Learning Objectives: Compute and evaluate one or two iterations of interim cashflows in a three-tiered securitization structure. Describe the treatment of excess spread in a securitization structure and estimate the value of the overcollateralization account at the end of each year. Explain the tests on the excess spread that a custodian must go through at the end of each year to determine the cash flow to the overcollateralization account and to the equity noteholders.

Questions:

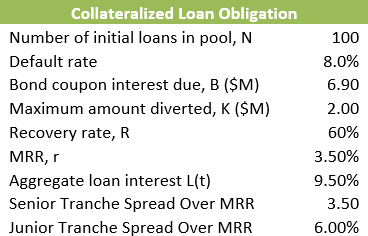

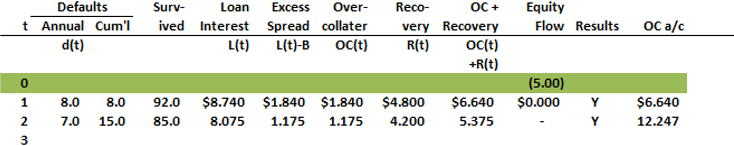

24.19.1. A collateralized loan obligation (CLO) comprises 100 identical leveraged loans, each with a par value of $1,000,000, priced at par. The senior tranche makes up 85% of the CLO, and the Junior tranche encompasses 10%. The relevant information for this CLO is given in the table below:

Given the above information, what is the excess spread in year 3?

a. $0.94M

b. $1.175M

c. $0.51M

d. $0.41M

24.19.2. A collateralized loan obligation (CLO) comprises 200 identical leveraged loans, each with a par value of $1,000,000, priced at par. These loans yield a fixed spread of 5.50% over a one-month MRR (Moscow Interbank Offer Rate). MRR is flat at 3.50%. The CLO's capital structure includes senior, junior, and equity tranches, which represent 75%, 20%, and 5% of the pool, respectively. The spreads on the senior and junior tranches are 300 basis points (bps) and 600 bps, respectively. Any spread surpassing $1,000,000 is directed to the trust account. We need to calculate the cash flows to the junior tranche and the excess trust account in the initial period.

All proceeds in the trust account after year 2 will be used for reinvestment. Assuming a default rate of 4%, 0% recovery rate, and that all defaults occur at the end of the year (after interest has been paid), what is closest to the amount that will be reinvested at the end of year 2?

a. $150,000

b. $104,000

c. 2,254,000

d. $254,000

24.19.3. Suppose Gamma Securitization has a portfolio of loans with an aggregate loan interest of $1,000,000 for the current year. The bond coupon interest due for the same period is $1,200,000. The overcollateralization account balance at the end of the previous year was $300,000, and the recoveries from defaults in the past year amounted to $100,000.

Based on the provided scenario, how much will be left in the overcollateralization account after the custodian performs the tests on the excess spread?

a. $100,000

b. -$100,000

c. $0

d. $200,000

Answers here:

Questions:

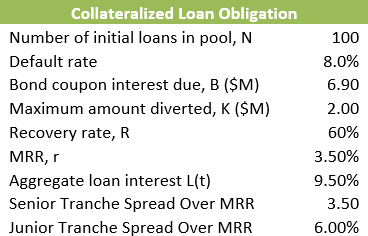

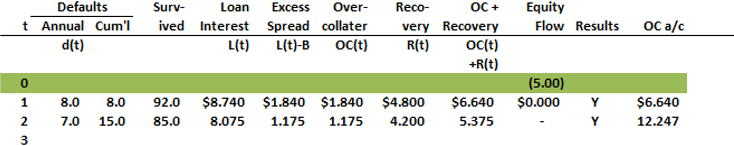

24.19.1. A collateralized loan obligation (CLO) comprises 100 identical leveraged loans, each with a par value of $1,000,000, priced at par. The senior tranche makes up 85% of the CLO, and the Junior tranche encompasses 10%. The relevant information for this CLO is given in the table below:

Given the above information, what is the excess spread in year 3?

a. $0.94M

b. $1.175M

c. $0.51M

d. $0.41M

24.19.2. A collateralized loan obligation (CLO) comprises 200 identical leveraged loans, each with a par value of $1,000,000, priced at par. These loans yield a fixed spread of 5.50% over a one-month MRR (Moscow Interbank Offer Rate). MRR is flat at 3.50%. The CLO's capital structure includes senior, junior, and equity tranches, which represent 75%, 20%, and 5% of the pool, respectively. The spreads on the senior and junior tranches are 300 basis points (bps) and 600 bps, respectively. Any spread surpassing $1,000,000 is directed to the trust account. We need to calculate the cash flows to the junior tranche and the excess trust account in the initial period.

All proceeds in the trust account after year 2 will be used for reinvestment. Assuming a default rate of 4%, 0% recovery rate, and that all defaults occur at the end of the year (after interest has been paid), what is closest to the amount that will be reinvested at the end of year 2?

a. $150,000

b. $104,000

c. 2,254,000

d. $254,000

24.19.3. Suppose Gamma Securitization has a portfolio of loans with an aggregate loan interest of $1,000,000 for the current year. The bond coupon interest due for the same period is $1,200,000. The overcollateralization account balance at the end of the previous year was $300,000, and the recoveries from defaults in the past year amounted to $100,000.

Based on the provided scenario, how much will be left in the overcollateralization account after the custodian performs the tests on the excess spread?

a. $100,000

b. -$100,000

c. $0

d. $200,000

Answers here: