Learning Objectives: Describe how correlation impacts the price of quanto options as well as other multi-asset exotic options. Describe the structure, uses, and payoffs of a correlation swap. Estimate the impact of different correlations between assets in the trading book on the VaR capital charge.

Questions:

24.1.1. A US investor is considering a quanto call option on German DAX 30 index, which allows the holder to exchange the payoff of a foreign asset back into their home currency (USD) at a fixed exchange rate.

Given the unique nature of quanto options, which best describes how the correlation between the price of the DAX 30 index and the USD/EUR exchange rate impacts the price of the quanto option?

a. A positive correlation between the DAX 30 index and the USD/EUR exchange rate decreases the quanto option price because fewer yen are needed for the same dollar payoff, favoring the call seller.

b. A negative correlation between the DAX 30 index and the USD/EUR exchange rate decreases the quanto option price because more yen are needed for the same dollar payoff, unfavorably affecting the call buyer.

c. A positive correlation between the DAX 30 index and the USD/EUR exchange rate increases the quanto option price because more yen are needed for the same dollar payoff.

d. A negative correlation between the DAX 30 index and the USD/EUR exchange rate increases the quanto option price because more yen are needed for the same dollar payoff, unfavorably affecting the call seller.

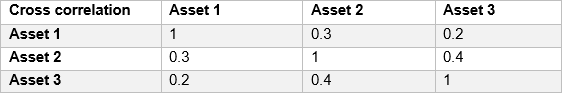

24.1.2. An investment firm is evaluating the potential use of correlation swaps as part of its risk management strategy. The firm is particularly interested in how these instruments can be used to hedge against adverse correlation movements between different asset classes. Consider the following data from a previous deal:

What would be the closest estimate of the payoff for this correlation swap if the firm, as the fixed correlation ratepayer, expected the realized correlation to be lower than what it actually was?

a. No payoff, as the realized correlation was lower than expected.

b. The firm, as the fixed correlation ratepayer, would pay USD 5,660,000 to the counterparty because the realized correlation was higher than the fixed correlation.

c. The firm, as the fixed correlation ratepayer, would receive USD 5,660,000 to the counterparty because the realized correlation was higher than the fixed correlation.

d. The payoff cannot be determined without more information.

24.1.3. A risk manager at Peak-Valley Asset Managers Ltd is assessing the potential losses over a 5-day period for a two-asset portfolio given the following parameters:

b. We are 99% certain that we will not lose more than USD 6.5588 million in the next 5 days due to correlated market price changes of assets 1 and 2

c. We are 99% certain that we will not lose more than USD 1.8611 million in the next 5 days due to correlated market price changes of assets 1 and 2

d. We are 99% certain that we will not lose anything less than USD 4.1615 million in the next 5 days due to correlated market price changes of assets 1 and 2

Answers here:

Questions:

24.1.1. A US investor is considering a quanto call option on German DAX 30 index, which allows the holder to exchange the payoff of a foreign asset back into their home currency (USD) at a fixed exchange rate.

Given the unique nature of quanto options, which best describes how the correlation between the price of the DAX 30 index and the USD/EUR exchange rate impacts the price of the quanto option?

a. A positive correlation between the DAX 30 index and the USD/EUR exchange rate decreases the quanto option price because fewer yen are needed for the same dollar payoff, favoring the call seller.

b. A negative correlation between the DAX 30 index and the USD/EUR exchange rate decreases the quanto option price because more yen are needed for the same dollar payoff, unfavorably affecting the call buyer.

c. A positive correlation between the DAX 30 index and the USD/EUR exchange rate increases the quanto option price because more yen are needed for the same dollar payoff.

d. A negative correlation between the DAX 30 index and the USD/EUR exchange rate increases the quanto option price because more yen are needed for the same dollar payoff, unfavorably affecting the call seller.

24.1.2. An investment firm is evaluating the potential use of correlation swaps as part of its risk management strategy. The firm is particularly interested in how these instruments can be used to hedge against adverse correlation movements between different asset classes. Consider the following data from a previous deal:

- Notional Amount: USD 20,000,000

- Fixed Correlation (Contracted): 0.150

- Realized Correlation at Maturity: 0.433

What would be the closest estimate of the payoff for this correlation swap if the firm, as the fixed correlation ratepayer, expected the realized correlation to be lower than what it actually was?

a. No payoff, as the realized correlation was lower than expected.

b. The firm, as the fixed correlation ratepayer, would pay USD 5,660,000 to the counterparty because the realized correlation was higher than the fixed correlation.

c. The firm, as the fixed correlation ratepayer, would receive USD 5,660,000 to the counterparty because the realized correlation was higher than the fixed correlation.

d. The payoff cannot be determined without more information.

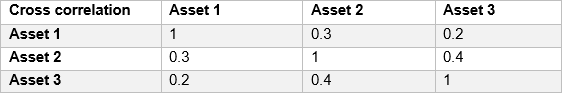

24.1.3. A risk manager at Peak-Valley Asset Managers Ltd is assessing the potential losses over a 5-day period for a two-asset portfolio given the following parameters:

- Asset 1: Invested amount = $60 million, Daily standard deviation of returns = 1%

- Asset 2: Invested amount = $7 million, Daily standard deviation of returns = 4%

- Correlation between Asset 1 and Asset 2 = 0.6

b. We are 99% certain that we will not lose more than USD 6.5588 million in the next 5 days due to correlated market price changes of assets 1 and 2

c. We are 99% certain that we will not lose more than USD 1.8611 million in the next 5 days due to correlated market price changes of assets 1 and 2

d. We are 99% certain that we will not lose anything less than USD 4.1615 million in the next 5 days due to correlated market price changes of assets 1 and 2

Answers here: