Learning objectives: Describe the different CCP netting schemes, the benefit of netting and distinguish between bilateral netting and multilateral netting. Discuss the key challenges in relation to the clearing of over-the-counter (OTC) derivative products. Describe the three types of participants that channel trade through a CCP.

Questions:

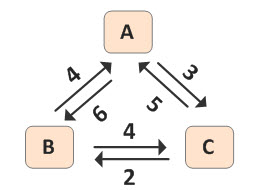

601.1. Below is an illustration of bilateral exposures without netting between three counterparties. An arrow indicates the direction of money owed. For example, entity A has a credit exposure of 4.0 to entity B, while entity B has an exposure of 6.0 to entity A.

Each of the following is true EXCEPT which is false?

a. If there is no netting whatsoever, a default of entity A will cause a loss of 6.0 for entity B and a loss of 3.0 for entity C but entity A will still claim a total amount of 9.0 owed to them

b. If there is bilateral netting, a default of entity A will cause a loss of 2.0 for entity B but entity C will suffer no loss

c. If there is bilateral netting, a default of entity B will cause a loss of 4.0 for entity A but entity C will suffer no loss

d. If there is multilateral netting, none of the entities has any exposure to any other entity

601.2. Which is TRUE?

a. If a derivative contract is standardized, then it cannot be complex

b. A CCP cannot by definition centrally clear over-the-counter (OTC) derivative contracts, such as single-name credit default swaps (CDS)

c. Credit default swaps (CDS) are more difficult to clear than interest rates swaps primarily due to wrong-way risk and jump-to-default risk

d. Clearing interest rate swaps would not have a meaningful impact because these are only a single type and the size of their market is relatively small

601.3. How can a non-clearing member who has no directly relationship with the CCP gain the benefits of central clearing?

a. A non-clearing member (NCM) cannot gain the benefits of central clearing

b. By channeling trades though a general clearing member (GCM) as its counterparty

c. By channeling trades though an individual clearing member (ICM) as its counterparty

d. The non-clearing member must convert into a universal application channel clearing member (UACCM)

Answers here:

Questions:

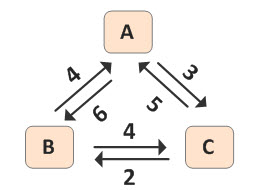

601.1. Below is an illustration of bilateral exposures without netting between three counterparties. An arrow indicates the direction of money owed. For example, entity A has a credit exposure of 4.0 to entity B, while entity B has an exposure of 6.0 to entity A.

Each of the following is true EXCEPT which is false?

a. If there is no netting whatsoever, a default of entity A will cause a loss of 6.0 for entity B and a loss of 3.0 for entity C but entity A will still claim a total amount of 9.0 owed to them

b. If there is bilateral netting, a default of entity A will cause a loss of 2.0 for entity B but entity C will suffer no loss

c. If there is bilateral netting, a default of entity B will cause a loss of 4.0 for entity A but entity C will suffer no loss

d. If there is multilateral netting, none of the entities has any exposure to any other entity

601.2. Which is TRUE?

a. If a derivative contract is standardized, then it cannot be complex

b. A CCP cannot by definition centrally clear over-the-counter (OTC) derivative contracts, such as single-name credit default swaps (CDS)

c. Credit default swaps (CDS) are more difficult to clear than interest rates swaps primarily due to wrong-way risk and jump-to-default risk

d. Clearing interest rate swaps would not have a meaningful impact because these are only a single type and the size of their market is relatively small

601.3. How can a non-clearing member who has no directly relationship with the CCP gain the benefits of central clearing?

a. A non-clearing member (NCM) cannot gain the benefits of central clearing

b. By channeling trades though a general clearing member (GCM) as its counterparty

c. By channeling trades though an individual clearing member (ICM) as its counterparty

d. The non-clearing member must convert into a universal application channel clearing member (UACCM)

Answers here: