Learning objectives: Explain the elements of the proposed Standardized Measurement Approach (SMA), including the business indicator, internal loss multiplier and loss component, and calculate the operational risk capital requirement for a bank using the SMA. Compare the SMA to earlier methods of calculating operational risk capital, including the Alternative Measurement Approaches (AMA), and explain the rationale for the proposal to replace them. Describe general and specific criteria recommended by the Basel Committee for the identification, collection, and treatment of operational loss data.

Questions:

803.1. Supervisory experience with the Advanced Measurement Approach (AMA) for operational risk was decidedly mixed. According to the Consultative Document (published in 2016), "The inherent complexity of the AMA and the lack of comparability arising from a wide range of internal modelling practices have exacerbated variability in risk-weighted asset calculations, and have eroded confidence in risk-weighted capital ratios. The Committee has therefore determined that the withdrawal of internal modelling approaches for operational risk regulatory capital from the Basel Framework is warranted." Aspiring to greater comparability and relative simplicity, the Committee proposed instead the Standardized Measurement Approach (SMA) and argued, "The SMA combines the Business Indicator (BI), a simple financial statement proxy of operational risk exposure, with bank-specific operational loss data."

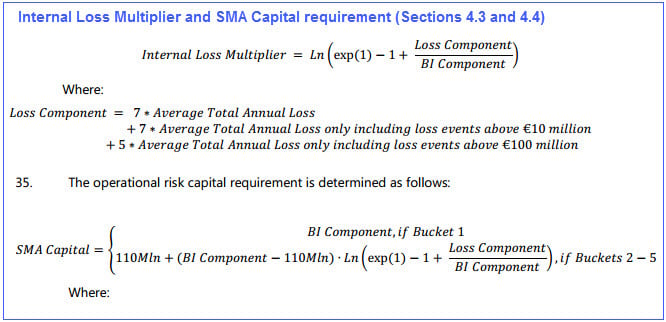

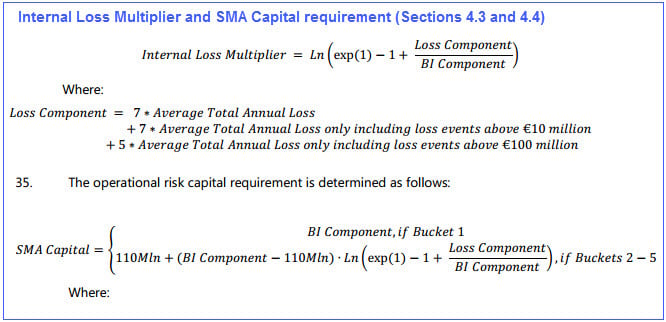

The formula for the operational risk capital requirement (and the Internal Loss Multiplier) under the Standardized Measurement Approach (SMA) is shown below:

Consider a large bank with a Business Indicator Component (BI Component) of 300 million euros. During past 10 years the bank has suffered the following losses:

a. € 189.00 million euros

b. € 203.75 million euros

c. € 272.20 million euros

d. € 394.60 million euros

803.2. With respect to the business indicator (BI) in the Standardized Measurement Approach (SMA), each of the following is true EXCEPT which is false?

a. BI is reduced by operating expenses and/or negative income

b. Banks are divided into five buckets according to the size of their BI

c. The BI is the sum of three components: Interest, Lease and Dividend (ILDC); Services (SC); and Financial (FC); i.e., BI = ILDC(avg) + SC(avg) + FC(avg)

d. The BI Component increases linearly within buckets, but the marginal effect of the BI on the BI Component is greater for the higher buckets than for the lower ones

803.3. Under the SMA, medium and large banks are required to use loss data as a direct input into capital calculations. The integrity of such loss data is therefore crucial. In terms of some definitions, the Committee writes, "Gross loss is a loss before recoveries of any type. Net loss is defined as the loss after taking into account the impact of recoveries. The recovery is an independent occurrence, related to the original loss event, separate in time, in which funds or inflows of economic benefits are received from a third party; Banks must be able to discretely identify the gross loss amounts, non-insurance recoveries, and insurance recoveries for all operational loss events."

In regard to the minimum standards for the use of loss data under the SMA, each of the following is true EXCEPT which is false?

a. Banks must include insurance premiums in gross losses; and must use losses net of insurance recoveries as an input for the SMA loss data set

b. The bank must be able to map its historical internal loss data into the relevant Level 1 supervisory categories as defined in Annex 9 of the Basel II accord

c. Losses caused by a common operational risk event or by related operational risk events over time must be grouped and entered into the SMA loss data set as a single loss.

d. The bank must have an appropriate de minimis gross loss threshold for internal loss data collection, which can vary between banks and across event types but cannot be higher than €10,000 (except when the bank first moves to the SMA)

Answers here:

Questions:

803.1. Supervisory experience with the Advanced Measurement Approach (AMA) for operational risk was decidedly mixed. According to the Consultative Document (published in 2016), "The inherent complexity of the AMA and the lack of comparability arising from a wide range of internal modelling practices have exacerbated variability in risk-weighted asset calculations, and have eroded confidence in risk-weighted capital ratios. The Committee has therefore determined that the withdrawal of internal modelling approaches for operational risk regulatory capital from the Basel Framework is warranted." Aspiring to greater comparability and relative simplicity, the Committee proposed instead the Standardized Measurement Approach (SMA) and argued, "The SMA combines the Business Indicator (BI), a simple financial statement proxy of operational risk exposure, with bank-specific operational loss data."

The formula for the operational risk capital requirement (and the Internal Loss Multiplier) under the Standardized Measurement Approach (SMA) is shown below:

Consider a large bank with a Business Indicator Component (BI Component) of 300 million euros. During past 10 years the bank has suffered the following losses:

- Six losses of € 5.0 million euros each, and

- Eight losses of € 15.0 million euros each

a. € 189.00 million euros

b. € 203.75 million euros

c. € 272.20 million euros

d. € 394.60 million euros

803.2. With respect to the business indicator (BI) in the Standardized Measurement Approach (SMA), each of the following is true EXCEPT which is false?

a. BI is reduced by operating expenses and/or negative income

b. Banks are divided into five buckets according to the size of their BI

c. The BI is the sum of three components: Interest, Lease and Dividend (ILDC); Services (SC); and Financial (FC); i.e., BI = ILDC(avg) + SC(avg) + FC(avg)

d. The BI Component increases linearly within buckets, but the marginal effect of the BI on the BI Component is greater for the higher buckets than for the lower ones

803.3. Under the SMA, medium and large banks are required to use loss data as a direct input into capital calculations. The integrity of such loss data is therefore crucial. In terms of some definitions, the Committee writes, "Gross loss is a loss before recoveries of any type. Net loss is defined as the loss after taking into account the impact of recoveries. The recovery is an independent occurrence, related to the original loss event, separate in time, in which funds or inflows of economic benefits are received from a third party; Banks must be able to discretely identify the gross loss amounts, non-insurance recoveries, and insurance recoveries for all operational loss events."

In regard to the minimum standards for the use of loss data under the SMA, each of the following is true EXCEPT which is false?

a. Banks must include insurance premiums in gross losses; and must use losses net of insurance recoveries as an input for the SMA loss data set

b. The bank must be able to map its historical internal loss data into the relevant Level 1 supervisory categories as defined in Annex 9 of the Basel II accord

c. Losses caused by a common operational risk event or by related operational risk events over time must be grouped and entered into the SMA loss data set as a single loss.

d. The bank must have an appropriate de minimis gross loss threshold for internal loss data collection, which can vary between banks and across event types but cannot be higher than €10,000 (except when the bank first moves to the SMA)

Answers here:

Last edited by a moderator: