Learning objective: Describe external rating scales, the rating process, and the link between ratings and default.

Questions:

917.1. Quotecan Corporation has issued a bond with the following features, characteristics and/or qualities: Quotecan's interest coverage ratio (i.e., earnings before interest and taxes, EBIT, divided by interest expense) is within reasonable limits such that, at least in the near term, investors have adequate protection and should expect their interest and principal payments on the bond. On the one hand, the bond is better than junk. On the other hand, the bond carries more credit risk than bonds issued by the highest-rated corporations like, for example, Microsoft (MSFT), Apple (AAPL), Exxon Mobil (XOM), Johnson & Johnson (JNJ), Walmart (WMT). To be more specific, Quotecan's capacity to repay may be impaired if adverse economic conditions materialize, or if circumstances suddenly change. While these obligations are not speculative in their entirety, they do contain just a few speculative elements which may render the protective elements unreliable over a longer time horizon.

Based on these facts, which credit rating is most likely assigned to Quotecan's bond offering?

a. A-1 or P-1

b. AA or Aa

c. B or B

d. BBB or Baa

917.2. In regard to an external credit rating, for example as issued from Moody's or Standard and Poor's, which of the following statements is TRUE?

a. External credit ratings are cardinal or interval measures of credit risk level

b. External credit ratings are a map to absolute measures of default probability

c. External credit ratings are the basis for an investment recommendation and investment suitability

d. External credit ratings are an opinion about the ability and willingness of an issuer to meet its financial obligations

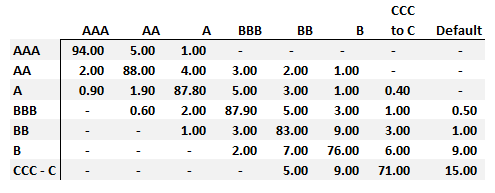

917.3. Consider the following one-year rating transition (aka, migration) matrix illustrated below:

About this migration matrix, each of the followings statements is true EXCEPT which is false?

a. Bonds rated either A, AA, or AAA will not default within one year

b. Over a one year period, the most likely outcome for any rated bond is an unchanged rating

c. At the end of two years, a bond with an AAA-rating will necessarily still be an investment-grade obligor

d. The probability that a bond with an AAA-rating will have the same rating at the end of two years is greater than 0.940^2 = 88.360%

Answers here:

Questions:

917.1. Quotecan Corporation has issued a bond with the following features, characteristics and/or qualities: Quotecan's interest coverage ratio (i.e., earnings before interest and taxes, EBIT, divided by interest expense) is within reasonable limits such that, at least in the near term, investors have adequate protection and should expect their interest and principal payments on the bond. On the one hand, the bond is better than junk. On the other hand, the bond carries more credit risk than bonds issued by the highest-rated corporations like, for example, Microsoft (MSFT), Apple (AAPL), Exxon Mobil (XOM), Johnson & Johnson (JNJ), Walmart (WMT). To be more specific, Quotecan's capacity to repay may be impaired if adverse economic conditions materialize, or if circumstances suddenly change. While these obligations are not speculative in their entirety, they do contain just a few speculative elements which may render the protective elements unreliable over a longer time horizon.

Based on these facts, which credit rating is most likely assigned to Quotecan's bond offering?

a. A-1 or P-1

b. AA or Aa

c. B or B

d. BBB or Baa

917.2. In regard to an external credit rating, for example as issued from Moody's or Standard and Poor's, which of the following statements is TRUE?

a. External credit ratings are cardinal or interval measures of credit risk level

b. External credit ratings are a map to absolute measures of default probability

c. External credit ratings are the basis for an investment recommendation and investment suitability

d. External credit ratings are an opinion about the ability and willingness of an issuer to meet its financial obligations

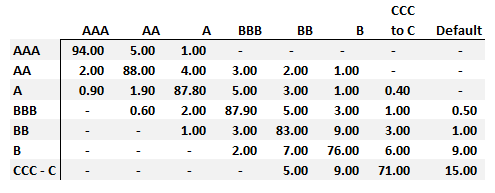

917.3. Consider the following one-year rating transition (aka, migration) matrix illustrated below:

About this migration matrix, each of the followings statements is true EXCEPT which is false?

a. Bonds rated either A, AA, or AAA will not default within one year

b. Over a one year period, the most likely outcome for any rated bond is an unchanged rating

c. At the end of two years, a bond with an AAA-rating will necessarily still be an investment-grade obligor

d. The probability that a bond with an AAA-rating will have the same rating at the end of two years is greater than 0.940^2 = 88.360%

Answers here:

Last edited by a moderator: