Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

706.1. Peter the Risk Analyst is conducting the valuation of a bilateral derivatives portfolio. The positions are between his firm, Nordyne Financial (NF), and Counterparty Inc. The counterparties do post collateral (i.e., the positions are collateralized) and the interest is paid on overnight cash collateral balances equal to the effective federal funds rate. With respect to his valuation, each of the following is true EXCEPT which is probably false?

a. In selecting a risk-free discount rate, he is correct to avoid using a U.S. Treasury rate because it will be artificially low

b. As the position is collateralized, for the risk-free discount rate he is justified in preferring the overnight indexed swap (OIS) rate instead of LIBOR

c. To ensure agreement with accountants and analysts, as he will assumes the OIS rate for the collateralized position, he should both ADD a collateral rate adjustment (CRA) and ADD a funding value adjustment (FVA), in addition to the credit value adjustment (CVA) and debt value adjustment (DVA).

d. He is correct to make both a credit value adjustment (CVA), which will reduce the value of the derivatives portfolio as the probability of Counterparty Inc's default increases, and a debt value adjustment (DVA), which will increase the value of the derivatives portfolio as the probability of Nordyne's default increase

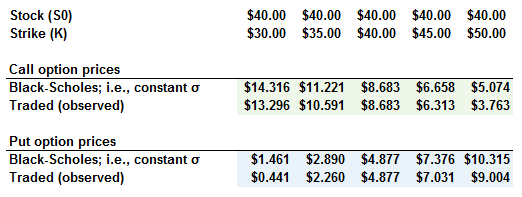

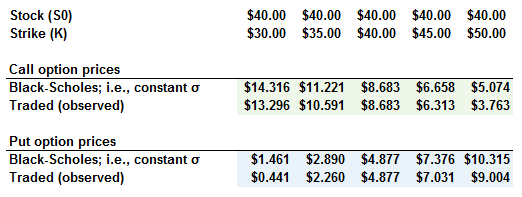

706.2. A certain stock price is currently trading at $40.00 while it trades options at various strike prices including $30.00, $35.00, $40.00 (i.e., at the money), $45.00 and $50.00. Below are shown, at each of these strike prices, both the computed (model) prices according to the Black-Scholes-Merton model and the corresponding traded (observed) price of the option. For example, the call option with a strike price of $35.00 has a Black-Scholes option price (assuming the same volatility as the ATM option) of $11.22 but this call option is actually trading at $10.591.

In comparison specifically to the lognormal distribution, which best characterizes the implied distribution of the stock price?

a. Lighter left and right tails

b. Lighter left but heavier right tail

c. Heavier left but lighter right tail

d. Heavier left and right tails

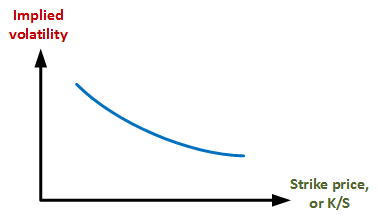

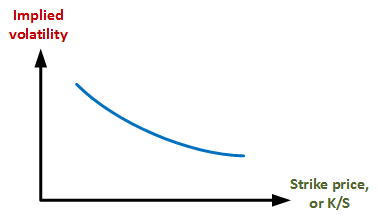

706.3. Assume we observe the following implied volatility smile, which may be called a volatility skew or smirk and is somewhat typical of equities:

Which of the following statement about this shape of the volatility smile is TRUE?

a. Greek call option delta is higher than delta given by the Black-Scholes Merton model

b. Put-call parity does not apply for either deeply in-the-money or out-of-the-money options

c. The price of the observed (traded) put options decreases as the strike price increases

d. Compared to the lognormal distribution, the implied distribution of the underlying stock on the right tail (where stock prices are higher) is heavier

Answers here:

Questions:

706.1. Peter the Risk Analyst is conducting the valuation of a bilateral derivatives portfolio. The positions are between his firm, Nordyne Financial (NF), and Counterparty Inc. The counterparties do post collateral (i.e., the positions are collateralized) and the interest is paid on overnight cash collateral balances equal to the effective federal funds rate. With respect to his valuation, each of the following is true EXCEPT which is probably false?

a. In selecting a risk-free discount rate, he is correct to avoid using a U.S. Treasury rate because it will be artificially low

b. As the position is collateralized, for the risk-free discount rate he is justified in preferring the overnight indexed swap (OIS) rate instead of LIBOR

c. To ensure agreement with accountants and analysts, as he will assumes the OIS rate for the collateralized position, he should both ADD a collateral rate adjustment (CRA) and ADD a funding value adjustment (FVA), in addition to the credit value adjustment (CVA) and debt value adjustment (DVA).

d. He is correct to make both a credit value adjustment (CVA), which will reduce the value of the derivatives portfolio as the probability of Counterparty Inc's default increases, and a debt value adjustment (DVA), which will increase the value of the derivatives portfolio as the probability of Nordyne's default increase

706.2. A certain stock price is currently trading at $40.00 while it trades options at various strike prices including $30.00, $35.00, $40.00 (i.e., at the money), $45.00 and $50.00. Below are shown, at each of these strike prices, both the computed (model) prices according to the Black-Scholes-Merton model and the corresponding traded (observed) price of the option. For example, the call option with a strike price of $35.00 has a Black-Scholes option price (assuming the same volatility as the ATM option) of $11.22 but this call option is actually trading at $10.591.

In comparison specifically to the lognormal distribution, which best characterizes the implied distribution of the stock price?

a. Lighter left and right tails

b. Lighter left but heavier right tail

c. Heavier left but lighter right tail

d. Heavier left and right tails

706.3. Assume we observe the following implied volatility smile, which may be called a volatility skew or smirk and is somewhat typical of equities:

Which of the following statement about this shape of the volatility smile is TRUE?

a. Greek call option delta is higher than delta given by the Black-Scholes Merton model

b. Put-call parity does not apply for either deeply in-the-money or out-of-the-money options

c. The price of the observed (traded) put options decreases as the strike price increases

d. Compared to the lognormal distribution, the implied distribution of the underlying stock on the right tail (where stock prices are higher) is heavier

Answers here:

Last edited by a moderator: