and Securities Firms.

24.2.2. John, a risk manager at a Retail bank, is assessing the bank's liquidity transformation and asset-liability management strategies. Given the inherent risks of liquidity mismatches and market volatility, John is tasked with evaluating the bank’s approach to balancing short-term liabilities with longer-term asset investments.

Which of the following strategies would best mitigate the potential for liquidity crises and ensure compliance with regulatory capital requirements?

a. Increasing the bank's capital reserves to cover potential large-scale deposit withdrawals.

b. Investing primarily in short-term, liquid assets to closely match the bank's deposit liabilities.

c. Engaging in high-risk, high-return investments to maximize profitability in the short term.

d. Implementing rigorous stress testing scenarios to evaluate the bank’s response to sudden financial downturns.

24.2.3. Gary White, a consultant for a bank, is assessing the implications of the new regulatory requirement under CASS, which mandates the separation of depositor funds and prohibits their commingling. Given this context, Gary needs to recommend which types of collateral arrangements the bank should avoid to mitigate specific liquidity risks. Evaluate the options below and choose the arrangement that the bank should avoid considering the following risks:

a. Emphasize on margin loans, avoid securities lending, avoid repurchase agreements

b. Emphasize on securities lending, avoid repurchase agreements, avoid margin loans

c. Emphasize on repurchase agreements, avoid securities lending, avoid margin loans

d. Avoid all of them

Answers here:

Questions:

24.2.1. Henry Hoover, an officer at the Financial Conduct Authority (FCA), is tasked to categorize unique liquidity challenges faced by different financial institutions in the UK. He collected information but forgot to match the descriptions to the correct institution types in his report:

What should be the correct order of headings for his report?

a. Banks and Securities Firms, Money Market Mutual Funds, Hedge Funds.

b. Money Market Mutual Funds, Hedge Funds, Banks, and Securities Firms.

c. Money Market Mutual Funds, Banks and Securities Firms, Hedge Funds.

d. Hedge Funds, Money Market Mutual Funds, Banks and Securities Firms.

24.2.2. John, a risk manager at a Retail bank, is assessing the bank's liquidity transformation and asset-liability management strategies. Given the inherent risks of liquidity mismatches and market volatility, John is tasked with evaluating the bank’s approach to balancing short-term liabilities with longer-term asset investments.

Which of the following strategies would best mitigate the potential for liquidity crises and ensure compliance with regulatory capital requirements?

a. Increasing the bank's capital reserves to cover potential large-scale deposit withdrawals.

b. Investing primarily in short-term, liquid assets to closely match the bank's deposit liabilities.

c. Engaging in high-risk, high-return investments to maximize profitability in the short term.

d. Implementing rigorous stress testing scenarios to evaluate the bank’s response to sudden financial downturns.

24.2.3. Gary White, a consultant for a bank, is assessing the implications of the new regulatory requirement under CASS, which mandates the separation of depositor funds and prohibits their commingling. Given this context, Gary needs to recommend which types of collateral arrangements the bank should avoid to mitigate specific liquidity risks. Evaluate the options below and choose the arrangement that the bank should avoid considering the following risks:

- Recall Risk: The risk where the lender may need the securities back at a time that could be disadvantageous or costly for the borrower.

- Cash Reinvestment Risk: Risks arising from the need to reinvest cash received as collateral, which may yield lower returns or losses if the reinvestment underperforms.

- Leverage Risk: Occurs in margin loans that amplify both gains and losses, increasing the potential for significant financial impact if market conditions are unfavorable.

- Margin Call Risk: Involves the requirement for additional capital if the value of the collateral drops below a certain threshold, potentially forcing liquidation at significant losses.

a. Emphasize on margin loans, avoid securities lending, avoid repurchase agreements

b. Emphasize on securities lending, avoid repurchase agreements, avoid margin loans

c. Emphasize on repurchase agreements, avoid securities lending, avoid margin loans

d. Avoid all of them

Answers here: