Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

712.1. Today Plextech Bank enters into a fairly priced interest rate swap ("fairly priced" implies the value of the swap is zero at inception, T0) where Plextech Bank pays a fixed rate of 3.0% per annum with semi-annual compounding in exchange for receiving six-month LIBOR from its counterparty; in this way, Plexttech Bank is the fixed-rate payer. Interest payments are exchanged every six months (twice a year). The notional amount is USD $100.0 million and the tenor (swap life) is two years. When the bank enters the swap, the LIBOR/swap rate curve is flat at 3.0% per annum with semiannual compounding. Six months later, the LIBOR/swap rate shifts up by 50 basis points to 3.50%. At this time (T0 + 0.5 years), (immediately after the exchange) the current exposure of the bank will be nearest to what?

a. Zero

b. +500,000

c. +724,500

d. +833,300

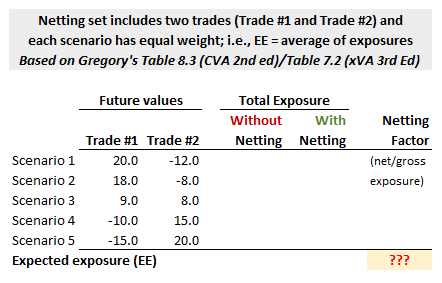

712.2. Consider a netting set consisting of only two trades that tend to be negatively correlated, as illustrated below under five scenarios:

The expected exposure (EE) should assume each scenario has equal weight, such that here expected exposure is the simple average of the five scenario exposures. If we define the netting factor as the ratio of net (i.e., with netting) expected exposure to gross (i.e., without netting) expected exposure, then what is the netting factor?

a. 25.0%

b. 50.0%

c. 75.0%

d. 100.0%

712.3. About the potential future exposure (PFE) of various instruments, each of the following is true EXCEPT which is false?

a. The PFE converges to zero at maturity for both the buyer and seller of a credit default swap (CDS)

b. The PFE at maturity is greater for a long option position than the corresponding short position on the same option

c. The PFE at maturity is greater for a cross-currency swap than an (vanilla) interest rate swap with otherwise similar characteristics

d. For both the fixed-rate payer and floating-rate payer in a vanilla IRS, the PFE will diffuse to a peak at approximately one-third the life of the swap and then amortize toward zero

Answers here:

Questions:

712.1. Today Plextech Bank enters into a fairly priced interest rate swap ("fairly priced" implies the value of the swap is zero at inception, T0) where Plextech Bank pays a fixed rate of 3.0% per annum with semi-annual compounding in exchange for receiving six-month LIBOR from its counterparty; in this way, Plexttech Bank is the fixed-rate payer. Interest payments are exchanged every six months (twice a year). The notional amount is USD $100.0 million and the tenor (swap life) is two years. When the bank enters the swap, the LIBOR/swap rate curve is flat at 3.0% per annum with semiannual compounding. Six months later, the LIBOR/swap rate shifts up by 50 basis points to 3.50%. At this time (T0 + 0.5 years), (immediately after the exchange) the current exposure of the bank will be nearest to what?

a. Zero

b. +500,000

c. +724,500

d. +833,300

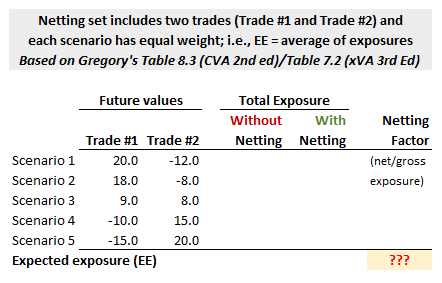

712.2. Consider a netting set consisting of only two trades that tend to be negatively correlated, as illustrated below under five scenarios:

The expected exposure (EE) should assume each scenario has equal weight, such that here expected exposure is the simple average of the five scenario exposures. If we define the netting factor as the ratio of net (i.e., with netting) expected exposure to gross (i.e., without netting) expected exposure, then what is the netting factor?

a. 25.0%

b. 50.0%

c. 75.0%

d. 100.0%

712.3. About the potential future exposure (PFE) of various instruments, each of the following is true EXCEPT which is false?

a. The PFE converges to zero at maturity for both the buyer and seller of a credit default swap (CDS)

b. The PFE at maturity is greater for a long option position than the corresponding short position on the same option

c. The PFE at maturity is greater for a cross-currency swap than an (vanilla) interest rate swap with otherwise similar characteristics

d. For both the fixed-rate payer and floating-rate payer in a vanilla IRS, the PFE will diffuse to a peak at approximately one-third the life of the swap and then amortize toward zero

Answers here:

Last edited by a moderator: