Learning objectives: Calculate and interpret the impact of different compounding frequencies on a bond’s value. Calculate discount factors given interest rate swap rates. Compute spot rates given discount factors.

Questions:

902.1. Analyst Patricia is analyzing the following four bonds:

In terms of their current theoretical prices, which bonds are, respectively, the cheapest and most expensive (among the four)?

a. Bond A is the cheapest and Bond D is the most expensive

b. Bond B is the cheapest and Bond C is the most expensive

c. Bond C is the cheapest and Bond A is the most expensive

d. Bond D is the cheapest and Bond B is the most expensive

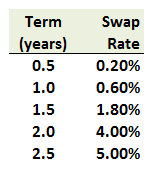

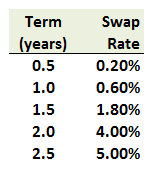

902.2. Below is a swap rates curve extending to 2.5 years:

Given this swap rate curve, which of the following is nearest to the one-year discount factor, d(1.0)?

a. 0.7764

b. 0.8808

c. 0.9222

d. 0.9940

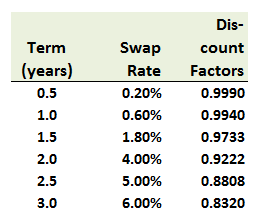

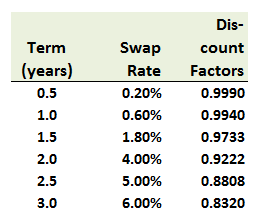

902.3. Below is a swap rate curve and the associated discount function extended out 3.0 years:

Which is nearest to the 2.5 year spot rate, Z(2.5)?

a. 4.091%

b. 5.000%

c. 5.142%

d. 5.533%

Answers here:

Questions:

902.1. Analyst Patricia is analyzing the following four bonds:

- Bond A is a $100.00 face value bond with 7.0 years to maturity that pays a monthly coupon at a rate of 6.0% per annum and offers a yield of 5.0% per annum (with monthly compound frequency)

- Bond B is a $100.00 face value bond with 10.0 years to maturity that pays a semi-annual coupon at a rate of 4.0% per annum and offers a yield of 5.0% per annum (with semi-annual compound frequency)

- Bond C is a $100.00 face value bond with 10.0 years to maturity that pays an annual coupon at a rate of 7.0% per annum and offers a yield of 6.0% per annum (with annual compound frequency)

- Bond D is a $1,000.00 face value zero-coupon bond with 30.0 years to maturity that offers a yield (aka, yield to maturity) of 8.0% per annum with semi-annual compound frequency

In terms of their current theoretical prices, which bonds are, respectively, the cheapest and most expensive (among the four)?

a. Bond A is the cheapest and Bond D is the most expensive

b. Bond B is the cheapest and Bond C is the most expensive

c. Bond C is the cheapest and Bond A is the most expensive

d. Bond D is the cheapest and Bond B is the most expensive

902.2. Below is a swap rates curve extending to 2.5 years:

Given this swap rate curve, which of the following is nearest to the one-year discount factor, d(1.0)?

a. 0.7764

b. 0.8808

c. 0.9222

d. 0.9940

902.3. Below is a swap rate curve and the associated discount function extended out 3.0 years:

Which is nearest to the 2.5 year spot rate, Z(2.5)?

a. 4.091%

b. 5.000%

c. 5.142%

d. 5.533%

Answers here: