Learning outcomes: Describe rating agencies’ assignment methodologies for issue and issuer ratings. Describe the relationship between borrower rating and probability of default. Compare agencies’ ratings to internal experts-based rating systems. Distinguish between the structural approaches and the reduced-form approaches to predicting default.

Questions:

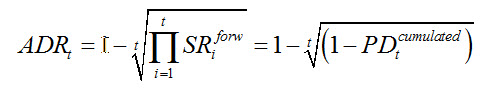

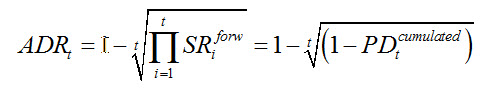

703.1. De Laurentis explains the annualized default rate (ADR) as follows: "If it is necessary to price a credit risk exposed transaction on a five year time horizon, it is useful to reduce the five-year cumulated default rate to an annual basis for the purposes of calculation. The annualized default rate can be calculated by solving the following equation:" (Source: Giacomo De Laurentis, Renato Maino, and Luca Molteni, Developing, Validating and Using Internal Ratings (West Sussex, United Kingdom: John Wiley & Sons, 2010))

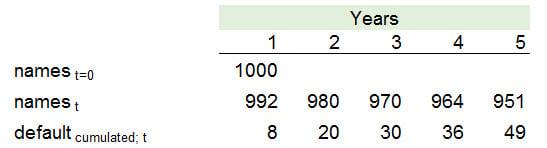

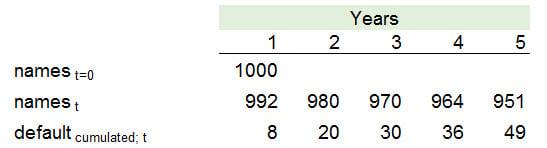

Assume the following pattern of defaults over five years (this is similar to Table 3.5):

(Source: Giacomo De Laurentis, Renato Maino, and Luca Molteni, Developing, Validating and Using Internal Ratings (West Sussex, United Kingdom: John Wiley & Sons, 2010))

What is nearest to the five year annualized default rate, ADR(5)?

a. 1.00%

b. 1.35%

c. 2.18%

d. 3.33%

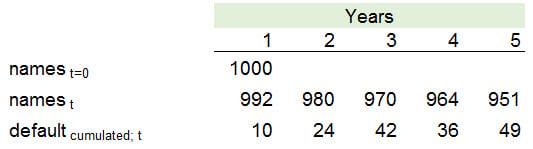

703.2. Assume the following pattern of defaults over five years for a given rating class:

Please note that what De Laurentis calls the "forward default probability" is more commonly called the conditional default probability; further, what he calls the marginal default probability is called an unconditional default probability by Hull. What is the relationship between the conditional (aka, forward) default probability and unconditional (aka, marginal) default probability in the third year?

a. They are equal

b. Conditional PD is higher than unconditional PD

c. Unconditional PD is higher than conditional PD

d. We need default during the third year; not enough information

703.3. Your firm's Risk Committee invites you to a meeting where they are deciding between a structural and reduced form approach to estimated credit risk for the firm. Each of the four members makes one of the statements below. Each of the statements is plausible EXCEPT which is probably not true?

a. We prefer stability over sensitivity to equity market movements and therefore a reduced form approach is better

b. Our experts have developed a causal (cause-and-effect) model that predicts default based on the likelihood of insolvency; this describes a structural approach

c. Our firm trades with a stock price so we do have an equity price and volatility but asset volatility is not a traded quantity for us, so the structural approach is not available to us

d. Our model is based on a correlation between explanatory variables and default but we are concerned whether we can generalize the results due to high sampling variability; this is an natural and expected risk with our reduced form approaches

Answers here:

Questions:

703.1. De Laurentis explains the annualized default rate (ADR) as follows: "If it is necessary to price a credit risk exposed transaction on a five year time horizon, it is useful to reduce the five-year cumulated default rate to an annual basis for the purposes of calculation. The annualized default rate can be calculated by solving the following equation:" (Source: Giacomo De Laurentis, Renato Maino, and Luca Molteni, Developing, Validating and Using Internal Ratings (West Sussex, United Kingdom: John Wiley & Sons, 2010))

Assume the following pattern of defaults over five years (this is similar to Table 3.5):

(Source: Giacomo De Laurentis, Renato Maino, and Luca Molteni, Developing, Validating and Using Internal Ratings (West Sussex, United Kingdom: John Wiley & Sons, 2010))

What is nearest to the five year annualized default rate, ADR(5)?

a. 1.00%

b. 1.35%

c. 2.18%

d. 3.33%

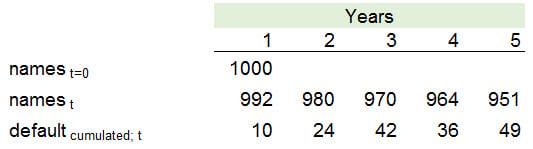

703.2. Assume the following pattern of defaults over five years for a given rating class:

Please note that what De Laurentis calls the "forward default probability" is more commonly called the conditional default probability; further, what he calls the marginal default probability is called an unconditional default probability by Hull. What is the relationship between the conditional (aka, forward) default probability and unconditional (aka, marginal) default probability in the third year?

a. They are equal

b. Conditional PD is higher than unconditional PD

c. Unconditional PD is higher than conditional PD

d. We need default during the third year; not enough information

703.3. Your firm's Risk Committee invites you to a meeting where they are deciding between a structural and reduced form approach to estimated credit risk for the firm. Each of the four members makes one of the statements below. Each of the statements is plausible EXCEPT which is probably not true?

a. We prefer stability over sensitivity to equity market movements and therefore a reduced form approach is better

b. Our experts have developed a causal (cause-and-effect) model that predicts default based on the likelihood of insolvency; this describes a structural approach

c. Our firm trades with a stock price so we do have an equity price and volatility but asset volatility is not a traded quantity for us, so the structural approach is not available to us

d. Our model is based on a correlation between explanatory variables and default but we are concerned whether we can generalize the results due to high sampling variability; this is an natural and expected risk with our reduced form approaches

Answers here: