Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

704.1. Asset correlations are not only important in financial markets, they often exhibit statistically significant and expected properties. However, there do exist several different measures of correlation. According to Meissner, each of the following statements about financial correlation is true EXCEPT which is not accurate?

a. If covariance is negative, then Pearson's Correlation must also be negative

b. Higher positive autocorrelation (aka, persistence) implies lower mean reversion

c. If the data is cardinal, then Kendall's tau is a more efficient and consistent estimator of correlation than Pearson's

d. To fit the distribution of equity correlations, standard distributions (e.g., normal, lognormal or even beta) are inferior to the versatile Johnson SB distribution

704.2. The default (Pearson) correlation coefficient between two bonds is 0.50. If their individual default probabilities are, respectively, 5.0% and 7.0%, then which is nearest to their joint default probability?

a. 0.350%

b. 1.250%

c. 3.130%

d. 13.76%

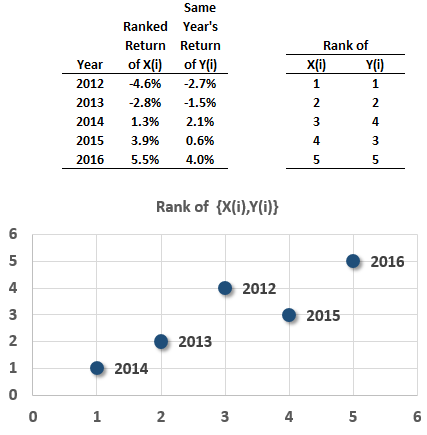

704.3. Peter the analyst has compiled the annual returns for two funds, X(i) and Y(i), over the last five years from 2012 to 2016, inclusive. These returns are shown below. Although the data are cardinal, given the small dataset, Peter wants to compute the rank correlation of returns. He sorts the X(i) returns, from worst to best, and shows the corresponding Y(i) returns. For example, in 2015 the X(2015) return of 1.3% was the 3rd-worst (and 3rd-best for that matter!); in the same year, the Y(2015) return of +2.1% was the 4th-worst (or 2nd-best) among its own return series. Peter also plotted the pairwise rankings, see chart in lower panel below.

What is the Kendall's tau, τ, for this dataset?

a. zero

b. +0.80

c. +0.90

d. +8.89

Answers here:

Questions:

704.1. Asset correlations are not only important in financial markets, they often exhibit statistically significant and expected properties. However, there do exist several different measures of correlation. According to Meissner, each of the following statements about financial correlation is true EXCEPT which is not accurate?

a. If covariance is negative, then Pearson's Correlation must also be negative

b. Higher positive autocorrelation (aka, persistence) implies lower mean reversion

c. If the data is cardinal, then Kendall's tau is a more efficient and consistent estimator of correlation than Pearson's

d. To fit the distribution of equity correlations, standard distributions (e.g., normal, lognormal or even beta) are inferior to the versatile Johnson SB distribution

704.2. The default (Pearson) correlation coefficient between two bonds is 0.50. If their individual default probabilities are, respectively, 5.0% and 7.0%, then which is nearest to their joint default probability?

a. 0.350%

b. 1.250%

c. 3.130%

d. 13.76%

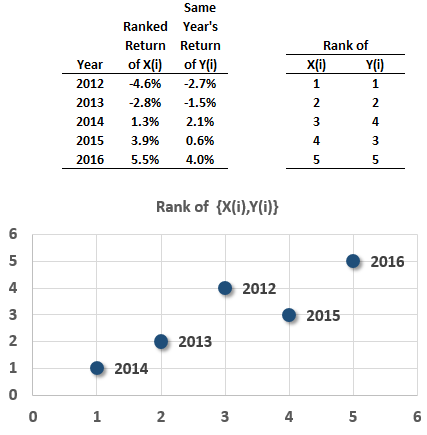

704.3. Peter the analyst has compiled the annual returns for two funds, X(i) and Y(i), over the last five years from 2012 to 2016, inclusive. These returns are shown below. Although the data are cardinal, given the small dataset, Peter wants to compute the rank correlation of returns. He sorts the X(i) returns, from worst to best, and shows the corresponding Y(i) returns. For example, in 2015 the X(2015) return of 1.3% was the 3rd-worst (and 3rd-best for that matter!); in the same year, the Y(2015) return of +2.1% was the 4th-worst (or 2nd-best) among its own return series. Peter also plotted the pairwise rankings, see chart in lower panel below.

What is the Kendall's tau, τ, for this dataset?

a. zero

b. +0.80

c. +0.90

d. +8.89

Answers here: