Learning objectives: Explain the key features of a good rating system. Describe the experts-based approaches, statistical-based models, and numerical approaches to predicting default. Describe a rating migration matrix and calculate the probability of default, cumulative probability of default, marginal probability of default, and annualized default rate.

Questions:

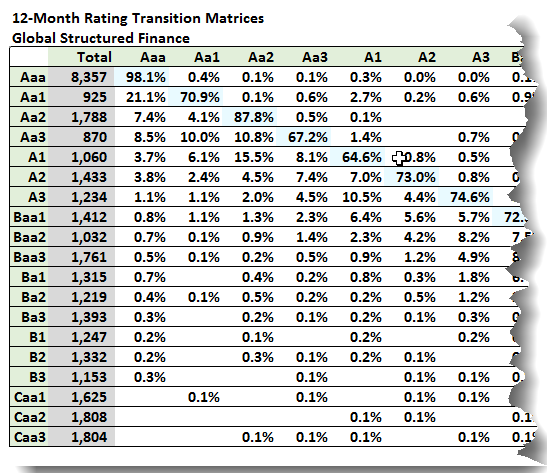

702.1. Assume the following actual, recent but truncated (on the right) 12-month rating migration matrix from Moody's:

Consider an issuer who is rated "Aa1" today (at the beginning of the year). Which of the following is nearest to the probability that this issuer does not fall into any LOWER rating category at any time over the next two years; put another way, what is the probability the issuer never experiences a rating of "Aa2" or worse over the next two years?

a. 50.3%

b. 64.9%

c. 75.0%

d. 86.0%

702.2. Each of the following is a desirable feature of a credit rating system EXCEPT which is not?

a. Measurable and verifiable: Ratings should give expectations in terms of default probabilities which can be adequately and continuous back tested

b. Positive and monotonic: In comparing two ratings, the firm with a better rating will have lower financial leverage (defined as assets/equity or debt/equity)

c. Specificity: The rating system is measuring the distance from the default event without any regards to other corporate financial features not directly related to it, such as short term fluctuations in stock prices

d. Objective and homogeneity: The rating system generates judgments based only on credit risk considerations, while avoiding any influence by other considerations; and, ratings are comparable among portfolios, market segments, and customer types

702.3. According to De Laurentis among the following approaches which is is the LEAST LIKELY to meet the criteria of Measurability and Verifiability?

a. Internal expert-based

b. External rating agency

c. Structural approach

d. Discriminant analysis

Answers here:

Questions:

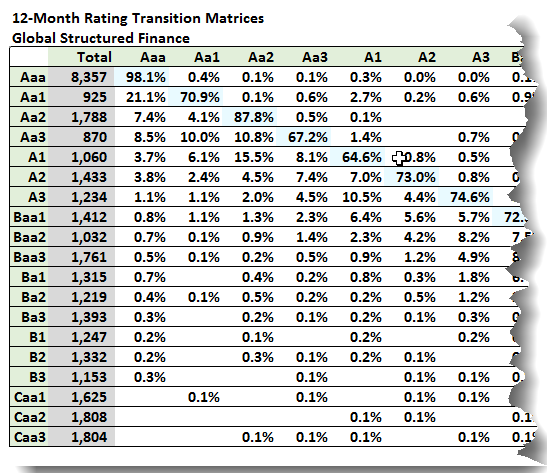

702.1. Assume the following actual, recent but truncated (on the right) 12-month rating migration matrix from Moody's:

Consider an issuer who is rated "Aa1" today (at the beginning of the year). Which of the following is nearest to the probability that this issuer does not fall into any LOWER rating category at any time over the next two years; put another way, what is the probability the issuer never experiences a rating of "Aa2" or worse over the next two years?

a. 50.3%

b. 64.9%

c. 75.0%

d. 86.0%

702.2. Each of the following is a desirable feature of a credit rating system EXCEPT which is not?

a. Measurable and verifiable: Ratings should give expectations in terms of default probabilities which can be adequately and continuous back tested

b. Positive and monotonic: In comparing two ratings, the firm with a better rating will have lower financial leverage (defined as assets/equity or debt/equity)

c. Specificity: The rating system is measuring the distance from the default event without any regards to other corporate financial features not directly related to it, such as short term fluctuations in stock prices

d. Objective and homogeneity: The rating system generates judgments based only on credit risk considerations, while avoiding any influence by other considerations; and, ratings are comparable among portfolios, market segments, and customer types

702.3. According to De Laurentis among the following approaches which is is the LEAST LIKELY to meet the criteria of Measurability and Verifiability?

a. Internal expert-based

b. External rating agency

c. Structural approach

d. Discriminant analysis

Answers here:

Last edited by a moderator: