Learning objectives: Describe and calculate the following metrics for credit exposure: ... expected positive exposure and negative exposure, effective exposure, and maximum exposure. Compare the characterization of credit exposure to VaR methods and describe additional considerations used in the determination of credit exposure.

Questions:

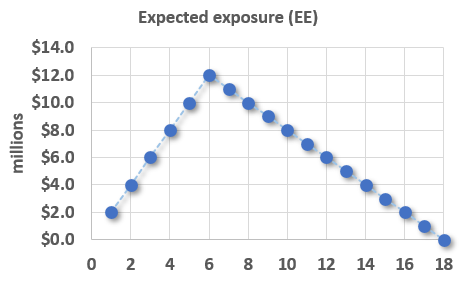

909.1. The graph below plots the expected exposure (EE) of a position over the next 18 months, starting at +2.0 million in the first month and finishing at zero in the eighteenth month:

The expected exposure (EE) is observed once per month such that there are 18 observations; for example, EE(+2 months) = +$4.0 million, EE(+17 months) = +$1.0 million. Given this exposure profile, what is the position's expected positive exposure (EPE)?

a. Zero

b. 6.0

c. 7.5

d. 9.0

909.2. There are several different, but compatible, measures of counterparty credit exposure. In his introduction to the various metrics, Gregory explains, "The different [counterparty credit exposure] metrics introduced will be appropriate for different applications. There is no standard nomenclature used and some terms may be used in other context(s) elsewhere. We follow the original regulator definitions (BCBS, 2005)." (Source: Jon Gregory, The xVA Challenge: Counterparty Credit Risk, Funding, Collateral, and Capital, 3rd edition (West Sussex, UK: John Wiley & Sons, 2015)

The key metrics introduced include: expected future value (EFV), potential future exposure (PFE), expected exposure (EE), Maximum potential future exposure (PFE), expected positive exposure (EPE), effective expected exposure (effective EE), and effective expected positive exposure (EEPE). In regard to this "metric soup" when it comes to measuring counterparty credit exposure, each of the following statements is true EXCEPT which is inaccurate?

a. For bilateral (i.e., non-loan) contracts, counterparty exposure at default (EAD) is typically set equal to expected exposure (EE)

b. Effective EPE (EEPE) is a conservative version of EPE that attempts to capture rollover risk and/or short-dated but large exposures

c. Among the metrics listed above, the only two that average several future values over time are expected positive exposure (EPE) and effective EPE (EEPE)

d. Except for expected future value (EFV) which can be negative, each of the metrics listed above (i.e., EE, 9X.X% PFE, EPE, EEE, and EEPE) are necessarily non-negative

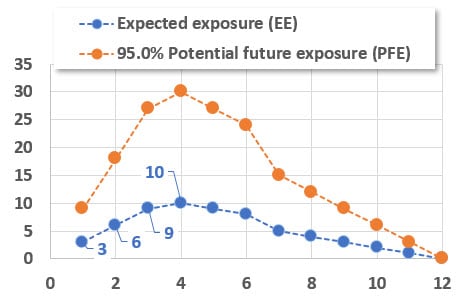

909.3. Below are illustrated the expected exposure (EE) and 95.0% potential future exposure (PFE) for a position over the next twelve months. Each exposure is measured once per month.

Which of the following is most likely to be TRUE about this position's exposure profile?

a. The expected positive exposure (EPE) is +9.0 million

b. The effective expected positive exposure (aka, EEPE) is +9.0 million

c. The effective expected exposure (aka, effective EE) at +10 months is $2.0 million

d. The maximum 95.0% potential future exposure (aka, maximum PFE) is $30.0 * (12-4) * 1.645 = $395.0 million

Answers here:

Questions:

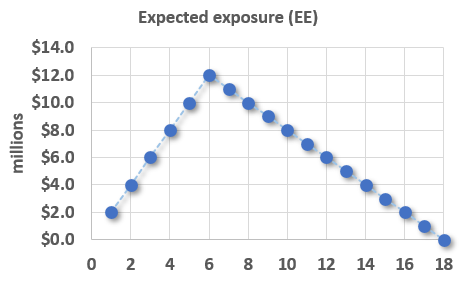

909.1. The graph below plots the expected exposure (EE) of a position over the next 18 months, starting at +2.0 million in the first month and finishing at zero in the eighteenth month:

The expected exposure (EE) is observed once per month such that there are 18 observations; for example, EE(+2 months) = +$4.0 million, EE(+17 months) = +$1.0 million. Given this exposure profile, what is the position's expected positive exposure (EPE)?

a. Zero

b. 6.0

c. 7.5

d. 9.0

909.2. There are several different, but compatible, measures of counterparty credit exposure. In his introduction to the various metrics, Gregory explains, "The different [counterparty credit exposure] metrics introduced will be appropriate for different applications. There is no standard nomenclature used and some terms may be used in other context(s) elsewhere. We follow the original regulator definitions (BCBS, 2005)." (Source: Jon Gregory, The xVA Challenge: Counterparty Credit Risk, Funding, Collateral, and Capital, 3rd edition (West Sussex, UK: John Wiley & Sons, 2015)

The key metrics introduced include: expected future value (EFV), potential future exposure (PFE), expected exposure (EE), Maximum potential future exposure (PFE), expected positive exposure (EPE), effective expected exposure (effective EE), and effective expected positive exposure (EEPE). In regard to this "metric soup" when it comes to measuring counterparty credit exposure, each of the following statements is true EXCEPT which is inaccurate?

a. For bilateral (i.e., non-loan) contracts, counterparty exposure at default (EAD) is typically set equal to expected exposure (EE)

b. Effective EPE (EEPE) is a conservative version of EPE that attempts to capture rollover risk and/or short-dated but large exposures

c. Among the metrics listed above, the only two that average several future values over time are expected positive exposure (EPE) and effective EPE (EEPE)

d. Except for expected future value (EFV) which can be negative, each of the metrics listed above (i.e., EE, 9X.X% PFE, EPE, EEE, and EEPE) are necessarily non-negative

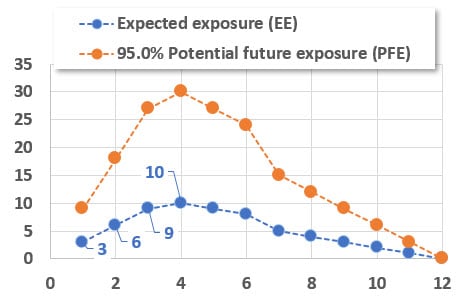

909.3. Below are illustrated the expected exposure (EE) and 95.0% potential future exposure (PFE) for a position over the next twelve months. Each exposure is measured once per month.

Which of the following is most likely to be TRUE about this position's exposure profile?

a. The expected positive exposure (EPE) is +9.0 million

b. The effective expected positive exposure (aka, EEPE) is +9.0 million

c. The effective expected exposure (aka, effective EE) at +10 months is $2.0 million

d. The maximum 95.0% potential future exposure (aka, maximum PFE) is $30.0 * (12-4) * 1.645 = $395.0 million

Answers here:

Last edited by a moderator: