Learning objectives: Identify and describe the different ways institutions can quantify, manage and mitigate counterparty risk. Identify and explain the costs of an OTC derivative. Explain the components of the xVA term.

Questions:

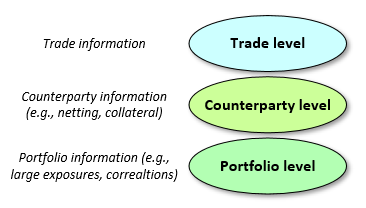

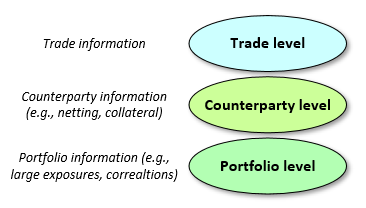

902.1. Patricia is a Risk Analyst working on a counterparty risk management system for her international financial services firm. The Risk Committee of the Board has requested that her system assess counterparty risk at three levels: trade level, counterparty level, and portfolio level.

In the context of these three levels, Patricia is trying to evaluate the pros and cons of credit limits and the credit value adjustment (CVA). Each of the following is true EXCEPT which is false?

a. CVA and credit limits are complements in this three-level system

b. Credit limits act at the portfolio level by limiting exposures to avoid concentrations

c. CVA focuses on evaluating counterparty risk at the trade level and counterparty level

d. CVA encourages maximizing the number of trading counterparties in order to maximize the benefits of netting, but credit limits encourage minimizing this number to encourage smaller exposures

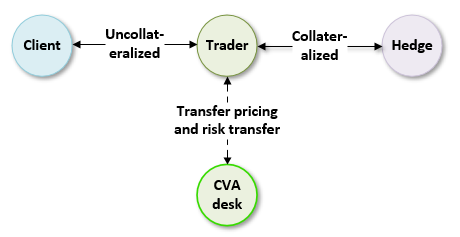

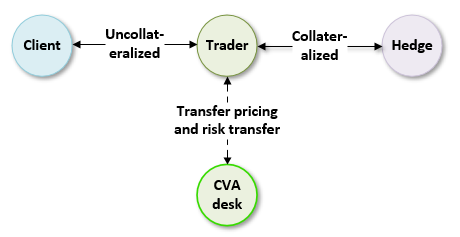

902.2. The figure below illustrates the general role of the credit value adjustment (CVA) desk at Heroic Multifunction Bank (aka, the bank). Assume the trader is a market maker. The uncollateralized trade with the customer (on the left) is hedged with a collateralized trade (on the right):

Assume the uncollateralized transaction (with the client) has a positive mark-to-market (MTM) value such that, by definition, the collateralized hedge position, therefore, has a negative MTM value. If the market moves such that, with respect to the position with the client, the position's positive MTM value INCREASES and becomes even more positive, then which of the following implications is most likely to be TRUE?

a. Funding cost (FVA) is positive

b. From the trader's (market maker's) perspective, CVA decreases

c. Because the position is hedged, there is no associated regulatory cost of capital to the bank

d. The trader (market maker) writes a contingent credit default swap (CCDS) to transfer its counterparty risk

902.3. In regard to his firm's derivative contract, Peter the Risk Analyst has performed the first step of a valuation by determining that the basic value ("basic valuation") of the position is $50.0 million. His next step is to make adjustments for the relevant xVA terms. For the derivative contract, the value of these xVA terms include the following:

a. $35.0 milloin

b. $39.0 million

c. $47.0 million

d. $55.0 million

Answers here:

Questions:

902.1. Patricia is a Risk Analyst working on a counterparty risk management system for her international financial services firm. The Risk Committee of the Board has requested that her system assess counterparty risk at three levels: trade level, counterparty level, and portfolio level.

In the context of these three levels, Patricia is trying to evaluate the pros and cons of credit limits and the credit value adjustment (CVA). Each of the following is true EXCEPT which is false?

a. CVA and credit limits are complements in this three-level system

b. Credit limits act at the portfolio level by limiting exposures to avoid concentrations

c. CVA focuses on evaluating counterparty risk at the trade level and counterparty level

d. CVA encourages maximizing the number of trading counterparties in order to maximize the benefits of netting, but credit limits encourage minimizing this number to encourage smaller exposures

902.2. The figure below illustrates the general role of the credit value adjustment (CVA) desk at Heroic Multifunction Bank (aka, the bank). Assume the trader is a market maker. The uncollateralized trade with the customer (on the left) is hedged with a collateralized trade (on the right):

Assume the uncollateralized transaction (with the client) has a positive mark-to-market (MTM) value such that, by definition, the collateralized hedge position, therefore, has a negative MTM value. If the market moves such that, with respect to the position with the client, the position's positive MTM value INCREASES and becomes even more positive, then which of the following implications is most likely to be TRUE?

a. Funding cost (FVA) is positive

b. From the trader's (market maker's) perspective, CVA decreases

c. Because the position is hedged, there is no associated regulatory cost of capital to the bank

d. The trader (market maker) writes a contingent credit default swap (CCDS) to transfer its counterparty risk

902.3. In regard to his firm's derivative contract, Peter the Risk Analyst has performed the first step of a valuation by determining that the basic value ("basic valuation") of the position is $50.0 million. His next step is to make adjustments for the relevant xVA terms. For the derivative contract, the value of these xVA terms include the following:

- CVA = $5.0 million

- DVA = $2.0 million

- FVA = $1.0 unsecured funding cost (not a funding benefit)

- ColVa = 0 (not applicable because the contract is uncollateralized)

- KVA = $4.0 million

- MVA = $3.0 million

a. $35.0 milloin

b. $39.0 million

c. $47.0 million

d. $55.0 million

Answers here:

Last edited by a moderator: