AIMs: Calculate the expected exposure and potential future exposure over the remargining period given normal distribution assumptions. Describe the assumptions and parameters involved in modeling collateral. Calculate the expected exposure and potential future exposure over the remargining period given normal distribution assumptions. Describe the assumptions and parameters involved in modeling collateral.

Questions:

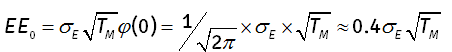

329.1. Gregory gives the following approximation for expected exposure (EE) when the mark-to-market (MtM) is characterized by a normal distribution with zero mean:

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

Assume an exposure is normally distributed with zero mean and volatility of 9.0% per annum. If there are 250 trading days, which is nearest to the expected exposure (EE) at the end of ten (10) days?

a. 0.72%

b. 1.45%

c. 3.60%

d. 7.18%

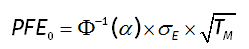

329.2. For a normal distribution with zero mean, Gregory shows the potential future exposure (PFE) is given by:

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

where sigma is the (annual) volatility for a collateralized exposure (all netted positions and the impact of current collateral held against the exposure where relevant), and T(M) is remargin frequency in years. If there are 250 trading days, which is nearest to the 99.0% confident PFE at the end of thirty (30) days?

a. 8.77%

b. 12.11%

c. 23.64%

d. 34.95%

329.3. About modeling the credit exposure of collateralized positions, Gregory asserts each of the following as true EXCEPT which is false?

a. If a position is "strongly collateralized," instead of a long-term risk, the primary concerns are (i) the length of the remargin period and (ii) the volatilities of the exposure and collateral

b. For risk assessment purposes, the remargin period (i.e., when collateral will be received in a worst case scenario) will be equal to the legal margin call frequency; i.e., the remargin period is typically one day

c. A source of risk is the imperfect collateralisation at a given date due to the terms in the collateral agreement (threshold, minimum transfer amount and rounding) which will not permit a call for the full credit support amount.

d. A source of risk is the risk that the exposure increases in-between margin calls and it is therefore not possible to collateralize that portion of the exposure.

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

Answers:

Questions:

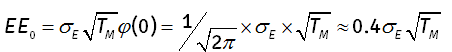

329.1. Gregory gives the following approximation for expected exposure (EE) when the mark-to-market (MtM) is characterized by a normal distribution with zero mean:

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

Assume an exposure is normally distributed with zero mean and volatility of 9.0% per annum. If there are 250 trading days, which is nearest to the expected exposure (EE) at the end of ten (10) days?

a. 0.72%

b. 1.45%

c. 3.60%

d. 7.18%

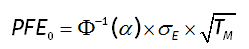

329.2. For a normal distribution with zero mean, Gregory shows the potential future exposure (PFE) is given by:

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

where sigma is the (annual) volatility for a collateralized exposure (all netted positions and the impact of current collateral held against the exposure where relevant), and T(M) is remargin frequency in years. If there are 250 trading days, which is nearest to the 99.0% confident PFE at the end of thirty (30) days?

a. 8.77%

b. 12.11%

c. 23.64%

d. 34.95%

329.3. About modeling the credit exposure of collateralized positions, Gregory asserts each of the following as true EXCEPT which is false?

a. If a position is "strongly collateralized," instead of a long-term risk, the primary concerns are (i) the length of the remargin period and (ii) the volatilities of the exposure and collateral

b. For risk assessment purposes, the remargin period (i.e., when collateral will be received in a worst case scenario) will be equal to the legal margin call frequency; i.e., the remargin period is typically one day

c. A source of risk is the imperfect collateralisation at a given date due to the terms in the collateral agreement (threshold, minimum transfer amount and rounding) which will not permit a call for the full credit support amount.

d. A source of risk is the risk that the exposure increases in-between margin calls and it is therefore not possible to collateralize that portion of the exposure.

(Source: Jon Gregory, Counterparty Credit Risk: The New Challenge for Global Financial Markets (West Sussex, UK: John Wiley & Sons, 2010))

Answers: