Learning objectives: Define cross hedging, and compute and interpret the minimum variance hedge ratio and hedge effectiveness. Compute the optimal number of futures contracts needed to hedge an exposure, and explain and calculate the “tailing the hedge” adjustment. Explain how to use stock index futures contracts to change a stock portfolio’s beta. Explain the term “rolling the hedge forward” and describe some of the risks that arise from this strategy.

Questions:

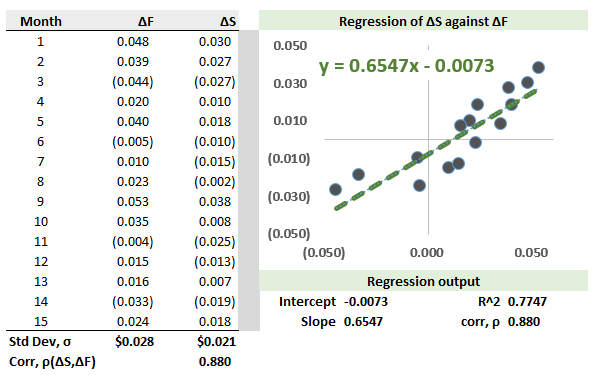

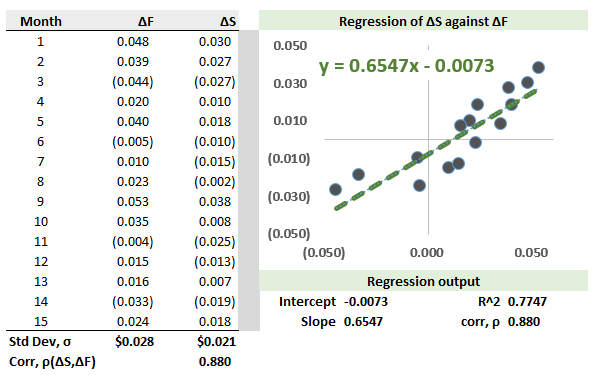

711.1. Viaflex Airlines expects to purchase 2.0 million gallons of jet fuel in two months and decides to use heating oil futures for hedging (each heating oil contract traded by the CME Group is on 42,000 gallons of heating oil). Their corporate treasury department decides to base the hedge on the last 15 months of price changes. The standard deviation of the change, ΔS, in jet fuel prices per gallon was $0.0210 and the standard deviation of the change, ΔF, in the futures price for the contract on heating oil was $0.0280. As this will be a cross-hedge, the correlation between the price changes is 0.880. Below are displayed the price changes and the resulting OLS regression line; for example, the coefficient of determination equals 0.7747 which is the square of the correlation coefficient.

Please note that although heating oil futures contracts will be used for this cross-hedge, Viaflex will NOT be "tailing the hedge;" i.e., the hedge will be based on the intended quantity of gallons purchased. Which of the following is nearest to the optimal number of contracts that should be used to hedge?

a. 14.0

b. 22.0

c. 31.0

d. 40.0

711.2. Each of the following statements is true about hedging and cross-hedging with futures contracts EXCEPT which is not accurate?

a. If the correlation coefficient is zero, the optimal number of contracts is zero

b. Tailing the hedge refers to adjusting the number of futures contracts used to hedge in order to reflect the impact daily settlement (by using to the commodity position value rather than quantity of commodity position)

c. A stack and roll hedge takes a position in futures contracts with delivery dates (much) earlier than the expiration date of the hedge, then closes out these contracts and enters new short-term futures contracts

d. There is no theoretical reason or advantage for the owner of an equity portfolio to fully neutralize beta (i.e., to achieve net beta of zero) by hedging with S&P 500 futures contracts because she could have instead invested in the risk-free asset with less transaction cost

711.3. Sally the portfolio manager oversees a $9.0 million large-cap equities portfolio with a a beta of 1.30. She has decided the portfolio's beta is too high and calibrates a new target beta of 0.70. If she employs S&P 500 index futures contracts to reduce the beta, which is nearest to the trade?

a. Short 9.0 contracts

b. Short 27.0 contracts

c. Short 54.0 contracts

d. Long 13.0 contracts

Answers here:

Questions:

711.1. Viaflex Airlines expects to purchase 2.0 million gallons of jet fuel in two months and decides to use heating oil futures for hedging (each heating oil contract traded by the CME Group is on 42,000 gallons of heating oil). Their corporate treasury department decides to base the hedge on the last 15 months of price changes. The standard deviation of the change, ΔS, in jet fuel prices per gallon was $0.0210 and the standard deviation of the change, ΔF, in the futures price for the contract on heating oil was $0.0280. As this will be a cross-hedge, the correlation between the price changes is 0.880. Below are displayed the price changes and the resulting OLS regression line; for example, the coefficient of determination equals 0.7747 which is the square of the correlation coefficient.

Please note that although heating oil futures contracts will be used for this cross-hedge, Viaflex will NOT be "tailing the hedge;" i.e., the hedge will be based on the intended quantity of gallons purchased. Which of the following is nearest to the optimal number of contracts that should be used to hedge?

a. 14.0

b. 22.0

c. 31.0

d. 40.0

711.2. Each of the following statements is true about hedging and cross-hedging with futures contracts EXCEPT which is not accurate?

a. If the correlation coefficient is zero, the optimal number of contracts is zero

b. Tailing the hedge refers to adjusting the number of futures contracts used to hedge in order to reflect the impact daily settlement (by using to the commodity position value rather than quantity of commodity position)

c. A stack and roll hedge takes a position in futures contracts with delivery dates (much) earlier than the expiration date of the hedge, then closes out these contracts and enters new short-term futures contracts

d. There is no theoretical reason or advantage for the owner of an equity portfolio to fully neutralize beta (i.e., to achieve net beta of zero) by hedging with S&P 500 futures contracts because she could have instead invested in the risk-free asset with less transaction cost

711.3. Sally the portfolio manager oversees a $9.0 million large-cap equities portfolio with a a beta of 1.30. She has decided the portfolio's beta is too high and calibrates a new target beta of 0.70. If she employs S&P 500 index futures contracts to reduce the beta, which is nearest to the trade?

a. Short 9.0 contracts

b. Short 27.0 contracts

c. Short 54.0 contracts

d. Long 13.0 contracts

Answers here: