Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

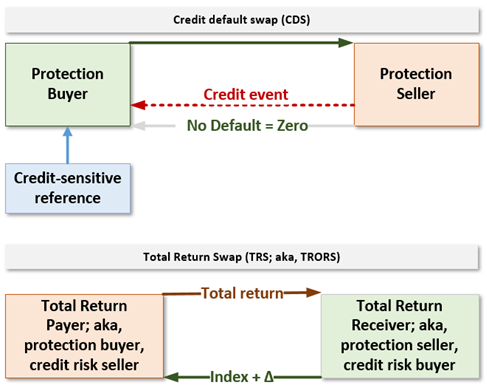

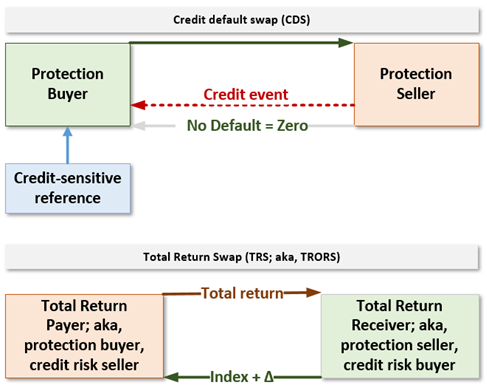

715.1. Both the credit default swap (CDS) and the total return swap (TRS, aka TRORS) can be used to hedge risk, but the TRS is a more comprehensive hedge instrument. While the CDS hedges credit risk--in particular, default risk and credit deterioration risk--the TRS hedges both credit and market risk. Consider the mechanical similarities and differences, as illustrated below.

About the CDS and TRS, each of the following statements is true EXCEPT which is false?

a. The total return swap (TRS) is equivalent to a FUNDED credit default swap (CDS)

b. Upon a legitimate credit event in a CDS, the protection buyer stops paying the regular premium and the protection seller pays notional multiplied by (one minus the recovery rate); ie, (1-RR)

c. In the TRS, the Receiver will pay its counterparty for depreciation in value of the reference, but in some leveraged TRSs, the buyer holds the explicit option to default on this obligation and abandon the collateral

d. The CDS is a first-to-default (1TD) put if the reference is a portfolio of credit-sensitive assets and the credit (payoff) event is default of any one of the assets; in which case, the spread will depend at least partly on the degree of pairwise correlation between reference credits

715.2. You are pricing (aka, valuation) a to-be newly issued mortgage-backed security (MBS) where the mortgage pool has an original loan balance of $20.0 million. Due to lower interest rates, your model makes an assumption of 235% Public Securities Association (PSA). Under this assumption, which of the following is the nearest to the model's prepayments in the first month (excluding the scheduled prepayment, of course)?

a. $3,336.40

b. $7,850.26

c. $40,000.00

d. $94,000.00

715.3. Consider the following schedule for a 60-month loan with an original principal balance of $300,000 and yield of 5.0%. The loan fully amortizes (please note the schedule is truncated such that months six through 56 are skipped).

Each of the following is true EXCEPT which is false?

a. The Macaulay duration is about 4.88 years

b The weighted average life (WAL) exceeds the duration

c. A increase in yield will increase the WAL but decrease the duration

d. The mortgage payment factor is given by [0.050*(1+0.050)^60]/[(1+0.050)^60 - 1]

Answers here:

Questions:

715.1. Both the credit default swap (CDS) and the total return swap (TRS, aka TRORS) can be used to hedge risk, but the TRS is a more comprehensive hedge instrument. While the CDS hedges credit risk--in particular, default risk and credit deterioration risk--the TRS hedges both credit and market risk. Consider the mechanical similarities and differences, as illustrated below.

About the CDS and TRS, each of the following statements is true EXCEPT which is false?

a. The total return swap (TRS) is equivalent to a FUNDED credit default swap (CDS)

b. Upon a legitimate credit event in a CDS, the protection buyer stops paying the regular premium and the protection seller pays notional multiplied by (one minus the recovery rate); ie, (1-RR)

c. In the TRS, the Receiver will pay its counterparty for depreciation in value of the reference, but in some leveraged TRSs, the buyer holds the explicit option to default on this obligation and abandon the collateral

d. The CDS is a first-to-default (1TD) put if the reference is a portfolio of credit-sensitive assets and the credit (payoff) event is default of any one of the assets; in which case, the spread will depend at least partly on the degree of pairwise correlation between reference credits

715.2. You are pricing (aka, valuation) a to-be newly issued mortgage-backed security (MBS) where the mortgage pool has an original loan balance of $20.0 million. Due to lower interest rates, your model makes an assumption of 235% Public Securities Association (PSA). Under this assumption, which of the following is the nearest to the model's prepayments in the first month (excluding the scheduled prepayment, of course)?

a. $3,336.40

b. $7,850.26

c. $40,000.00

d. $94,000.00

715.3. Consider the following schedule for a 60-month loan with an original principal balance of $300,000 and yield of 5.0%. The loan fully amortizes (please note the schedule is truncated such that months six through 56 are skipped).

Each of the following is true EXCEPT which is false?

a. The Macaulay duration is about 4.88 years

b The weighted average life (WAL) exceeds the duration

c. A increase in yield will increase the WAL but decrease the duration

d. The mortgage payment factor is given by [0.050*(1+0.050)^60]/[(1+0.050)^60 - 1]

Answers here: