AIMs: Define and calculate CVA and CVA spread in the presence of a bilateral contract. Explain issues that need to be considered in pricing bilateral CVA. Explain challenges in pricing CVA arising from the presence of exotic products and the issue of path dependency.

Questions:

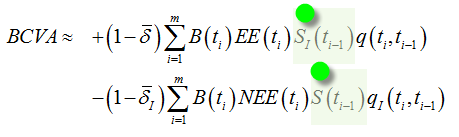

333.1. The following is Gregory's formula for bilateral credit value adjustment (BCVA):

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

The first term generalizes the unilateral CVA but contains the additional multiplicative factor, S(I)[t(i-1)]. If the formula represents an Institution's BVCA with respect to its Counterparty, what does the S(I) factor represent?

a. Probability of the Institution's survival

b. Probability of the Counterparty's survival

c. Recovery rate of the Institution's collateral

d. Recovery rate of the Counterparty's collateral

333.2. Each of the following is a true statement about the bilateral credit value adjustment (BCVA) formula EXCEPT which is not necessarily true?

a. The second BCVA term is often known as DVA (debt value adjustment) and it corresponds to cases where the institution defaults (before their counterparty); i.e., they will make a ‘‘gain’’ if the MtM is negative

b. The BCVA can be negative unlike the unilateral CVA which is always positive; a negative BCVA implies that the risky value of a derivative (or netting set of derivatives) is greater than the risk-free value.

c. The impact of BCVA caused by netting will not always be advantageous; in particular, if the second term in the BCVA equation dominates ("This normally corresponds to a situation where the institution in question is more risky than their counterparty.")

d. If all counterparties in the market agree on the approach and parameters for calculation of BCVA, then the total amount of counterparty risk in the market (as represented by the sum of all BCVAs) will the sum of all expected exposures, sum of EE(t) for all positions.

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

333.3. A trader needs to have a very quick idea of the BCVA (bilateral credit value adjustment) on a swap. The EPE (expected positive exposure) for a trade of this type is 7.0% whilst the ENE (expected negative exposure) is 4.0%. The credit spread of the counterparty is considered to be around 300 basis points per annum and the credit spread of the trader’s own institution is 200 basis points per annum. Which is nearest to an estimate of the BCVA?

a. 2 bps

b. 9 bps

c. 13 bps

d. 17 bps

Answers:

Questions:

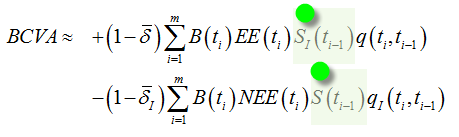

333.1. The following is Gregory's formula for bilateral credit value adjustment (BCVA):

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

The first term generalizes the unilateral CVA but contains the additional multiplicative factor, S(I)[t(i-1)]. If the formula represents an Institution's BVCA with respect to its Counterparty, what does the S(I) factor represent?

a. Probability of the Institution's survival

b. Probability of the Counterparty's survival

c. Recovery rate of the Institution's collateral

d. Recovery rate of the Counterparty's collateral

333.2. Each of the following is a true statement about the bilateral credit value adjustment (BCVA) formula EXCEPT which is not necessarily true?

a. The second BCVA term is often known as DVA (debt value adjustment) and it corresponds to cases where the institution defaults (before their counterparty); i.e., they will make a ‘‘gain’’ if the MtM is negative

b. The BCVA can be negative unlike the unilateral CVA which is always positive; a negative BCVA implies that the risky value of a derivative (or netting set of derivatives) is greater than the risk-free value.

c. The impact of BCVA caused by netting will not always be advantageous; in particular, if the second term in the BCVA equation dominates ("This normally corresponds to a situation where the institution in question is more risky than their counterparty.")

d. If all counterparties in the market agree on the approach and parameters for calculation of BCVA, then the total amount of counterparty risk in the market (as represented by the sum of all BCVAs) will the sum of all expected exposures, sum of EE(t) for all positions.

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

333.3. A trader needs to have a very quick idea of the BCVA (bilateral credit value adjustment) on a swap. The EPE (expected positive exposure) for a trade of this type is 7.0% whilst the ENE (expected negative exposure) is 4.0%. The credit spread of the counterparty is considered to be around 300 basis points per annum and the credit spread of the trader’s own institution is 200 basis points per annum. Which is nearest to an estimate of the BCVA?

a. 2 bps

b. 9 bps

c. 13 bps

d. 17 bps

Answers: