AIM: Define the following metrics for credit exposure: expected mark-to-market, expected exposure, potential future exposure...

Questions:

321.1. In regard to the counterparty credit exposure of a bilateral derivatives position (trade), each of the following statements is true about expected mark-to-market (MtM) of except which is FALSE?

a. Expected MtM can be negative

b. Expected MtM is approximately, but not exactly, equal to the future expected replacement cost

c. Expected MtM can be significantly different from the current value

d. Expected MtM should be approximately, but not exactly, equal to zero

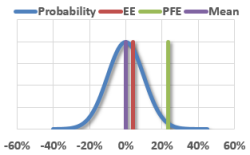

321.2. Suppose a mark-to-market (MtM) is defined by a normal distribution with mean (mu) of 2.0% and standard deviation (sigma) of 5.0%. Each of the following is true about the Expected Exposure (EE) except which is false?

a. The EE is greater than 2.0%

b. The EE is greater than the 95% confident potential future exposure (PFE)

c. An increase in the mean (mu) assumption will increase the EE

d. An increase in the standard deviation (sigma) assumption will increase the EE

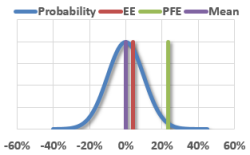

321.3. Suppose a mark-to-market (MtM) is defined by a normal distribution with mean (mu) of 1.0% and standard deviation (sigma) of 3.0%. Each of the following is true about the Potential Future Exposure (PFE) except which is false?

a. PFE is similar to value at risk (VaR) except it is defined further (far) into the future and is associated with a future gain rather than loss

b. The 99% PFE is greater than the 95% PFE is greater than the expected exposure (EE)

c. If the mean is reduced by 1.0%, to mu = zero, the PFE will increase by 3.0%

d. The PFE is defined only at a specific future point in time (T), it does not incorporate or average the entire life of the position

Answers:

Questions:

321.1. In regard to the counterparty credit exposure of a bilateral derivatives position (trade), each of the following statements is true about expected mark-to-market (MtM) of except which is FALSE?

a. Expected MtM can be negative

b. Expected MtM is approximately, but not exactly, equal to the future expected replacement cost

c. Expected MtM can be significantly different from the current value

d. Expected MtM should be approximately, but not exactly, equal to zero

321.2. Suppose a mark-to-market (MtM) is defined by a normal distribution with mean (mu) of 2.0% and standard deviation (sigma) of 5.0%. Each of the following is true about the Expected Exposure (EE) except which is false?

a. The EE is greater than 2.0%

b. The EE is greater than the 95% confident potential future exposure (PFE)

c. An increase in the mean (mu) assumption will increase the EE

d. An increase in the standard deviation (sigma) assumption will increase the EE

321.3. Suppose a mark-to-market (MtM) is defined by a normal distribution with mean (mu) of 1.0% and standard deviation (sigma) of 3.0%. Each of the following is true about the Potential Future Exposure (PFE) except which is false?

a. PFE is similar to value at risk (VaR) except it is defined further (far) into the future and is associated with a future gain rather than loss

b. The 99% PFE is greater than the 95% PFE is greater than the expected exposure (EE)

c. If the mean is reduced by 1.0%, to mu = zero, the PFE will increase by 3.0%

d. The PFE is defined only at a specific future point in time (T), it does not incorporate or average the entire life of the position

Answers: