Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

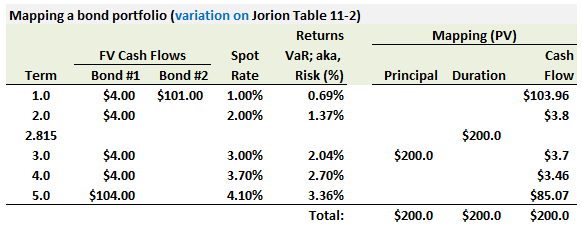

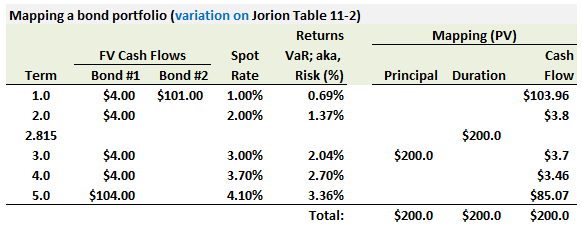

703.1. A portfolio consists of two bonds: the first bond has a five-year maturity and pays a 4.0% annual coupon, the second bond matures in one year and pays a 1.0% annual coupon. Both bonds conveniently price at par (aka, their yield is equal to their coupon rate). The portfolio's (Macaulay) duration is 2.815 years.

Each of the following statements is true EXCEPT which is inaccurate?

a. Under the principal mapping approach, portfolio VaR is about $4.08 million

b. Under the duration mapping approach, portfolio VaR is about $2.74 million

c. Under the cash flow mapping approach, and given an unrealistic assumption of perfect correlation among the risk factors, portfolio VaR is about $3.80 million

d. Under the cash flow mapping approach, and given an assumption that all pairwise correlations between risk factors are 0.40, portfolio VaR is about $3.32 million

703.2. A risk manager is backtesting a company’s one-day 99.0% VaR model over a four-year horizon at a 90.0% two-tailed confidence level. If we assume 250 days in a year, so that that backtest sample size is 1,000 days, what is the maximum number of daily losses exceeding the 1-day 99.0% VaR that is acceptable to conclude that the model is calibrated correctly?

a. 10 exceptions

b. 15 exceptions

c. 19 exceptions

d. 23 exceptions

703.3. Zerphase Financial Corporation is going to conduct a backtest of its 99.0% value at risk (VaR) model. The sample window size is 300 days; i.e., the previous 15 months and each month has 20 trading days. The desired two-tailed confidence is 95.0%. About this backtest, each of the following statements is true EXCEPT which is false?

a. the maximum number of exceptions (the cutoff) is six; if more than six are observed, the model should be rejected

b. if no exceptions are observed (i.e., exceptions equals zero), we do not need to reject the model as bad

c. If no exceptions are observed (i.e., exceptions equals zero), there is a 4.90% probability that the model is bad

d. If one exception is observed, then we will not reject the model, but we do risk committing a Type 2 (aka, Type II) error

Answers here:

Questions:

703.1. A portfolio consists of two bonds: the first bond has a five-year maturity and pays a 4.0% annual coupon, the second bond matures in one year and pays a 1.0% annual coupon. Both bonds conveniently price at par (aka, their yield is equal to their coupon rate). The portfolio's (Macaulay) duration is 2.815 years.

Each of the following statements is true EXCEPT which is inaccurate?

a. Under the principal mapping approach, portfolio VaR is about $4.08 million

b. Under the duration mapping approach, portfolio VaR is about $2.74 million

c. Under the cash flow mapping approach, and given an unrealistic assumption of perfect correlation among the risk factors, portfolio VaR is about $3.80 million

d. Under the cash flow mapping approach, and given an assumption that all pairwise correlations between risk factors are 0.40, portfolio VaR is about $3.32 million

703.2. A risk manager is backtesting a company’s one-day 99.0% VaR model over a four-year horizon at a 90.0% two-tailed confidence level. If we assume 250 days in a year, so that that backtest sample size is 1,000 days, what is the maximum number of daily losses exceeding the 1-day 99.0% VaR that is acceptable to conclude that the model is calibrated correctly?

a. 10 exceptions

b. 15 exceptions

c. 19 exceptions

d. 23 exceptions

703.3. Zerphase Financial Corporation is going to conduct a backtest of its 99.0% value at risk (VaR) model. The sample window size is 300 days; i.e., the previous 15 months and each month has 20 trading days. The desired two-tailed confidence is 95.0%. About this backtest, each of the following statements is true EXCEPT which is false?

a. the maximum number of exceptions (the cutoff) is six; if more than six are observed, the model should be rejected

b. if no exceptions are observed (i.e., exceptions equals zero), we do not need to reject the model as bad

c. If no exceptions are observed (i.e., exceptions equals zero), there is a 4.90% probability that the model is bad

d. If one exception is observed, then we will not reject the model, but we do risk committing a Type 2 (aka, Type II) error

Answers here: