Learning objectives: Define the VaR measure of risk, describe assumptions about return distributions and holding periods, and explain the limitations of VaR. Explain and calculate ES and compare and contrast VaR and ES. Define the properties of a coherent risk measure and explain the meaning of each property. Explain why VaR is not a coherent risk measure.

24.2.1. JoAnn Goodman is a risk manager for INSURE CO and is estimating the potential loss the $10,000,000 portfolio can expect over a specific time frame at a given confidence level. JoAnn is using the mean variance framework, meaning that asset’s returns are normally distributed. The asset has an annual return of 30.0% and volatility of 20.0% per annum. JoAnn originally assumes that there are 250 trading days in the year but quickly realizes that this year is the first year that trading occurs on Saturdays as well and thus there are 302 trading days this year. If she is using a 20-day time horizon and a 95% relative VaR, how much did the relative $ VaR change because of the change in total trading days?

a. $1,235,828.79

b. $84,500

c. $101,149.92

d. $47,901.41

24.2.2. Jerry is head of risk management for Chocolate Pension Fund. The CIO, Ellen, wants to add exposure to a private catastrophe bond fund sold by an insurance company. A catastrophe bond fund is an insurance-linked note the principal of a catastrophe bond is structured to be at risk if a specified catastrophic natural disaster occurs. Ellen wants to know what the average loss in the back 5% of the tail would be.

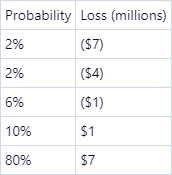

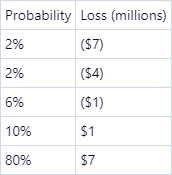

The slide deck sent by the insurance company did not have much information; it showed a required $10M investment and showed that there are five discrete outcomes of the investment with the following probabilities:

What is the most appropriate methodology to answer Ellen’s question, and what is the size of risk interval?

a. VaR, -$1M

b. Expected Shortfall, -$4.6M

c. VaR, -$4.6M

d. Expected Shortfall, -$1M

24.2.3. Scott, a risk manager at a small deep-value strategy, is trying to ensure his company is using a coherent risk benchmark. The deep value strategy can be volatile, and thus, Scott wants to see how his capital at risk would adjust if the portfolio had the same holdings but in a smaller proportion to increase its allocation to the risk-free asset. Which principal of a coherent benchmark is reflected in the below scenario?

a. Translation Invariance

b. Homogeneity

c. Subadditivity

d. Monotonicity

Answers here:

24.2.1. JoAnn Goodman is a risk manager for INSURE CO and is estimating the potential loss the $10,000,000 portfolio can expect over a specific time frame at a given confidence level. JoAnn is using the mean variance framework, meaning that asset’s returns are normally distributed. The asset has an annual return of 30.0% and volatility of 20.0% per annum. JoAnn originally assumes that there are 250 trading days in the year but quickly realizes that this year is the first year that trading occurs on Saturdays as well and thus there are 302 trading days this year. If she is using a 20-day time horizon and a 95% relative VaR, how much did the relative $ VaR change because of the change in total trading days?

a. $1,235,828.79

b. $84,500

c. $101,149.92

d. $47,901.41

24.2.2. Jerry is head of risk management for Chocolate Pension Fund. The CIO, Ellen, wants to add exposure to a private catastrophe bond fund sold by an insurance company. A catastrophe bond fund is an insurance-linked note the principal of a catastrophe bond is structured to be at risk if a specified catastrophic natural disaster occurs. Ellen wants to know what the average loss in the back 5% of the tail would be.

The slide deck sent by the insurance company did not have much information; it showed a required $10M investment and showed that there are five discrete outcomes of the investment with the following probabilities:

What is the most appropriate methodology to answer Ellen’s question, and what is the size of risk interval?

a. VaR, -$1M

b. Expected Shortfall, -$4.6M

c. VaR, -$4.6M

d. Expected Shortfall, -$1M

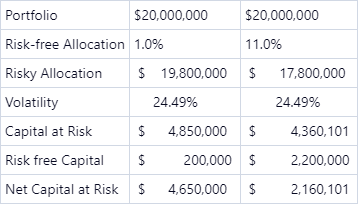

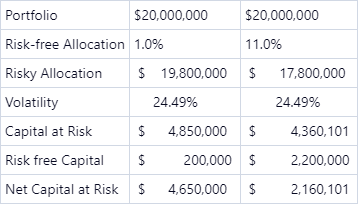

24.2.3. Scott, a risk manager at a small deep-value strategy, is trying to ensure his company is using a coherent risk benchmark. The deep value strategy can be volatile, and thus, Scott wants to see how his capital at risk would adjust if the portfolio had the same holdings but in a smaller proportion to increase its allocation to the risk-free asset. Which principal of a coherent benchmark is reflected in the below scenario?

a. Translation Invariance

b. Homogeneity

c. Subadditivity

d. Monotonicity

Answers here:

Last edited: