Learning objectives: Differentiate among current exposure, peak exposure, expected exposure, and expected positive exposure. Explain the treatment of counterparty credit risk (CCR) both as a credit risk and as a market risk and describe its implications for trading activities and risk management for a financial institution. Describe a stress test that can be performed on a loan portfolio and on a derivative portfolio. Calculate the stressed expected loss, the stress loss for the loan portfolio and the stress loss on a derivative portfolio.

Questions:

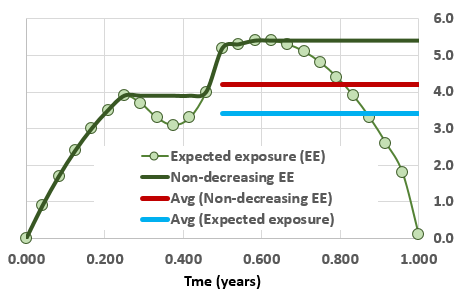

707.1. The following plots the exposure profile for a given netting set:

Each of the lines in this chart is a function of the expected exposure (EE) which is plotted with green circular markers. The solid dark green line is a non-decreasing EE. The light blue horizontal line is the time-weighted average of the expected exposure; the red horizontal line is the time-weighted average of the non-decreasing EE. Each of the following statements is true about this exposure profile EXCEPT which is false?

a. Effective EPE is about 4.2

b. Peak exposure is about 5.4

c. Expected positive exposure (EPE) is about 3.4

d. Potential future exposure (PFE) cannot be inferred from the chart

707.2. Rick is the bank's Credit Counterparty Risk (CCR) Manager and he is preparing a stress test report for a credit portfolio that includes positions with five major counterparties. In addition to default risk and credit deterioration, each of these positions does expose the bank to fluctuations in its credit valuation adjustment (CVA). Because the stress test report will be presented to the bank's Chief Risk Officer (CRO), Rick wants to summarize all relevant values but he does not want to show more values than necessary. Which of the following is the MOST LIKELY number of values (ie, stress test results) that he will need to present in his report?

a. One value for the aggregate portfolio

b. Six values: one for the credit risk of each counterparty plus one for credit risk of the portfolio

c. Ten values: for each counterparty, both market and credit risk (but overall portfolio values will be superfluous)

d. At least twelve values: both credit risk and market risk of each counterparty plus the portfolio

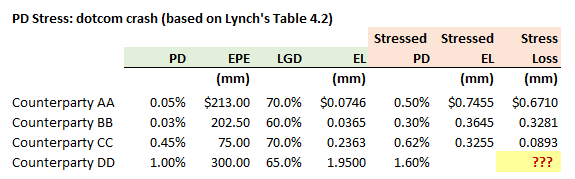

707.3. The following table illustrates how a financial institution might reconsider its stress test of current exposure in an expected-loss framework:

What should be the Stress Loss value (cell indicted by "???") for Counterparty DD?

a. $420,000

b. $935,500

c. $1,170,000

d. $4,800,000

Answers here:

Questions:

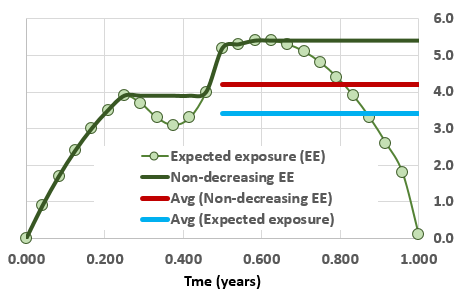

707.1. The following plots the exposure profile for a given netting set:

Each of the lines in this chart is a function of the expected exposure (EE) which is plotted with green circular markers. The solid dark green line is a non-decreasing EE. The light blue horizontal line is the time-weighted average of the expected exposure; the red horizontal line is the time-weighted average of the non-decreasing EE. Each of the following statements is true about this exposure profile EXCEPT which is false?

a. Effective EPE is about 4.2

b. Peak exposure is about 5.4

c. Expected positive exposure (EPE) is about 3.4

d. Potential future exposure (PFE) cannot be inferred from the chart

707.2. Rick is the bank's Credit Counterparty Risk (CCR) Manager and he is preparing a stress test report for a credit portfolio that includes positions with five major counterparties. In addition to default risk and credit deterioration, each of these positions does expose the bank to fluctuations in its credit valuation adjustment (CVA). Because the stress test report will be presented to the bank's Chief Risk Officer (CRO), Rick wants to summarize all relevant values but he does not want to show more values than necessary. Which of the following is the MOST LIKELY number of values (ie, stress test results) that he will need to present in his report?

a. One value for the aggregate portfolio

b. Six values: one for the credit risk of each counterparty plus one for credit risk of the portfolio

c. Ten values: for each counterparty, both market and credit risk (but overall portfolio values will be superfluous)

d. At least twelve values: both credit risk and market risk of each counterparty plus the portfolio

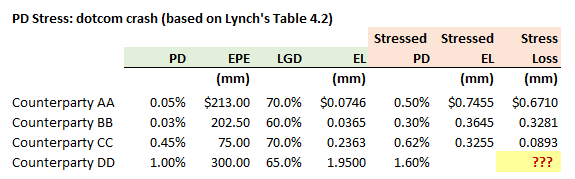

707.3. The following table illustrates how a financial institution might reconsider its stress test of current exposure in an expected-loss framework:

What should be the Stress Loss value (cell indicted by "???") for Counterparty DD?

a. $420,000

b. $935,500

c. $1,170,000

d. $4,800,000

Answers here: