Learning Objectives: Describe the various regulatory capital requirements. Calculate the credit support amount (margin) under various scenarios.

Questions:

24.28.1. Which of the following statements about the regulatory margin requirements for non-centrally cleared derivatives contracts is NOT true?

a. Initial margin is required to cover potential future exposure, while variation margin is required to cover current exposure.

b. The minimum transfer amount (MTA) for variation margin cannot exceed €500,000.

c. Initial margin can be netted across different asset classes, provided the contracts are subject to the same legally enforceable netting agreements.

d. The standardized margin schedule provided by regulators can be used to calculate the initial margin for non-centrally cleared derivatives contracts.

24.28.2. Maplewood Financial and Downers Grove Capital have entered into a derivatives contract with a two-way collateral agreement. Under this agreement, both parties are required to post collateral based on certain parameters. The agreement specifies a threshold of $1,000,000, a minimum transfer amount of $150,000, and rounding to the nearest $25,000.

Before the current collateral assessment, Maplewood Financial had not provided any collateral, while Downers Grove Capital held $45,000 in collateral previously posted by Maplewood Financial. The latest valuation indicates that Maplewood Financial has a substantial positive mark-to-market position worth +$1,105,000.00 from its perspective, which translates to a negative position of -$1,105,000.00 for Downers Grove Capital.

The credit support amount is the collateral amount that can be requested based on the valuation. Given the provided information, determine the credit support amount.

a. Downers Grove Financial returns $150,000

b. Maplewood Financial calls $150,000

c. No capital is exchanged.

d. Maplewood Financial calls $45,000

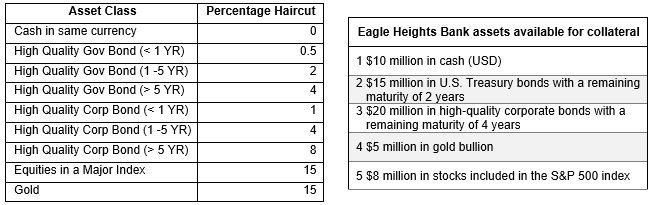

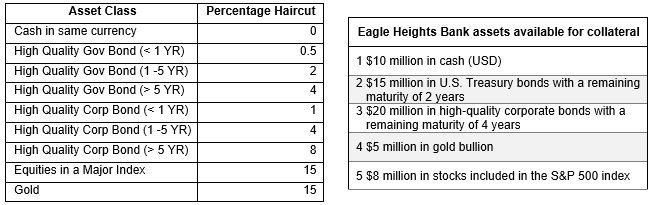

24.28.3. Eagle Heights Bank is engaging in an interest rate swap to help hedge its risk. As part of the regulatory requirements, Eagle Heights Bank needs to post collateral to cover the margin requirements for these transactions.

Eagle Heights Bank has the following assets available for posting collateral.

If the total margin requirement for the interest rate swap contract is USD 45 million, calculate the total value of collateral that Eagle Heights Bank needs to post after applying the appropriate haircuts (according to the percentage haircut list above). Eagle Heights Bank plans to use its assets available for collateral in the order listed above.

a. $45.00M

b. $43.90M

c. $46.29M

d. $53.00M

Answers here:

Questions:

24.28.1. Which of the following statements about the regulatory margin requirements for non-centrally cleared derivatives contracts is NOT true?

a. Initial margin is required to cover potential future exposure, while variation margin is required to cover current exposure.

b. The minimum transfer amount (MTA) for variation margin cannot exceed €500,000.

c. Initial margin can be netted across different asset classes, provided the contracts are subject to the same legally enforceable netting agreements.

d. The standardized margin schedule provided by regulators can be used to calculate the initial margin for non-centrally cleared derivatives contracts.

24.28.2. Maplewood Financial and Downers Grove Capital have entered into a derivatives contract with a two-way collateral agreement. Under this agreement, both parties are required to post collateral based on certain parameters. The agreement specifies a threshold of $1,000,000, a minimum transfer amount of $150,000, and rounding to the nearest $25,000.

Before the current collateral assessment, Maplewood Financial had not provided any collateral, while Downers Grove Capital held $45,000 in collateral previously posted by Maplewood Financial. The latest valuation indicates that Maplewood Financial has a substantial positive mark-to-market position worth +$1,105,000.00 from its perspective, which translates to a negative position of -$1,105,000.00 for Downers Grove Capital.

The credit support amount is the collateral amount that can be requested based on the valuation. Given the provided information, determine the credit support amount.

a. Downers Grove Financial returns $150,000

b. Maplewood Financial calls $150,000

c. No capital is exchanged.

d. Maplewood Financial calls $45,000

24.28.3. Eagle Heights Bank is engaging in an interest rate swap to help hedge its risk. As part of the regulatory requirements, Eagle Heights Bank needs to post collateral to cover the margin requirements for these transactions.

Eagle Heights Bank has the following assets available for posting collateral.

If the total margin requirement for the interest rate swap contract is USD 45 million, calculate the total value of collateral that Eagle Heights Bank needs to post after applying the appropriate haircuts (according to the percentage haircut list above). Eagle Heights Bank plans to use its assets available for collateral in the order listed above.

a. $45.00M

b. $43.90M

c. $46.29M

d. $53.00M

Answers here: