Concept: These on-line quiz questions are not specifically linked to learning objectives, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

700.1. 2. A risk manager is estimating the market risk of a portfolio using both the normal distribution and the lognormal distribution assumptions. The manager gathers the following data on the portfolio:

a. 95.0% one-month lognormal VaR is less than its corresponding normal VaR by about $70,000

b. 95.0% one-month lognormal VaR is less than its corresponding normal VaR by about $195,000

c. 95.0% one-month lognormal VaR is greater than its corresponding normal VaR by about $23,700

d. 95.0% one-month lognormal VaR is greater than its corresponding normal VaR by about $105,800

700.2. A risk measure is coherent if is satisfies four properties: monotonicity, subadditivity, positive homogeneity, translation invariance. Which of the following is a true statement?

a. Historical simulation value at risk (HS VaR) is coherent

b. We can apply a bootstrap to the estimation of confidence intervals for coherent risk measures

c. Incoherent risk measures are largely a theoretical problem without significant practical consequence

d. If we estimate expected shortfall (ES) as a weighted average of tail VaRs (aka, quantiles), then the resulting ES is not coherent

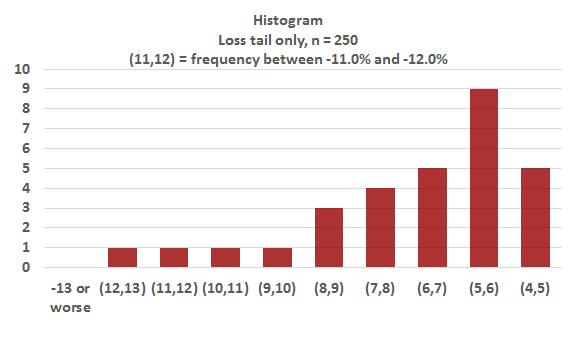

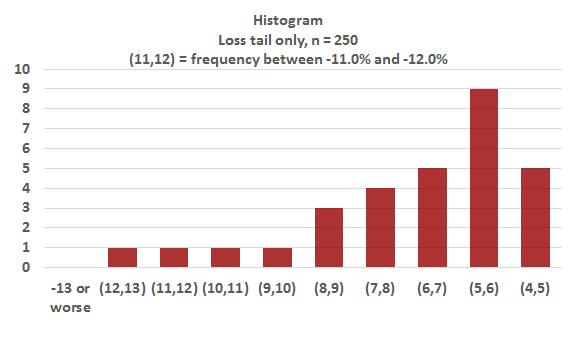

700.3. Donald the risk manager collects 250 trading days of profit and loss (P/L) and plots the daily outcomes in a histogram. The loss tail of the histogram is plotted below, but it is only the worst sixteen (16) losses out of the total 250; ie., the body of the histogram is not shown:

Under the simple historical simulation (HS) approach, which is nearest to the 95.0% value at risk (VaR)

a. 6.5%

b. 9.5%

c. 12.5%

d. It is undefined because 5% of 250 is not an integer

Answers here:

Questions:

700.1. 2. A risk manager is estimating the market risk of a portfolio using both the normal distribution and the lognormal distribution assumptions. The manager gathers the following data on the portfolio:

- Expected return per annum: 12.0%

- Expected volatility per annum: 28.0%

- Current portfolio value: USD 10,000,000

- Trading days: 20 per month and 250 per year

a. 95.0% one-month lognormal VaR is less than its corresponding normal VaR by about $70,000

b. 95.0% one-month lognormal VaR is less than its corresponding normal VaR by about $195,000

c. 95.0% one-month lognormal VaR is greater than its corresponding normal VaR by about $23,700

d. 95.0% one-month lognormal VaR is greater than its corresponding normal VaR by about $105,800

700.2. A risk measure is coherent if is satisfies four properties: monotonicity, subadditivity, positive homogeneity, translation invariance. Which of the following is a true statement?

a. Historical simulation value at risk (HS VaR) is coherent

b. We can apply a bootstrap to the estimation of confidence intervals for coherent risk measures

c. Incoherent risk measures are largely a theoretical problem without significant practical consequence

d. If we estimate expected shortfall (ES) as a weighted average of tail VaRs (aka, quantiles), then the resulting ES is not coherent

700.3. Donald the risk manager collects 250 trading days of profit and loss (P/L) and plots the daily outcomes in a histogram. The loss tail of the histogram is plotted below, but it is only the worst sixteen (16) losses out of the total 250; ie., the body of the histogram is not shown:

Under the simple historical simulation (HS) approach, which is nearest to the 95.0% value at risk (VaR)

a. 6.5%

b. 9.5%

c. 12.5%

d. It is undefined because 5% of 250 is not an integer

Answers here: