AIM: Define gross loss and net loss and identify which specific items should be included or excluded in gross loss computations per the Basel committee. Describe the process and considerations suggested by the Basel committee for a bank to use in determining a loss data threshold. Describe the four data elements which are required to compute a bank's operational risk capital charge per the Basel Committee's AMA framework. Define an operational risk management framework (ORMF) and an operational risk measurement system (ORMS) and explain the relationship between a bank’s ORMF and its ORMS.

Questions:

411.1. In Operational Risk Operational Risk--Supervisory Guidelines for the Advanced Measurement Approaches (AMA), the Basel Committee writes, "An operational risk loss can only arise from an operational risk event. The scope of operational risk loss refers to the type of events, whether or not having an impact on the financial statement, to be included in the operational risk database, and the purposes for which they are included (eg for management and/or measurement purposes)."

In regard to gross and net operational losses due to operational risk events, each of the following is true EXCEPT which is false?

a. As input for its advanced measurement approach (AMA), a bank may use "gross loss" amount or "net loss" amount, where gross loss is the loss before recoveries of any type and net loss is defined as the loss after taking into account the impact of appropriate recoveries, if the bank can demonstrate the appropriateness of its choice to its supervisors.

b. Gross loss amount must be measured on a mark-to-market basis but cannot be based on replacement cost. Recoveries due to insurance, up to the full 100%, may be included in net loss as an input in the bank's AMA model.

c. Provisions ("reserves"), which are reflected in the comprehensive income statement, must be INCLUDED in the gross loss computation.

d. Cost of general maintenance on plant, property and equipment (PP&E) and insurance premiums should be EXCLUDED from the gross loss computation.

411.2. According to the Basel Committee, "The AMA of a bank requires the use of four data elements which are: internal loss data (ILD); external data (ED); scenario analysis (SA) and business environment and internal control factors (BEICFs)."

About these four data elements, each of the following is true EXCEPT which is false?

a. Internal loss data (ILD) is the only component of the AMA model that records a bank's actual loss experience. ILD should be used to assist in the estimation of loss frequencies, to inform the severity distribution(s) to the extent possible, and to serve as an input into scenario analysis as it provides a foundation for the bank’s scenarios within its own risk profile.

b. External data (ED) provides information on large actual losses that have not been experienced by the bank, and is therefore a natural complement to ILD in modeling loss severity.

c. Scenario analysis (SA) is qualitative by nature and therefore the outputs from a scenario process necessarily contain significant uncertainties. This uncertainty should be reflected in the output of the model producing a range for the capital requirements estimate.

d. Business environment and internal control factors (BEICFs) have in practice the greatest direct impact (among the four data elements) to the capital charge and they offer the advantage of easy, direct, objective input into the capital model with the disadvantage being they are backward-looking.

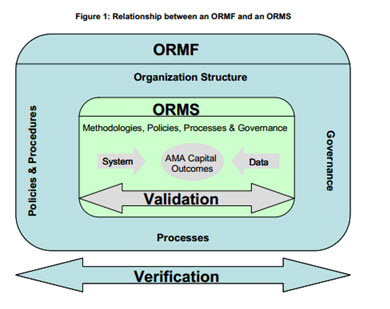

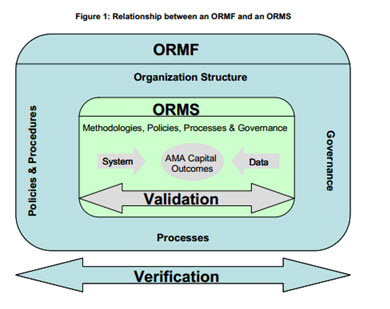

411.3. In the assigned reading (Operational Risk--Supervisory Guidelines for the Advanced Measurement Approaches), the Basel Committee publishes the figure below (Figure 1) to illustrate the relationship between an operational risk management framework (ORMF) and an operational risk measurement system (ORMS):

In regard to an ORMF and ORMS, each of the following is true EXCEPT which is false?

a. The Basel Framework requires banks to develop an operational risk management framework which consists of a bank’s: (a) risk organizational and governance structure; (b) policies, procedures and processes; (c) systems used by a bank in identifying, measuring, monitoring, controlling and mitigating operational risk; and (d) operational risk measurement system (ORMS)

b. The governance structure commonly adopted by banks for their operational risk discipline relies on two lines of defense: 1. business line management and 2. an independent corporate operational risk management function. Verification and validation are components of the first line of defense (business line management).

c. Verification of the ORMF is done on a periodic basis and is typically conducted by the bank's internal and/or external audit. Verification activities test the effectiveness of the overall ORMF, consistent with policies approved by the board of directors, and also test ORMS validation processes to ensure they are independent and implemented in a manner consistent with established bank policies.

d. Validation ensures that the ORMS used by the bank is sufficiently robust and provides assurance of the integrity of inputs, assumptions, processes and outputs. Specifically, the independent validation process should provide enhanced assurance that the risk measurement methodology results in an operational risk capital charge.

Answers here:

Questions:

411.1. In Operational Risk Operational Risk--Supervisory Guidelines for the Advanced Measurement Approaches (AMA), the Basel Committee writes, "An operational risk loss can only arise from an operational risk event. The scope of operational risk loss refers to the type of events, whether or not having an impact on the financial statement, to be included in the operational risk database, and the purposes for which they are included (eg for management and/or measurement purposes)."

In regard to gross and net operational losses due to operational risk events, each of the following is true EXCEPT which is false?

a. As input for its advanced measurement approach (AMA), a bank may use "gross loss" amount or "net loss" amount, where gross loss is the loss before recoveries of any type and net loss is defined as the loss after taking into account the impact of appropriate recoveries, if the bank can demonstrate the appropriateness of its choice to its supervisors.

b. Gross loss amount must be measured on a mark-to-market basis but cannot be based on replacement cost. Recoveries due to insurance, up to the full 100%, may be included in net loss as an input in the bank's AMA model.

c. Provisions ("reserves"), which are reflected in the comprehensive income statement, must be INCLUDED in the gross loss computation.

d. Cost of general maintenance on plant, property and equipment (PP&E) and insurance premiums should be EXCLUDED from the gross loss computation.

411.2. According to the Basel Committee, "The AMA of a bank requires the use of four data elements which are: internal loss data (ILD); external data (ED); scenario analysis (SA) and business environment and internal control factors (BEICFs)."

About these four data elements, each of the following is true EXCEPT which is false?

a. Internal loss data (ILD) is the only component of the AMA model that records a bank's actual loss experience. ILD should be used to assist in the estimation of loss frequencies, to inform the severity distribution(s) to the extent possible, and to serve as an input into scenario analysis as it provides a foundation for the bank’s scenarios within its own risk profile.

b. External data (ED) provides information on large actual losses that have not been experienced by the bank, and is therefore a natural complement to ILD in modeling loss severity.

c. Scenario analysis (SA) is qualitative by nature and therefore the outputs from a scenario process necessarily contain significant uncertainties. This uncertainty should be reflected in the output of the model producing a range for the capital requirements estimate.

d. Business environment and internal control factors (BEICFs) have in practice the greatest direct impact (among the four data elements) to the capital charge and they offer the advantage of easy, direct, objective input into the capital model with the disadvantage being they are backward-looking.

411.3. In the assigned reading (Operational Risk--Supervisory Guidelines for the Advanced Measurement Approaches), the Basel Committee publishes the figure below (Figure 1) to illustrate the relationship between an operational risk management framework (ORMF) and an operational risk measurement system (ORMS):

In regard to an ORMF and ORMS, each of the following is true EXCEPT which is false?

a. The Basel Framework requires banks to develop an operational risk management framework which consists of a bank’s: (a) risk organizational and governance structure; (b) policies, procedures and processes; (c) systems used by a bank in identifying, measuring, monitoring, controlling and mitigating operational risk; and (d) operational risk measurement system (ORMS)

b. The governance structure commonly adopted by banks for their operational risk discipline relies on two lines of defense: 1. business line management and 2. an independent corporate operational risk management function. Verification and validation are components of the first line of defense (business line management).

c. Verification of the ORMF is done on a periodic basis and is typically conducted by the bank's internal and/or external audit. Verification activities test the effectiveness of the overall ORMF, consistent with policies approved by the board of directors, and also test ORMS validation processes to ensure they are independent and implemented in a manner consistent with established bank policies.

d. Validation ensures that the ORMS used by the bank is sufficiently robust and provides assurance of the integrity of inputs, assumptions, processes and outputs. Specifically, the independent validation process should provide enhanced assurance that the risk measurement methodology results in an operational risk capital charge.

Answers here:

Last edited by a moderator: