Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

703.1. Operational data governance at Alphafind Financial Services includes the following data quality rules and/or procedures:

I. Each transaction record has a identifier (ID) called the primary key which prevents duplicates and manages dependencies in the SQL relational database

II. Key data samples from the database are routinely checked against a third-party "system of record" in order to ensure the values are corroborated by real-life entities

III. Key financial and market variables that are published in, and inform, client recommendation reports are time-stamped and include an "expiration (aka, to be used by) date"

IV. When financial values such as trailing 12-month earnings per share (EPS) are aggregated from different sources into the database, the values employ similar calculations so that they are comparable and comparisons are reasonable

These data quality rules do reflect EACH of the following desirable data quality dimensions EXCEPT which is NOT specifically reflected in Alphafind's four rules above?

a. Accuracy

b. Completeness

c. Consistency

d. Uniqueness

703.2. Basel identifies seven high-level categories (Category Level 1) operational loss types, as follows:

I. Coding Error: a software code error causes the banks intelligent deposit machines to fail to create suspicious-transaction reports which leads the regular to impose fines due to a breach of anti money-laundering (AML) laws

II. Aggressive Sales: Motivated by compensation plans, certain retail branch managers use aggressive sales tactics to over-sell financial products to their customers, and in some cases the products are not "suitable" for the customers

III. Misunderstood Order: In the communication chain from client to banker to trader's assistant to trader, because the client is a foreign-language speaker, the client's trade is misunderstood and an order for $1,000,000 is placed rather than an order for $100,000 which is the trade the client intended (EDPM: Transaction Capture, Execution and Maintenance)

IV. Too-expensive Salesforce: The board hires a new chief executive officer (CEO) who re-organizes the sales force and and the sales incentive plan in order to accelerate cross-selling to large and national accounts, but the cost structure of the incentive plan is a persistent drag on profitability especially as competitors shift to cheaper online sales tactics

Which of these events or mistakes is an operational loss in the classic seven-category framework?

a. None are operational losses

b. I., II., and III. are operational losses but IV. is not

c. I. and IV. are operational losses, but II. and III. are not

d. All are operational losses

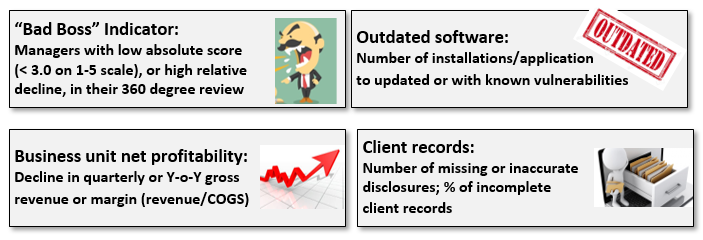

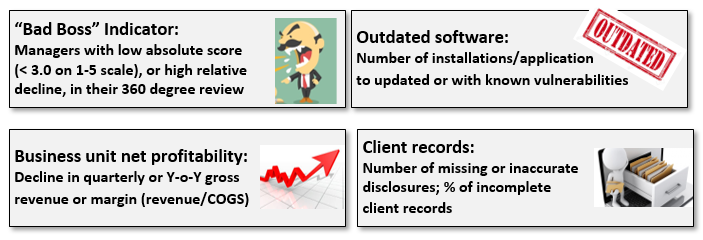

703.3. Your colleague Barry shows you the first draft of a new Operational Risk Dashboard that will contains the firm's operational key risk indicators (KRIs). The Risk Committee of the board has asked for key risk indicators and, specifically, that requested that the KRIs are distinguished from key performance indicators (KPIs) and key control indicators (KCIs). Here is Barry's first draft:

At first glance, all four of these metric sets appear to be plausible key risk indicators (KRIs) EXCEPT which is the LEAST LIKELY to meet the board's request for KRIs?

a. Bad boss indicators

b. Outdated software indicators

c. Business unit net profitability indicators

d. Client record indicators

Answers here:

Questions:

703.1. Operational data governance at Alphafind Financial Services includes the following data quality rules and/or procedures:

I. Each transaction record has a identifier (ID) called the primary key which prevents duplicates and manages dependencies in the SQL relational database

II. Key data samples from the database are routinely checked against a third-party "system of record" in order to ensure the values are corroborated by real-life entities

III. Key financial and market variables that are published in, and inform, client recommendation reports are time-stamped and include an "expiration (aka, to be used by) date"

IV. When financial values such as trailing 12-month earnings per share (EPS) are aggregated from different sources into the database, the values employ similar calculations so that they are comparable and comparisons are reasonable

These data quality rules do reflect EACH of the following desirable data quality dimensions EXCEPT which is NOT specifically reflected in Alphafind's four rules above?

a. Accuracy

b. Completeness

c. Consistency

d. Uniqueness

703.2. Basel identifies seven high-level categories (Category Level 1) operational loss types, as follows:

- Execution, Delivery, and Process Management (EDPM)

- Clients, Products, and Business Practice (CPBP)

- Business Disruption and Systems Failures (BDSF)

- Internal Fraud

- External Fraud

- Employment Practices and Workplace Safety (EPWS)

- Damage to Physical Assets

I. Coding Error: a software code error causes the banks intelligent deposit machines to fail to create suspicious-transaction reports which leads the regular to impose fines due to a breach of anti money-laundering (AML) laws

II. Aggressive Sales: Motivated by compensation plans, certain retail branch managers use aggressive sales tactics to over-sell financial products to their customers, and in some cases the products are not "suitable" for the customers

III. Misunderstood Order: In the communication chain from client to banker to trader's assistant to trader, because the client is a foreign-language speaker, the client's trade is misunderstood and an order for $1,000,000 is placed rather than an order for $100,000 which is the trade the client intended (EDPM: Transaction Capture, Execution and Maintenance)

IV. Too-expensive Salesforce: The board hires a new chief executive officer (CEO) who re-organizes the sales force and and the sales incentive plan in order to accelerate cross-selling to large and national accounts, but the cost structure of the incentive plan is a persistent drag on profitability especially as competitors shift to cheaper online sales tactics

Which of these events or mistakes is an operational loss in the classic seven-category framework?

a. None are operational losses

b. I., II., and III. are operational losses but IV. is not

c. I. and IV. are operational losses, but II. and III. are not

d. All are operational losses

703.3. Your colleague Barry shows you the first draft of a new Operational Risk Dashboard that will contains the firm's operational key risk indicators (KRIs). The Risk Committee of the board has asked for key risk indicators and, specifically, that requested that the KRIs are distinguished from key performance indicators (KPIs) and key control indicators (KCIs). Here is Barry's first draft:

At first glance, all four of these metric sets appear to be plausible key risk indicators (KRIs) EXCEPT which is the LEAST LIKELY to meet the board's request for KRIs?

a. Bad boss indicators

b. Outdated software indicators

c. Business unit net profitability indicators

d. Client record indicators

Answers here:

Last edited by a moderator: