Learning Objectives: Compute the adjusted RAROC for a project to determine its viability. Explain challenges in modeling diversification benefits, including aggregating a firm’s risk capital and allocating economic capital to different business lines. Explain best practices in implementing an approach that uses RAROC to allocate economic capital.

Questions:

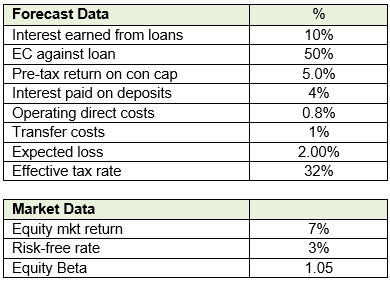

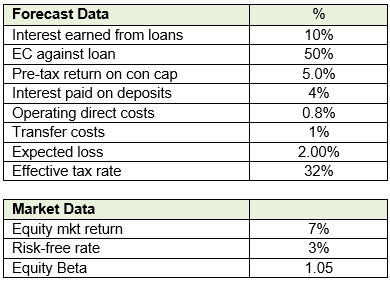

24.13.1. The bank is considering an investment of $200 million in a loan portfolio and seeks to determine the financial viability of this investment by calculating the Adjusted RORAC. The board is particularly interested in systemic risk factors affecting the investment. The hurdle rate for assessing viability is set at 6%.

a. The project adds value on a risk-adjusted basis because the adjusted RORAC is greater than the hurdle rate of 6%.

b. No, the project doesn’t add value based on a risk-adjusted basis because the adjusted RORAC is less than the risk-free rate of 3%.

c. The project adds value on a risk-adjusted basis because the adjusted RORAC is greater than the risk-free rate of 3%.

d. No, the project doesn’t add value based on a risk-adjusted basis because the adjusted RORAC is less than the hurdle rate of 6%.

24.13.2. The board is considering optimizing capital allocation by taking advantage of the diversification effects between two departments: Consumer Credit Cards and Consumer Purchase Loans, which have a negative correlation of -0.1162.

Data Provided:

Which of the following is the Board’s best option to optimize this allocation to reflect the negative correlation between the departments?

a. To fully diversify, the allocation should be $29.79 million to Consumer Credit Cards and $36.24 million to Consumer Purchase Loans.

b. To fully diversify, the allocation should be $60.21 million to Consumer Credit Cards and $73.58 million to Consumer Purchase Loans.

c. Increase Allocation to Consumer Credit Cards by $23.79 million and Consumer Purchase loans by $ 43.79 million

d. Increase Allocation to Consumer Credit Cards by $43.79 million and Consumer Purchase loans by $23.79 million

24.13.3. Financial Frontier Bank (FFB) has implemented a RAROC system to align risk and capital across its business units. After a year, which outcome is LEAST likely due to the RAROC implementation?

a. Increase in disputes over economic capital allocations

b. Reallocation of resources from lower to higher RAROC units

c. Increased activity in the parameter review group

d. Decrease in the frequency of risk parameter reviews.

Answers here:

Questions:

24.13.1. The bank is considering an investment of $200 million in a loan portfolio and seeks to determine the financial viability of this investment by calculating the Adjusted RORAC. The board is particularly interested in systemic risk factors affecting the investment. The hurdle rate for assessing viability is set at 6%.

a. The project adds value on a risk-adjusted basis because the adjusted RORAC is greater than the hurdle rate of 6%.

b. No, the project doesn’t add value based on a risk-adjusted basis because the adjusted RORAC is less than the risk-free rate of 3%.

c. The project adds value on a risk-adjusted basis because the adjusted RORAC is greater than the risk-free rate of 3%.

d. No, the project doesn’t add value based on a risk-adjusted basis because the adjusted RORAC is less than the hurdle rate of 6%.

24.13.2. The board is considering optimizing capital allocation by taking advantage of the diversification effects between two departments: Consumer Credit Cards and Consumer Purchase Loans, which have a negative correlation of -0.1162.

Data Provided:

- Consumer Credit Card VaR (99%): $90 million

- Consumer Purchase Loan VaR (99%): $110 million

Which of the following is the Board’s best option to optimize this allocation to reflect the negative correlation between the departments?

a. To fully diversify, the allocation should be $29.79 million to Consumer Credit Cards and $36.24 million to Consumer Purchase Loans.

b. To fully diversify, the allocation should be $60.21 million to Consumer Credit Cards and $73.58 million to Consumer Purchase Loans.

c. Increase Allocation to Consumer Credit Cards by $23.79 million and Consumer Purchase loans by $ 43.79 million

d. Increase Allocation to Consumer Credit Cards by $43.79 million and Consumer Purchase loans by $23.79 million

24.13.3. Financial Frontier Bank (FFB) has implemented a RAROC system to align risk and capital across its business units. After a year, which outcome is LEAST likely due to the RAROC implementation?

a. Increase in disputes over economic capital allocations

b. Reallocation of resources from lower to higher RAROC units

c. Increased activity in the parameter review group

d. Decrease in the frequency of risk parameter reviews.

Answers here: