Learning objectives: Calculate a bank’s net liquidity position and explain factors that affect the supply and demand of liquidity at a bank. Compare strategies that a bank can use to meet demands for additional liquidity. Estimate a bank’s liquidity needs through three methods (sources and uses of funds, structure of funds and liquidity indicators).

Questions:

20.6.1. Over the next 24 hours, Greenlux State Bank estimates that the following cash inflows and outflows (all figures in millions) will occur:

What is the bank's projected net liquidity position?

a. -30.0 million

b. +10.0 million

c. +40.0 million

d. +90.0 million

20.6.2. Experienced liquidity managers tend to employ one of three strategies: asset liquidity management (aka, asset conversion), borrowed liquidity (aka, purchased liquidity or liability management), or balanced liquidity management. About these strategies, each of the following statements is true EXCEPT which is false?

a. A liquid asset has a ready market, a reasonably stable price and is reversible

b. If a bank's primary goal is to avoid shrinking its balance sheet (and weakening the appearance of the balance sheet), then a borrowed liquidity strategy is better than an asset liquidity strategy

c. If a bank's primary goal is to minimize risk, then a borrowed liquidity strategy is better than an asset liquidity strategy

d. A balanced liquidity strategy balances the opportunity cost associated with storing liquidity in assets against the risks of interest rate volatility and credit availability associated with borrowing liquidity

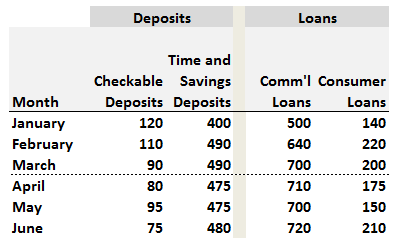

20.6.3. First City Bell Bank has forecast its checkable deposits, time and saving deposits, and commercial and household loans over the next six months; aka, semester.

If we employ the sources and uses of funds method to estimate the bank’s liquidity needs over the semester, which of the following statements is TRUE?

a. During February, sources of liquidity equal zero

b. During the first quarter (Jan, Feb, March), Acme expects a positive liquidity gap

c. Over the cumulative six-month semester (Jan through June), Acme expects a positive liquidity gap

d. During April, sources of $15 partially offset uses of $25 to imply a negative liquidity gap of ten because $15 - $25 = -$10

Answers here:

Questions:

20.6.1. Over the next 24 hours, Greenlux State Bank estimates that the following cash inflows and outflows (all figures in millions) will occur:

What is the bank's projected net liquidity position?

a. -30.0 million

b. +10.0 million

c. +40.0 million

d. +90.0 million

20.6.2. Experienced liquidity managers tend to employ one of three strategies: asset liquidity management (aka, asset conversion), borrowed liquidity (aka, purchased liquidity or liability management), or balanced liquidity management. About these strategies, each of the following statements is true EXCEPT which is false?

a. A liquid asset has a ready market, a reasonably stable price and is reversible

b. If a bank's primary goal is to avoid shrinking its balance sheet (and weakening the appearance of the balance sheet), then a borrowed liquidity strategy is better than an asset liquidity strategy

c. If a bank's primary goal is to minimize risk, then a borrowed liquidity strategy is better than an asset liquidity strategy

d. A balanced liquidity strategy balances the opportunity cost associated with storing liquidity in assets against the risks of interest rate volatility and credit availability associated with borrowing liquidity

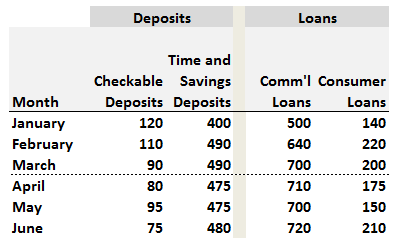

20.6.3. First City Bell Bank has forecast its checkable deposits, time and saving deposits, and commercial and household loans over the next six months; aka, semester.

If we employ the sources and uses of funds method to estimate the bank’s liquidity needs over the semester, which of the following statements is TRUE?

a. During February, sources of liquidity equal zero

b. During the first quarter (Jan, Feb, March), Acme expects a positive liquidity gap

c. Over the cumulative six-month semester (Jan through June), Acme expects a positive liquidity gap

d. During April, sources of $15 partially offset uses of $25 to imply a negative liquidity gap of ten because $15 - $25 = -$10

Answers here: