Learning objectives: Describe delta hedging for an option, forward, and futures contracts. Describe the dynamic aspects of delta hedging and distinguish between dynamic hedging and hedge-and-forget strategy. Define the delta of a portfolio.

Questions:

818.1. A market maker takes a short position in 1,000 European call options on copper futures. The options mature in three months, and the futures contract underlying the option matures in four months. The current four-month futures price is $3.30 per pound, the exercise price of the options is $3.00, the risk-free interest rate is 4.0% per annum, and the volatility of silver futures prices is 20.2% per annum. Which is nearest to the position delta? (note: this question is inspired by Hull's EOC Question 19.10)

a. -833.0

b. -525.0

c. -314.0

d. +267.0

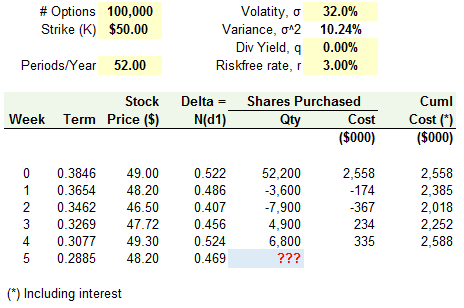

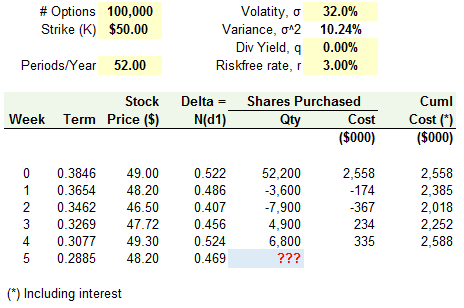

818.2. Goldgreen International is an investment bank who has written 100,000 call options with a strike price of $50.00 on a stock whose volatility is 32.0% per annum while the risk-free rate is 3.0% per annum. The options initially have a maturity of 20 weeks, when the percentage delta is 0.5220 (see first row below). Because Goldgreen seeks to dynamically maintain delta neutrality, the firm immediately purchases 52,000 shares. Consequently, the initial position delta is zero. Although Goldgreen prefers the performance of continuous re-balancing, due to transaction costs, it decides to re-balance once per week. The exhibit below simulates five weeks of stock price changes (note: this is a variation on Hull's Table 19.3):

As shown, at the end of the fifth week, the stock price has dropped to $48.20. At this time, what is the trade (i.e., number of shares purchased) that Goldgreen will execute?

a. Sell 3,375 shares

b. Sell 5,500 shares

c. Buy 2,190 shares

d. Buy 8,540 shares

818.3. Translab Financial is a broker-dealer who earlier today executed two sets of trades on behalf of clients:

a. Buy 250 shares of ABC Corp and Sell 1,750 shares of XYZ Corp

b. Buy 900 shares of ABC Corp and Sell 3,800 shares of XYZ Corp

c. Sell 600 shares of ABC Corp and Buy 4,600 shares of XYZ Corp

d. Sell 1,800 shares of ABC Corp and buy 1,330 shares of XYZ Corp

Answers here:

Questions:

818.1. A market maker takes a short position in 1,000 European call options on copper futures. The options mature in three months, and the futures contract underlying the option matures in four months. The current four-month futures price is $3.30 per pound, the exercise price of the options is $3.00, the risk-free interest rate is 4.0% per annum, and the volatility of silver futures prices is 20.2% per annum. Which is nearest to the position delta? (note: this question is inspired by Hull's EOC Question 19.10)

a. -833.0

b. -525.0

c. -314.0

d. +267.0

818.2. Goldgreen International is an investment bank who has written 100,000 call options with a strike price of $50.00 on a stock whose volatility is 32.0% per annum while the risk-free rate is 3.0% per annum. The options initially have a maturity of 20 weeks, when the percentage delta is 0.5220 (see first row below). Because Goldgreen seeks to dynamically maintain delta neutrality, the firm immediately purchases 52,000 shares. Consequently, the initial position delta is zero. Although Goldgreen prefers the performance of continuous re-balancing, due to transaction costs, it decides to re-balance once per week. The exhibit below simulates five weeks of stock price changes (note: this is a variation on Hull's Table 19.3):

As shown, at the end of the fifth week, the stock price has dropped to $48.20. At this time, what is the trade (i.e., number of shares purchased) that Goldgreen will execute?

a. Sell 3,375 shares

b. Sell 5,500 shares

c. Buy 2,190 shares

d. Buy 8,540 shares

818.3. Translab Financial is a broker-dealer who earlier today executed two sets of trades on behalf of clients:

- Client #1 entered into 100 option contracts for a nine-month straddle on the stock of ABC Corp at a strike price of $10.00 while the stock price is $9.00. Consequently, Translab's position is a "top straddle" or "straddle write" where Translab writes the calls and puts. The percentage delta of the out-of-the-money (OTM) calls is 0.470.

- Client #2 entered into 100 option contracts for a six-month bull spread on the stock of XYZ Corp while the stock price is $19.00. Because (in the bull spread) the client buys calls at the lower strike price of $18.00 and sells calls with a higher strike price of $25.00, Translab as its counterparty effectively has a position in bear spread: Translab is long the call option with the higher strike price and short the call option with the lower strike price. The out-of-the-money calls (with a $25.00 strike price) have a percentage delta of 0.20, and the in-the-money calls (with an $18.00 strike price) have a percentage delta of 0.660.

a. Buy 250 shares of ABC Corp and Sell 1,750 shares of XYZ Corp

b. Buy 900 shares of ABC Corp and Sell 3,800 shares of XYZ Corp

c. Sell 600 shares of ABC Corp and Buy 4,600 shares of XYZ Corp

d. Sell 1,800 shares of ABC Corp and buy 1,330 shares of XYZ Corp

Answers here: