AIMs: Explain the decomposition of P&L for a bond into separate factors including carry roll-down, rate change and spread change effects. Identify the most common assumptions in carry roll-down scenarios, including realized forwards, unchanged term structure, and unchanged yield.

Questions:

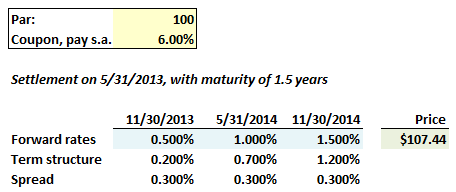

317.1. A $100 par bond that pays a semi-annual coupon with coupon rate of 6.0% settles on 5/31/2013 and matures in 1.5 years on 11/30/2104. The price of the bond is $107.44 as the six month forward rates are 0.5%, 1.0%, and 1.5%, where each forward rate is the sum of a term structure rate and a constant spread of 30 basis points:

After six months, as of 11/30/2013, excluding the cash carry (i.e., excluding the coupon), which is nearest to the carry-roll-down after six months under an assumption of realized forwards?

a. -$2.73

b. -$0.55

c. +$1.89

d. +$2.40

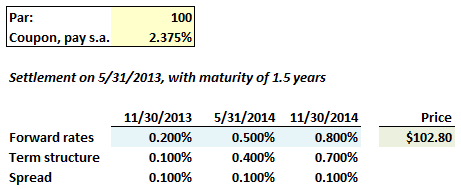

317.2. Under the following upward-sloping forward rate curve (i.e., 0.20%, 0.50%, 0.80%, where forward rate = term structure plus spread), a 2 3/8s bond with 1.5 years to maturity has a price of $102.80 as of 5/31/2013 settlement:

If we want to estimate the bond's price in six months, as of 11/30/2103, we can assume either an unchanged term structure, realized forwards, or unchanged yield. About the bond's price in six months, each of the following statements is true EXCEPT for which is false?

a. In six months, the bond price will be greater under an assumption of unchanged term structure than an assumption of realized forwards

b. Over the next six months, the carry-roll-down, excluding coupon, is positive under either an assumption of unchanged term structure or realized forwards

c. Under as assumption of unchanged yields, the one-period gross return over the next six months will be approximately 0.50% with semi-annual compounding

d. Under as assumption of unchanged yields, the price of the bond in six months will be $101.87

317.3. If we observe an upward-sloping term structure of semi-annual forward rates, each of the following is necessarily true EXCEPT for which is false?

a. If an assumption of realized forwards is accurate, there is no risk premium built into forward rates

b. If an assumption of unchanged term structure is accurate, there must be a risk premium built into forward rates

c. Under an assumption of realized forwards, the carry-roll-down, excluding the coupon (i.e., excluding cash carry) must be negative

d. Under an assumption of unchanged yields, a bond price might move up or down over the next six months; i.e., unclear with more information

Answers:

Questions:

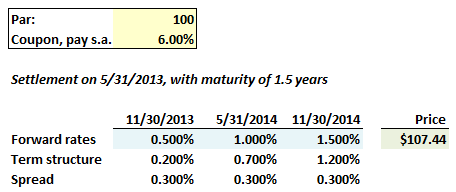

317.1. A $100 par bond that pays a semi-annual coupon with coupon rate of 6.0% settles on 5/31/2013 and matures in 1.5 years on 11/30/2104. The price of the bond is $107.44 as the six month forward rates are 0.5%, 1.0%, and 1.5%, where each forward rate is the sum of a term structure rate and a constant spread of 30 basis points:

After six months, as of 11/30/2013, excluding the cash carry (i.e., excluding the coupon), which is nearest to the carry-roll-down after six months under an assumption of realized forwards?

a. -$2.73

b. -$0.55

c. +$1.89

d. +$2.40

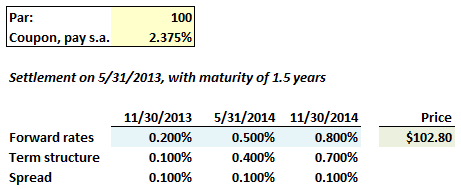

317.2. Under the following upward-sloping forward rate curve (i.e., 0.20%, 0.50%, 0.80%, where forward rate = term structure plus spread), a 2 3/8s bond with 1.5 years to maturity has a price of $102.80 as of 5/31/2013 settlement:

If we want to estimate the bond's price in six months, as of 11/30/2103, we can assume either an unchanged term structure, realized forwards, or unchanged yield. About the bond's price in six months, each of the following statements is true EXCEPT for which is false?

a. In six months, the bond price will be greater under an assumption of unchanged term structure than an assumption of realized forwards

b. Over the next six months, the carry-roll-down, excluding coupon, is positive under either an assumption of unchanged term structure or realized forwards

c. Under as assumption of unchanged yields, the one-period gross return over the next six months will be approximately 0.50% with semi-annual compounding

d. Under as assumption of unchanged yields, the price of the bond in six months will be $101.87

317.3. If we observe an upward-sloping term structure of semi-annual forward rates, each of the following is necessarily true EXCEPT for which is false?

a. If an assumption of realized forwards is accurate, there is no risk premium built into forward rates

b. If an assumption of unchanged term structure is accurate, there must be a risk premium built into forward rates

c. Under an assumption of realized forwards, the carry-roll-down, excluding the coupon (i.e., excluding cash carry) must be negative

d. Under an assumption of unchanged yields, a bond price might move up or down over the next six months; i.e., unclear with more information

Answers: