Learning Objectives: Describe the differences between funding exposure and credit exposure. Describe and calculate the effective expected positive exposure. Explain the general impact of aggregation on exposure and the impact of aggregation on exposure when there is correlation between transaction values.

Questions:

24.32.1. As a risk manager at a financial institution, you analyze a portfolio of interest rate swaps containing both collateralized and uncollateralized swaps with various counterparties. Given recent interest rate volatility, there's a focus on understanding the potential impact of counterparty defaults. Your task is to distinguish between funding exposure and credit exposure within these swap contracts.

What is the difference between funding exposure and credit exposure in an interest rate swaps portfolio, based on swap contract evaluations and margin impacts in default and non-default scenarios?

a. Funding exposure in swap contracts is measured at the portfolio level, while credit exposure is assessed at the netting set level in default scenarios, dependent on close-out values and potential legal disputes.

b. In swap contracts, funding and credit exposures are assessed during default scenarios, focusing on the total potential exposure without distinguishing between the operational contexts of margin postings.

c. Credit exposure in swaps is calculated during non-default scenarios while funding exposure arises when a counterparty defaults.

d. Swap contracts do not differentiate between funding and credit exposures in practical terms; both are calculated using similar methodologies under the assumption of counterparty default, with no distinction made in the treatment of margins.

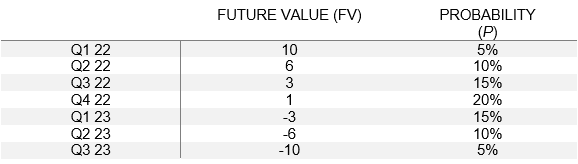

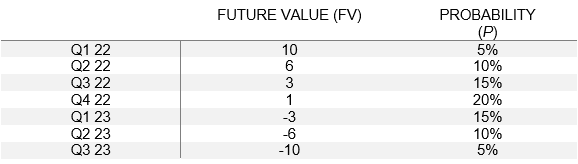

24.32.2. As a risk manager in the derivatives trading department of a financial institution, you are tasked with performing a detailed risk assessment for a portfolio of derivatives over the upcoming year.

What is the Effective Expected Positive Exposure (EEPE) for the derivative portfolio over the next year, and what does it represent?

a. EEPE = 0.575, averages these peaks and other exposures over time, providing a broader view of exposure throughout the assessment period.

b. EEPE = 0.6, averages these peaks and other exposures over time, providing a broader view of exposure throughout the assessment period.

c. EEPE = 0.575, focuses on the maximum exposure at any point up to the current assessment, emphasizing the peak risks.

d. EEPE = 0.6, focuses on the maximum exposure at any point up to the current assessment, emphasizing the peak risks.

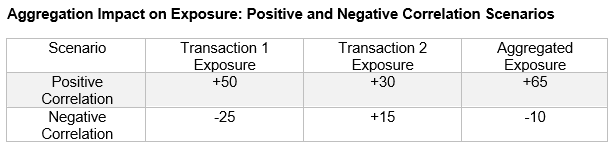

24.32.3. As a risk analyst, you are tasked with evaluating how combining different types of derivative transactions impacts the exposure of a derivative portfolio. These transactions are influenced by different market conditions and show varying degrees of correlation. Our recent internal review revealed both positive and negative correlations between these transactions, and you must assess how these correlations affect the overall exposure of the portfolio.

Aggregation can significantly impact exposure, especially with close-out netting agreements. The effect of aggregation depends on the correlation between transaction values. Positive correlation may lead to limited reduction in exposure, while negative correlation can result in a more substantial reduction.

Evaluate the following scenarios based on the provided data and explain how aggregation impacts exposure, focusing on the influence of correlation between transaction values.

Choose the option that correctly describes the impact of aggregation on exposure for each scenario:

a. In the positive correlation scenario, the aggregated exposure of +65 is less than the sum of individual exposures (+50 and +30), illustrating a reduction in overall risk. However, the reduction benefit is limited due to similar direction in value movements.

b. In the negative correlation scenario, the aggregated exposure of -10 is the same as sum of individual exposures (-25 and +15), suggesting no risk reduction through aggregation..

c. In the positive correlation scenario, the aggregated exposure equals the sum of the individual exposures, showing no impact from aggregation.

d. In the negative correlation scenario, the aggregated exposure is greater than the sum of individual exposures, indicating increased risk due to opposing value movements.

Answers here:

Questions:

24.32.1. As a risk manager at a financial institution, you analyze a portfolio of interest rate swaps containing both collateralized and uncollateralized swaps with various counterparties. Given recent interest rate volatility, there's a focus on understanding the potential impact of counterparty defaults. Your task is to distinguish between funding exposure and credit exposure within these swap contracts.

What is the difference between funding exposure and credit exposure in an interest rate swaps portfolio, based on swap contract evaluations and margin impacts in default and non-default scenarios?

a. Funding exposure in swap contracts is measured at the portfolio level, while credit exposure is assessed at the netting set level in default scenarios, dependent on close-out values and potential legal disputes.

b. In swap contracts, funding and credit exposures are assessed during default scenarios, focusing on the total potential exposure without distinguishing between the operational contexts of margin postings.

c. Credit exposure in swaps is calculated during non-default scenarios while funding exposure arises when a counterparty defaults.

d. Swap contracts do not differentiate between funding and credit exposures in practical terms; both are calculated using similar methodologies under the assumption of counterparty default, with no distinction made in the treatment of margins.

24.32.2. As a risk manager in the derivatives trading department of a financial institution, you are tasked with performing a detailed risk assessment for a portfolio of derivatives over the upcoming year.

What is the Effective Expected Positive Exposure (EEPE) for the derivative portfolio over the next year, and what does it represent?

a. EEPE = 0.575, averages these peaks and other exposures over time, providing a broader view of exposure throughout the assessment period.

b. EEPE = 0.6, averages these peaks and other exposures over time, providing a broader view of exposure throughout the assessment period.

c. EEPE = 0.575, focuses on the maximum exposure at any point up to the current assessment, emphasizing the peak risks.

d. EEPE = 0.6, focuses on the maximum exposure at any point up to the current assessment, emphasizing the peak risks.

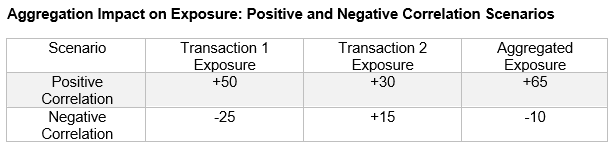

24.32.3. As a risk analyst, you are tasked with evaluating how combining different types of derivative transactions impacts the exposure of a derivative portfolio. These transactions are influenced by different market conditions and show varying degrees of correlation. Our recent internal review revealed both positive and negative correlations between these transactions, and you must assess how these correlations affect the overall exposure of the portfolio.

Aggregation can significantly impact exposure, especially with close-out netting agreements. The effect of aggregation depends on the correlation between transaction values. Positive correlation may lead to limited reduction in exposure, while negative correlation can result in a more substantial reduction.

Evaluate the following scenarios based on the provided data and explain how aggregation impacts exposure, focusing on the influence of correlation between transaction values.

Choose the option that correctly describes the impact of aggregation on exposure for each scenario:

a. In the positive correlation scenario, the aggregated exposure of +65 is less than the sum of individual exposures (+50 and +30), illustrating a reduction in overall risk. However, the reduction benefit is limited due to similar direction in value movements.

b. In the negative correlation scenario, the aggregated exposure of -10 is the same as sum of individual exposures (-25 and +15), suggesting no risk reduction through aggregation..

c. In the positive correlation scenario, the aggregated exposure equals the sum of the individual exposures, showing no impact from aggregation.

d. In the negative correlation scenario, the aggregated exposure is greater than the sum of individual exposures, indicating increased risk due to opposing value movements.

Answers here: