Concept: These on-line quiz questions are not specifically linked to AIMs, but are instead based on recent sample questions. The difficulty level is a notch, or two notches, easier than bionicturtle.com's typical AIM-by-AIM question such that the intended difficulty level is nearer to an actual exam question. As these represent "easier than our usual" practice questions, they are well-suited to online simulation.

Questions:

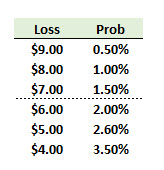

411.1. Your colleague has defined a discrete loss distribution. The tail of the loss distribution is shown below; for example, the worst loss of $9.00 will happen with a probability of 0.50%, a loss of $8.00 will occur with a probability of 1.00%.

The entire distribution spans 25 outcomes ranging from a $9.00 loss to a $15.00 gain, although only the six worst losses are shown. Which is nearest to the 95.0% expected shortfall (ES)?

a. $5.00

b. $6.50

c. $7.00

d. $8.00

411.2. Which of the following is necessarily true of expected shortfall (ES)?

a. 95% ES must always be greater than 95% value at risk (VaR) for a given distribution

b. ES is the best spectral risk measure because it assumes agents are risk-averse by assigning higher weights to higher losses in the tail

c. ES can be ambiguous or undefined if the probability distribution is continuous rather than discrete

d. ES is among a class of risk measures, called spectral risk measures, which are coherent and therefore satisfy four properties: monotonicity, sub-additivity, positive homogeneity and translation invariance

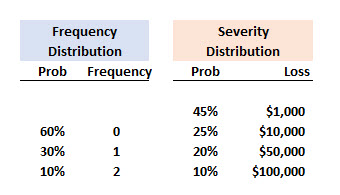

411.3. On any given day, a frequency distribution indicates that the probability of a single loss event is 30% and the probability that two loss events occur is 10% such that on 60% of days there

will be no loss events. For each loss event that does occur, there are four possible severity outcomes: a loss of $100,000 with 10% probability, a loss of $50,000 with 20% probability, a loss of $10,000 with 25% probability, and a loss of $1,000 with probability of 45%. As shown below:

Which is nearest to the 99.0% expected shortfall (ES) of the aggregate (tabulated) loss?

a. $37,500

b. $99,900

c. $135,000

d. $200,000

Answers here:

Questions:

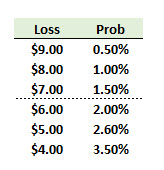

411.1. Your colleague has defined a discrete loss distribution. The tail of the loss distribution is shown below; for example, the worst loss of $9.00 will happen with a probability of 0.50%, a loss of $8.00 will occur with a probability of 1.00%.

The entire distribution spans 25 outcomes ranging from a $9.00 loss to a $15.00 gain, although only the six worst losses are shown. Which is nearest to the 95.0% expected shortfall (ES)?

a. $5.00

b. $6.50

c. $7.00

d. $8.00

411.2. Which of the following is necessarily true of expected shortfall (ES)?

a. 95% ES must always be greater than 95% value at risk (VaR) for a given distribution

b. ES is the best spectral risk measure because it assumes agents are risk-averse by assigning higher weights to higher losses in the tail

c. ES can be ambiguous or undefined if the probability distribution is continuous rather than discrete

d. ES is among a class of risk measures, called spectral risk measures, which are coherent and therefore satisfy four properties: monotonicity, sub-additivity, positive homogeneity and translation invariance

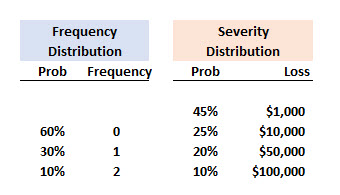

411.3. On any given day, a frequency distribution indicates that the probability of a single loss event is 30% and the probability that two loss events occur is 10% such that on 60% of days there

will be no loss events. For each loss event that does occur, there are four possible severity outcomes: a loss of $100,000 with 10% probability, a loss of $50,000 with 20% probability, a loss of $10,000 with 25% probability, and a loss of $1,000 with probability of 45%. As shown below:

Which is nearest to the 99.0% expected shortfall (ES) of the aggregate (tabulated) loss?

a. $37,500

b. $99,900

c. $135,000

d. $200,000

Answers here:

Last edited by a moderator: